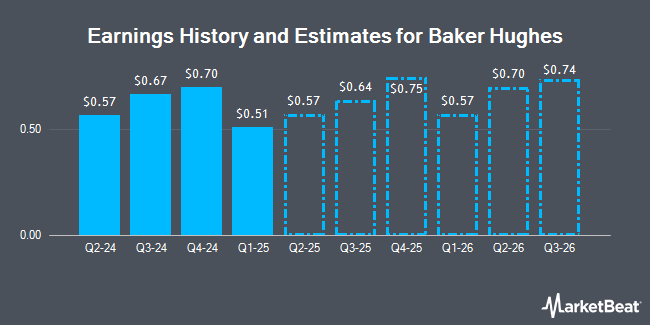

Baker Hughes Company (NASDAQ:BKR - Free Report) - Seaport Res Ptn lifted their Q3 2025 earnings per share (EPS) estimates for shares of Baker Hughes in a report issued on Tuesday, July 29th. Seaport Res Ptn analyst T. Curran now expects that the company will post earnings per share of $0.67 for the quarter, up from their previous estimate of $0.65. Seaport Res Ptn has a "Hold" rating on the stock. The consensus estimate for Baker Hughes' current full-year earnings is $2.59 per share. Seaport Res Ptn also issued estimates for Baker Hughes' Q4 2025 earnings at $0.72 EPS and Q1 2026 earnings at $0.56 EPS.

A number of other equities analysts also recently issued reports on BKR. TD Securities dropped their price target on Baker Hughes from $50.00 to $49.00 and set a "buy" rating on the stock in a research note on Thursday, April 24th. Jefferies Financial Group set a $58.00 target price on Baker Hughes in a report on Wednesday. Barclays raised their target price on Baker Hughes from $48.00 to $53.00 and gave the stock an "overweight" rating in a report on Thursday, July 24th. UBS Group reaffirmed a "neutral" rating and issued a $46.00 target price (up from $43.00) on shares of Baker Hughes in a report on Wednesday. Finally, Industrial Alliance Securities set a $53.00 target price on Baker Hughes in a report on Wednesday. Three research analysts have rated the stock with a hold rating and eighteen have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $51.47.

Get Our Latest Report on Baker Hughes

Baker Hughes Stock Performance

Shares of BKR stock traded down $1.54 on Friday, reaching $43.51. The stock had a trading volume of 7,323,705 shares, compared to its average volume of 8,645,018. The stock has a market cap of $42.90 billion, a P/E ratio of 14.22, a price-to-earnings-growth ratio of 5.35 and a beta of 0.94. Baker Hughes has a 1 year low of $32.25 and a 1 year high of $49.40. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.00 and a current ratio of 1.41. The company has a 50 day simple moving average of $39.71 and a 200 day simple moving average of $40.98.

Baker Hughes (NASDAQ:BKR - Get Free Report) last released its quarterly earnings results on Tuesday, July 22nd. The company reported $0.63 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.55 by $0.08. The firm had revenue of $6.91 billion for the quarter, compared to the consensus estimate of $6.64 billion. Baker Hughes had a return on equity of 14.56% and a net margin of 11.04%. The company's revenue for the quarter was down 3.2% on a year-over-year basis. During the same period last year, the business posted $0.57 EPS.

Baker Hughes Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, August 15th. Investors of record on Tuesday, August 5th will be given a $0.23 dividend. The ex-dividend date is Tuesday, August 5th. This represents a $0.92 annualized dividend and a yield of 2.1%. Baker Hughes's dividend payout ratio (DPR) is currently 30.07%.

Insider Buying and Selling

In related news, CEO Lorenzo Simonelli sold 526,568 shares of Baker Hughes stock in a transaction dated Wednesday, July 23rd. The stock was sold at an average price of $44.42, for a total value of $23,390,150.56. Following the completion of the transaction, the chief executive officer owned 667,593 shares in the company, valued at approximately $29,654,481.06. This trade represents a 44.10% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Corporate insiders own 0.27% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vanguard Group Inc. grew its stake in shares of Baker Hughes by 0.8% during the first quarter. Vanguard Group Inc. now owns 122,118,216 shares of the company's stock valued at $5,367,096,000 after buying an additional 924,501 shares during the last quarter. Capital Research Global Investors grew its stake in shares of Baker Hughes by 0.6% during the fourth quarter. Capital Research Global Investors now owns 27,687,590 shares of the company's stock valued at $1,135,744,000 after buying an additional 177,232 shares during the last quarter. Geode Capital Management LLC grew its stake in shares of Baker Hughes by 1.9% during the fourth quarter. Geode Capital Management LLC now owns 24,543,925 shares of the company's stock valued at $1,004,212,000 after buying an additional 465,832 shares during the last quarter. FMR LLC grew its stake in shares of Baker Hughes by 12.5% during the fourth quarter. FMR LLC now owns 15,702,057 shares of the company's stock valued at $644,098,000 after buying an additional 1,744,225 shares during the last quarter. Finally, Dimensional Fund Advisors LP grew its stake in shares of Baker Hughes by 1.5% during the first quarter. Dimensional Fund Advisors LP now owns 11,727,973 shares of the company's stock valued at $515,367,000 after buying an additional 175,495 shares during the last quarter. Hedge funds and other institutional investors own 92.06% of the company's stock.

Baker Hughes Company Profile

(

Get Free Report)

Baker Hughes Company provides a portfolio of technologies and services to energy and industrial value chain worldwide. The company operates through Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments. The OFSE segment designs and manufactures products and provides related services, including exploration, appraisal, development, production, rejuvenation, and decommissioning for onshore and offshore oilfield operations.

Further Reading

Before you consider Baker Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baker Hughes wasn't on the list.

While Baker Hughes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.