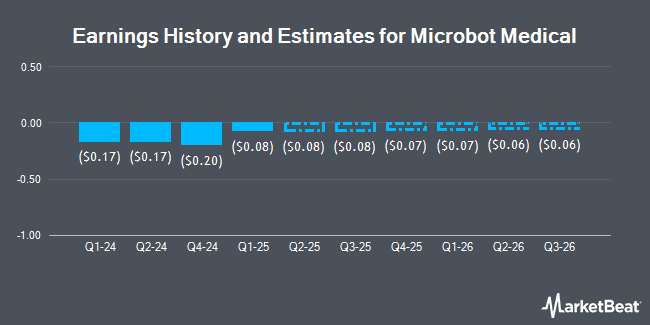

Microbot Medical Inc. (NASDAQ:MBOT - Free Report) - Investment analysts at HC Wainwright upped their Q3 2025 earnings per share (EPS) estimates for shares of Microbot Medical in a note issued to investors on Wednesday, October 1st. HC Wainwright analyst R. Selvaraju now expects that the biotechnology company will earn ($0.06) per share for the quarter, up from their prior estimate of ($0.08). HC Wainwright currently has a "Buy" rating and a $12.00 target price on the stock. The consensus estimate for Microbot Medical's current full-year earnings is ($0.71) per share. HC Wainwright also issued estimates for Microbot Medical's Q4 2025 earnings at ($0.03) EPS, FY2025 earnings at ($0.24) EPS, Q1 2026 earnings at ($0.05) EPS, Q3 2026 earnings at $0.04 EPS, Q4 2026 earnings at $0.12 EPS and FY2026 earnings at $0.10 EPS.

Several other equities research analysts have also recently weighed in on MBOT. Wall Street Zen raised Microbot Medical from a "sell" rating to a "hold" rating in a research report on Friday. Zacks Research downgraded shares of Microbot Medical from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 21st. Finally, Weiss Ratings reissued a "sell (d-)" rating on shares of Microbot Medical in a research note on Saturday, September 27th. One research analyst has rated the stock with a Buy rating, one has assigned a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $12.00.

View Our Latest Stock Analysis on Microbot Medical

Microbot Medical Price Performance

Microbot Medical stock opened at $3.07 on Monday. The firm has a market cap of $162.07 million, a price-to-earnings ratio of -5.29 and a beta of 1.25. The firm has a fifty day moving average price of $3.33 and a two-hundred day moving average price of $2.69. Microbot Medical has a fifty-two week low of $0.88 and a fifty-two week high of $4.67.

Microbot Medical (NASDAQ:MBOT - Get Free Report) last announced its quarterly earnings results on Tuesday, August 12th. The biotechnology company reported ($0.10) EPS for the quarter, missing the consensus estimate of ($0.08) by ($0.02).

Hedge Funds Weigh In On Microbot Medical

Several institutional investors have recently modified their holdings of MBOT. Geode Capital Management LLC raised its position in Microbot Medical by 24.7% in the 2nd quarter. Geode Capital Management LLC now owns 395,039 shares of the biotechnology company's stock valued at $996,000 after buying an additional 78,121 shares during the last quarter. DNB Asset Management AS boosted its position in Microbot Medical by 67.9% during the second quarter. DNB Asset Management AS now owns 192,786 shares of the biotechnology company's stock valued at $486,000 after purchasing an additional 77,965 shares during the last quarter. Goldman Sachs Group Inc. bought a new position in Microbot Medical in the first quarter valued at approximately $57,000. Virtu Financial LLC bought a new position in Microbot Medical in the first quarter valued at approximately $42,000. Finally, Lazari Capital Management Inc. acquired a new position in shares of Microbot Medical during the 2nd quarter worth approximately $54,000. Institutional investors own 16.30% of the company's stock.

Microbot Medical Company Profile

(

Get Free Report)

Microbot Medical Inc, a pre-clinical medical device company, engages in the research, design, and development of robotic endoluminal surgery devices targeting the minimally invasive surgery space. The company offers LIBERTY, an endovascular robotic surgical system which allows physicians to conduct a catheter-based procedure from outside the catheterization laboratory, and avoid radiation exposure, physical strain, and the risk of cross contamination for use in cardiovascular, peripheral, and neurovascular spaces.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Microbot Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microbot Medical wasn't on the list.

While Microbot Medical currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.