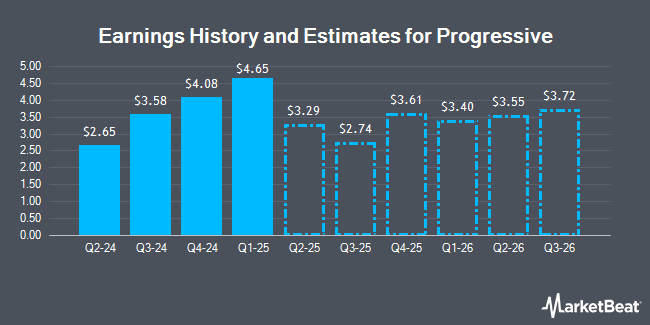

The Progressive Corporation (NYSE:PGR - Free Report) - Stock analysts at William Blair raised their Q3 2025 earnings per share (EPS) estimates for shares of Progressive in a note issued to investors on Wednesday, July 23rd. William Blair analyst A. Klauber now forecasts that the insurance provider will post earnings per share of $3.74 for the quarter, up from their prior forecast of $3.73. The consensus estimate for Progressive's current full-year earnings is $14.68 per share. William Blair also issued estimates for Progressive's FY2025 earnings at $17.38 EPS, Q1 2026 earnings at $4.57 EPS, Q2 2026 earnings at $3.68 EPS, Q3 2026 earnings at $4.18 EPS, Q4 2026 earnings at $5.19 EPS and FY2026 earnings at $17.62 EPS.

Progressive (NYSE:PGR - Get Free Report) last announced its quarterly earnings results on Wednesday, July 16th. The insurance provider reported $4.88 earnings per share for the quarter, topping analysts' consensus estimates of $4.43 by $0.45. The business had revenue of $20.08 billion for the quarter, compared to analysts' expectations of $20.39 billion. Progressive had a return on equity of 35.37% and a net margin of 12.66%. The business's quarterly revenue was up 12.1% on a year-over-year basis. During the same period in the prior year, the firm earned $2.48 EPS.

Other analysts have also recently issued reports about the company. UBS Group dropped their price target on Progressive from $280.00 to $268.00 and set a "neutral" rating on the stock in a research report on Monday, July 21st. Jefferies Financial Group dropped their price target on Progressive from $327.00 to $319.00 and set a "buy" rating on the stock in a research report on Friday, April 11th. Wall Street Zen cut Progressive from a "buy" rating to a "hold" rating in a research report on Friday, July 18th. Bank of America cut their target price on Progressive from $337.00 to $336.00 and set a "buy" rating on the stock in a research note on Thursday, July 17th. Finally, Keefe, Bruyette & Woods decreased their price target on Progressive from $290.00 to $268.00 and set a "market perform" rating for the company in a research note on Thursday, July 17th. Nine equities research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $286.88.

View Our Latest Analysis on PGR

Progressive Stock Performance

Shares of Progressive stock traded down $7.60 on Friday, reaching $242.50. 1,581,674 shares of the company were exchanged, compared to its average volume of 3,243,644. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.29 and a current ratio of 0.34. The company's 50-day moving average is $264.25 and its two-hundred day moving average is $266.28. The firm has a market cap of $142.16 billion, a price-to-earnings ratio of 13.67, a P/E/G ratio of 1.50 and a beta of 0.37. Progressive has a 1-year low of $208.13 and a 1-year high of $292.99.

Institutional Investors Weigh In On Progressive

Large investors have recently modified their holdings of the stock. Highline Wealth Partners LLC boosted its position in shares of Progressive by 114.0% in the first quarter. Highline Wealth Partners LLC now owns 92 shares of the insurance provider's stock worth $26,000 after buying an additional 49 shares during the period. TruNorth Capital Management LLC boosted its position in shares of Progressive by 210.0% in the first quarter. TruNorth Capital Management LLC now owns 93 shares of the insurance provider's stock worth $26,000 after buying an additional 63 shares during the period. HWG Holdings LP acquired a new stake in shares of Progressive in the first quarter worth $28,000. Minot DeBlois Advisors LLC acquired a new stake in shares of Progressive in the fourth quarter worth $28,000. Finally, Garde Capital Inc. acquired a new stake in shares of Progressive in the first quarter worth $33,000. 85.34% of the stock is owned by institutional investors.

Insider Buying and Selling at Progressive

In other news, CFO John P. Sauerland sold 10,000 shares of the firm's stock in a transaction on Monday, June 30th. The stock was sold at an average price of $263.79, for a total transaction of $2,637,900.00. Following the completion of the sale, the chief financial officer directly owned 228,024 shares of the company's stock, valued at $60,150,450.96. This trade represents a 4.20% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, insider John Jo Murphy sold 4,000 shares of the firm's stock in a transaction on Friday, June 20th. The stock was sold at an average price of $260.38, for a total value of $1,041,520.00. Following the sale, the insider directly owned 41,289 shares of the company's stock, valued at approximately $10,750,829.82. This represents a 8.83% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 33,972 shares of company stock worth $9,078,681. 0.34% of the stock is owned by insiders.

Progressive Dividend Announcement

The business also recently disclosed a dividend, which was paid on Friday, July 11th. Stockholders of record on Friday, July 4th were paid a dividend of $0.10 per share. This represents a dividend yield of 0.15%. The ex-dividend date was Thursday, July 3rd. Progressive's dividend payout ratio is presently 2.25%.

About Progressive

(

Get Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Featured Articles

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.