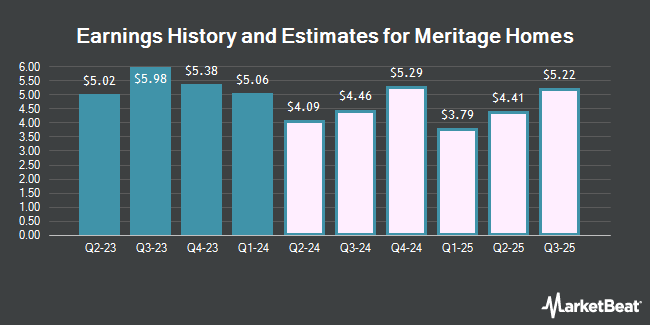

Meritage Homes Corporation (NYSE:MTH - Free Report) - Research analysts at Zacks Research reduced their Q3 2025 earnings per share estimates for Meritage Homes in a report issued on Wednesday, August 6th. Zacks Research analyst S. Mukherjee now expects that the construction company will earn $1.63 per share for the quarter, down from their prior forecast of $2.16. The consensus estimate for Meritage Homes' current full-year earnings is $9.44 per share. Zacks Research also issued estimates for Meritage Homes' Q4 2025 earnings at $1.74 EPS, FY2025 earnings at $7.10 EPS, Q3 2026 earnings at $1.88 EPS, Q4 2026 earnings at $2.14 EPS, FY2026 earnings at $7.50 EPS, Q1 2027 earnings at $1.76 EPS and FY2027 earnings at $9.13 EPS.

Meritage Homes (NYSE:MTH - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The construction company reported $2.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.99 by $0.05. Meritage Homes had a return on equity of 12.37% and a net margin of 10.27%. The firm had revenue of $1.62 billion during the quarter, compared to the consensus estimate of $1.60 billion. During the same period in the prior year, the company posted $3.15 earnings per share. The firm's quarterly revenue was down 4.6% compared to the same quarter last year.

MTH has been the subject of a number of other research reports. Keefe, Bruyette & Woods reduced their price objective on Meritage Homes from $77.00 to $75.00 and set a "market perform" rating for the company in a research note on Monday, July 28th. Wedbush reduced their price objective on Meritage Homes from $103.00 to $90.00 and set a "neutral" rating for the company in a research note on Friday, July 25th. UBS Group set a $107.00 price objective on Meritage Homes in a research note on Friday, April 25th. Zelman & Associates upgraded Meritage Homes to a "strong-buy" rating in a research note on Thursday, July 24th. Finally, Evercore ISI upped their price target on Meritage Homes from $97.00 to $100.00 and gave the stock an "outperform" rating in a research note on Friday, July 25th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, five have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $91.13.

View Our Latest Analysis on MTH

Meritage Homes Price Performance

Shares of NYSE MTH opened at $72.19 on Monday. The company has a current ratio of 2.16, a quick ratio of 2.16 and a debt-to-equity ratio of 0.35. Meritage Homes has a twelve month low of $59.27 and a twelve month high of $106.99. The stock has a 50 day moving average of $68.71 and a two-hundred day moving average of $69.84. The stock has a market cap of $5.14 billion, a P/E ratio of 6.49 and a beta of 1.29.

Meritage Homes Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Monday, June 16th were given a $0.43 dividend. The ex-dividend date was Monday, June 16th. This represents a $1.72 annualized dividend and a yield of 2.4%. Meritage Homes's dividend payout ratio is presently 15.47%.

Insider Buying and Selling at Meritage Homes

In other Meritage Homes news, Director Dennis V. Arriola acquired 2,200 shares of the business's stock in a transaction on Friday, July 25th. The stock was purchased at an average price of $70.00 per share, for a total transaction of $154,000.00. Following the completion of the transaction, the director owned 9,512 shares of the company's stock, valued at $665,840. The trade was a 30.09% increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Joseph Keough acquired 4,000 shares of the business's stock in a transaction on Thursday, June 12th. The stock was acquired at an average price of $66.16 per share, with a total value of $264,640.00. Following the transaction, the director directly owned 41,700 shares of the company's stock, valued at $2,758,872. This represents a 10.61% increase in their position. The disclosure for this purchase can be found here. Corporate insiders own 2.20% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the company. LPL Financial LLC boosted its stake in Meritage Homes by 56.1% in the 4th quarter. LPL Financial LLC now owns 10,265 shares of the construction company's stock worth $1,579,000 after buying an additional 3,687 shares during the last quarter. Envestnet Asset Management Inc. boosted its stake in Meritage Homes by 3.1% in the 4th quarter. Envestnet Asset Management Inc. now owns 144,416 shares of the construction company's stock worth $22,214,000 after buying an additional 4,378 shares during the last quarter. Bank of Montreal Can boosted its stake in Meritage Homes by 74.1% in the 4th quarter. Bank of Montreal Can now owns 15,908 shares of the construction company's stock worth $2,447,000 after buying an additional 6,772 shares during the last quarter. Renaissance Technologies LLC lifted its stake in shares of Meritage Homes by 56.2% in the 4th quarter. Renaissance Technologies LLC now owns 79,800 shares of the construction company's stock valued at $12,275,000 after purchasing an additional 28,700 shares in the last quarter. Finally, Raymond James Financial Inc. acquired a new position in shares of Meritage Homes in the 4th quarter valued at about $6,531,000. Hedge funds and other institutional investors own 98.44% of the company's stock.

About Meritage Homes

(

Get Free Report)

Meritage Homes Corporation, together with its subsidiaries, designs and builds single-family attached and detached homes in the United States. The company operates through two segments, Homebuilding and Financial Services. It acquires and develops land; and constructs, markets, and sells homes for entry-level and first move-up buyers in Arizona, California, Colorado, Utah, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Meritage Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meritage Homes wasn't on the list.

While Meritage Homes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report