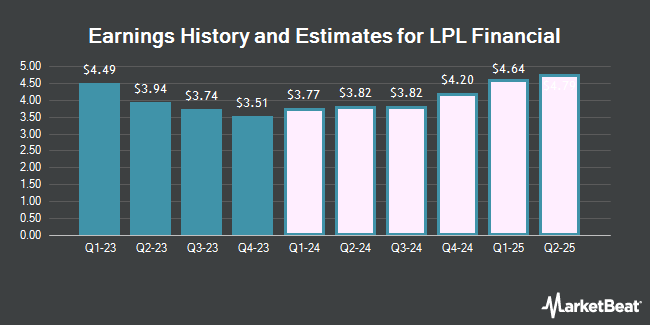

LPL Financial Holdings Inc. (NASDAQ:LPLA - Free Report) - William Blair decreased their Q1 2025 earnings per share (EPS) estimates for LPL Financial in a research note issued to investors on Monday, April 14th. William Blair analyst J. Schmitt now anticipates that the financial services provider will post earnings per share of $4.68 for the quarter, down from their prior forecast of $4.85. The consensus estimate for LPL Financial's current full-year earnings is $19.35 per share. William Blair also issued estimates for LPL Financial's Q2 2025 earnings at $4.50 EPS and Q3 2025 earnings at $4.47 EPS.

LPL Financial (NASDAQ:LPLA - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The financial services provider reported $4.25 earnings per share for the quarter, topping the consensus estimate of $4.01 by $0.24. LPL Financial had a return on equity of 49.41% and a net margin of 8.55%.

Other research analysts have also issued reports about the stock. Keefe, Bruyette & Woods lifted their price objective on shares of LPL Financial from $390.00 to $405.00 and gave the company an "outperform" rating in a research note on Friday, January 31st. Morgan Stanley increased their price objective on LPL Financial from $379.00 to $413.00 and gave the stock an "overweight" rating in a report on Thursday, February 6th. JPMorgan Chase & Co. raised their target price on LPL Financial from $397.00 to $405.00 and gave the stock an "overweight" rating in a research note on Friday, January 31st. JMP Securities reduced their price objective on shares of LPL Financial from $435.00 to $420.00 and set a "market outperform" rating for the company in a research note on Tuesday, April 8th. Finally, Wells Fargo & Company decreased their target price on shares of LPL Financial from $405.00 to $342.00 and set an "overweight" rating on the stock in a report on Tuesday, April 8th. One research analyst has rated the stock with a sell rating and twelve have given a buy rating to the stock. According to MarketBeat, LPL Financial currently has a consensus rating of "Moderate Buy" and a consensus target price of $369.83.

Get Our Latest Report on LPLA

LPL Financial Stock Performance

Shares of LPLA traded down $0.02 during trading hours on Tuesday, hitting $306.02. The company's stock had a trading volume of 413,918 shares, compared to its average volume of 825,788. The company has a market cap of $24.28 billion, a price-to-earnings ratio of 21.80, a PEG ratio of 0.94 and a beta of 0.64. The company has a debt-to-equity ratio of 1.60, a current ratio of 2.16 and a quick ratio of 2.16. The business has a 50 day simple moving average of $334.18 and a two-hundred day simple moving average of $321.70. LPL Financial has a 52-week low of $187.19 and a 52-week high of $384.04.

LPL Financial Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, March 25th. Stockholders of record on Tuesday, March 11th were paid a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a dividend yield of 0.39%. The ex-dividend date of this dividend was Tuesday, March 11th. LPL Financial's dividend payout ratio (DPR) is presently 8.55%.

Insider Activity at LPL Financial

In other LPL Financial news, CFO Matthew J. Audette sold 28,777 shares of the firm's stock in a transaction on Wednesday, February 5th. The shares were sold at an average price of $365.14, for a total value of $10,507,633.78. Following the sale, the chief financial officer now owns 13,663 shares of the company's stock, valued at $4,988,907.82. This trade represents a 67.81 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Marc Eliot Cohen sold 1,100 shares of the company's stock in a transaction dated Wednesday, February 26th. The shares were sold at an average price of $365.85, for a total transaction of $402,435.00. Following the transaction, the director now directly owns 4,075 shares of the company's stock, valued at approximately $1,490,838.75. This trade represents a 21.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 34,465 shares of company stock worth $12,562,070 in the last ninety days. 1.30% of the stock is owned by company insiders.

Hedge Funds Weigh In On LPL Financial

Several hedge funds have recently made changes to their positions in the business. Insigneo Advisory Services LLC purchased a new position in LPL Financial during the 1st quarter valued at $390,000. Sowell Financial Services LLC bought a new stake in shares of LPL Financial during the 1st quarter valued at about $957,000. Brighton Jones LLC purchased a new position in shares of LPL Financial during the first quarter valued at about $396,000. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH raised its stake in LPL Financial by 133.7% in the first quarter. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH now owns 21,325 shares of the financial services provider's stock worth $6,976,000 after buying an additional 12,200 shares in the last quarter. Finally, Foster Victor Wealth Advisors LLC lifted its holdings in LPL Financial by 0.4% in the first quarter. Foster Victor Wealth Advisors LLC now owns 54,658 shares of the financial services provider's stock worth $17,022,000 after buying an additional 199 shares during the period. 95.66% of the stock is owned by hedge funds and other institutional investors.

LPL Financial Company Profile

(

Get Free Report)

LPL Financial Holdings Inc, together with its subsidiaries, provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at enterprises in the United States. Its brokerage offerings include variable and fixed annuities, mutual funds, equities, fixed income, alternative investments, retirement and 529 education savings plans, and insurance.

Read More

Before you consider LPL Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LPL Financial wasn't on the list.

While LPL Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.