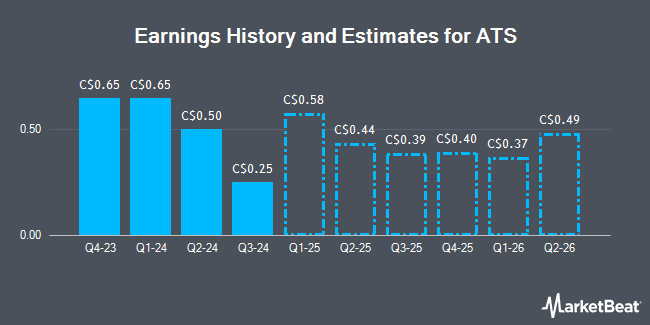

ATS Co. (TSE:ATS - Free Report) - Analysts at Raymond James Financial cut their Q3 2026 earnings per share estimates for ATS in a research note issued on Monday, August 18th. Raymond James Financial analyst M. Glen now expects that the company will post earnings per share of $0.41 for the quarter, down from their prior estimate of $0.51. Raymond James Financial has a "Outperform" rating and a $46.00 price target on the stock. Raymond James Financial also issued estimates for ATS's Q4 2026 earnings at $0.50 EPS, Q2 2027 earnings at $0.54 EPS, Q4 2027 earnings at $0.64 EPS and FY2027 earnings at $2.22 EPS.

ATS has been the topic of several other reports. Royal Bank Of Canada cut their target price on ATS from C$50.00 to C$49.00 and set an "outperform" rating on the stock in a report on Friday, August 8th. Scotiabank cut their target price on ATS from C$46.00 to C$45.00 and set a "sector perform" rating on the stock in a report on Monday, August 11th. Finally, TD Securities cut their target price on ATS from C$49.00 to C$46.00 and set a "buy" rating on the stock in a report on Monday, August 11th. Four research analysts have rated the stock with a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of C$47.60.

Check Out Our Latest Stock Report on ATS

ATS Trading Down 1.5%

TSE ATS traded down C$0.58 during trading on Wednesday, hitting C$37.48. 63,596 shares of the company traded hands, compared to its average volume of 230,260. ATS has a 12 month low of C$29.81 and a 12 month high of C$46.58. The business has a fifty day simple moving average of C$41.42 and a 200 day simple moving average of C$39.27. The company has a market capitalization of C$3.68 billion, a P/E ratio of 41.29 and a beta of 1.36.

ATS Company Profile

(

Get Free Report)

ATS Corp formerly, ATS Automation Tooling Systems Inc is a Canada-based company that provides automation systems. The company designs and builds customized automated manufacturing and testing systems for customers, and provides pre- and post-automation services. The company's products comprise conveyor systems, automated electrified monorails, tray handlers, laser systems, and other hardware and software products.

Read More

Before you consider ATS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ATS wasn't on the list.

While ATS currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.