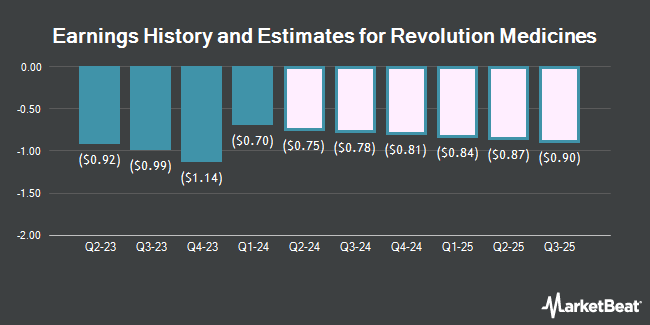

Revolution Medicines, Inc. (NASDAQ:RVMD - Free Report) - Equities research analysts at Lifesci Capital issued their Q3 2025 earnings per share estimates for shares of Revolution Medicines in a research note issued on Monday, August 18th. Lifesci Capital analyst C. Zhu forecasts that the company will post earnings per share of ($1.32) for the quarter. Lifesci Capital currently has a "Outperform" rating and a $80.00 target price on the stock. The consensus estimate for Revolution Medicines' current full-year earnings is ($3.49) per share. Lifesci Capital also issued estimates for Revolution Medicines' Q4 2025 earnings at ($1.35) EPS, FY2025 earnings at ($5.11) EPS, Q1 2026 earnings at ($1.41) EPS, Q2 2026 earnings at ($1.44) EPS, Q3 2026 earnings at ($1.51) EPS, Q4 2026 earnings at ($1.49) EPS and FY2026 earnings at ($5.93) EPS.

Several other research firms have also commented on RVMD. Needham & Company LLC reduced their price target on Revolution Medicines from $57.00 to $56.00 and set a "buy" rating on the stock in a report on Thursday, August 7th. Wedbush reaffirmed an "outperform" rating and set a $73.00 target price (up from $67.00) on shares of Revolution Medicines in a research note on Tuesday, June 24th. Oppenheimer lifted their target price on shares of Revolution Medicines from $70.00 to $75.00 and gave the stock an "outperform" rating in a research note on Thursday, May 8th. HC Wainwright restated a "buy" rating and set a $72.00 price target (down previously from $73.00) on shares of Revolution Medicines in a report on Wednesday, May 14th. Finally, Piper Sandler assumed coverage on shares of Revolution Medicines in a research report on Monday. They set an "overweight" rating and a $75.00 price target on the stock. Thirteen research analysts have rated the stock with a Buy rating, Based on data from MarketBeat, Revolution Medicines currently has a consensus rating of "Buy" and a consensus target price of $69.92.

View Our Latest Report on RVMD

Revolution Medicines Price Performance

Shares of NASDAQ RVMD traded up $0.53 during trading on Wednesday, hitting $37.01. The company had a trading volume of 1,091,784 shares, compared to its average volume of 1,900,156. The stock has a fifty day simple moving average of $37.48 and a two-hundred day simple moving average of $38.39. Revolution Medicines has a fifty-two week low of $29.17 and a fifty-two week high of $62.40. The firm has a market capitalization of $6.92 billion, a price-to-earnings ratio of -8.22 and a beta of 1.16. The company has a quick ratio of 11.79, a current ratio of 11.79 and a debt-to-equity ratio of 0.13.

Revolution Medicines (NASDAQ:RVMD - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported ($1.31) EPS for the quarter, missing analysts' consensus estimates of ($0.94) by ($0.37). During the same quarter in the previous year, the business posted ($0.81) earnings per share. The firm's revenue for the quarter was up .0% compared to the same quarter last year.

Institutional Investors Weigh In On Revolution Medicines

A number of institutional investors and hedge funds have recently made changes to their positions in RVMD. Wells Fargo & Company MN raised its stake in shares of Revolution Medicines by 51.8% in the 4th quarter. Wells Fargo & Company MN now owns 88,327 shares of the company's stock valued at $3,863,000 after acquiring an additional 30,155 shares during the period. Envestnet Asset Management Inc. increased its stake in Revolution Medicines by 21.7% during the 4th quarter. Envestnet Asset Management Inc. now owns 11,425 shares of the company's stock worth $500,000 after buying an additional 2,041 shares during the period. Russell Investments Group Ltd. increased its stake in Revolution Medicines by 11.4% during the 4th quarter. Russell Investments Group Ltd. now owns 4,243 shares of the company's stock worth $186,000 after buying an additional 434 shares during the period. Cerity Partners LLC purchased a new stake in Revolution Medicines during the 4th quarter worth approximately $250,000. Finally, Raymond James Financial Inc. purchased a new stake in Revolution Medicines during the 4th quarter worth approximately $14,067,000. 94.34% of the stock is owned by hedge funds and other institutional investors.

Revolution Medicines Company Profile

(

Get Free Report)

Revolution Medicines, Inc, a clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers. The company's research and development pipeline comprises RAS(ON) inhibitors designed to be used as monotherapy in combination with other RAS(ON) inhibitors and/or in combination with RAS companion inhibitors or other therapeutic agents, and RAS companion inhibitors for combination treatment strategies.

See Also

Before you consider Revolution Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolution Medicines wasn't on the list.

While Revolution Medicines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.