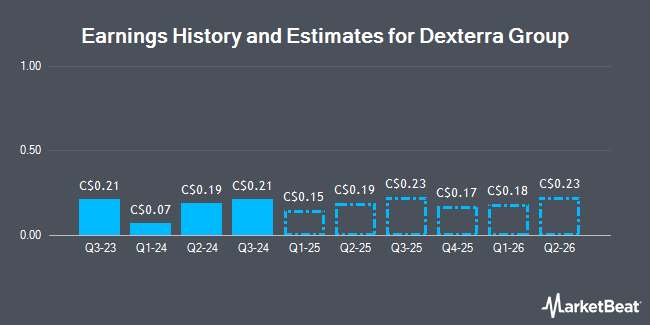

Dexterra Group Inc. (TSE:DXT - Free Report) - Research analysts at National Bank Financial decreased their Q3 2025 earnings per share (EPS) estimates for Dexterra Group in a report issued on Wednesday, August 6th. National Bank Financial analyst Z. Evershed now forecasts that the company will post earnings of $0.23 per share for the quarter, down from their prior estimate of $0.25. The consensus estimate for Dexterra Group's current full-year earnings is $0.71 per share. National Bank Financial also issued estimates for Dexterra Group's FY2025 earnings at $0.72 EPS.

A number of other analysts have also recently commented on the company. ATB Capital boosted their price objective on Dexterra Group from C$10.75 to C$11.75 and gave the company an "outperform" rating in a research report on Thursday, August 7th. National Bankshares raised their price objective on shares of Dexterra Group from C$13.00 to C$14.00 and gave the stock an "outperform" rating in a research report on Thursday, August 7th.

Check Out Our Latest Analysis on DXT

Dexterra Group Stock Performance

TSE:DXT traded up C$0.10 during trading hours on Monday, reaching C$9.99. The company had a trading volume of 27,520 shares, compared to its average volume of 39,412. Dexterra Group has a 1-year low of C$5.77 and a 1-year high of C$9.99. The firm has a market cap of C$635.76 million, a PE ratio of 50.86, a price-to-earnings-growth ratio of 0.90 and a beta of 1.02. The business's 50 day moving average price is C$9.29 and its 200-day moving average price is C$8.46. The company has a debt-to-equity ratio of 42.46, a current ratio of 1.46 and a quick ratio of 1.28.

About Dexterra Group

(

Get Free Report)

Dexterra Group Inc engages in the provision of support services for the creation, management, and operation of infrastructure in Canada. It operates through three segments: Integrated Facilities Management (IFM); Modular Solutions; and Workforce Accommodations, Forestry and Energy Services (WAFES). The IFM segment delivers operation and maintenance solutions for built assets and infrastructure in the public and private sectors, including aviation, defense, education, rail, healthcare, and leisure.

See Also

Before you consider Dexterra Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dexterra Group wasn't on the list.

While Dexterra Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.