Wall Street Zen lowered shares of Rapt Therapeutics (NASDAQ:RAPT - Free Report) from a hold rating to a sell rating in a report released on Saturday morning.

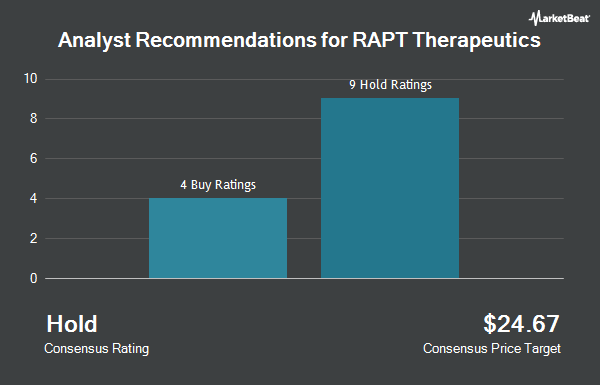

A number of other equities analysts also recently weighed in on the company. Lifesci Capital upgraded Rapt Therapeutics to a "strong-buy" rating and set a $31.00 target price on the stock in a research note on Tuesday, July 22nd. UBS Group cut their target price on Rapt Therapeutics from $16.00 to $8.00 and set a "neutral" rating on the stock in a research note on Thursday, May 22nd. HC Wainwright boosted their target price on Rapt Therapeutics to $27.00 and gave the stock a "buy" rating in a research note on Thursday, July 10th. JPMorgan Chase & Co. upgraded Rapt Therapeutics from an "underweight" rating to a "neutral" rating and set a $14.00 target price on the stock in a research note on Wednesday, July 30th. Finally, Wells Fargo & Company restated an "overweight" rating and issued a $38.00 target price (down previously from $51.00) on shares of Rapt Therapeutics in a research note on Friday. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, Rapt Therapeutics currently has a consensus rating of "Hold" and a consensus price target of $21.57.

Get Our Latest Stock Report on Rapt Therapeutics

Rapt Therapeutics Stock Performance

RAPT traded up $1.28 during midday trading on Friday, reaching $10.83. 563,049 shares of the company were exchanged, compared to its average volume of 107,229. The company's fifty day moving average price is $9.49 and its 200 day moving average price is $8.79. The company has a market cap of $179.05 million, a price-to-earnings ratio of -0.76 and a beta of 0.01. Rapt Therapeutics has a one year low of $5.67 and a one year high of $26.56.

Rapt Therapeutics (NASDAQ:RAPT - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported ($0.65) EPS for the quarter, missing analysts' consensus estimates of ($0.61) by ($0.04). As a group, sell-side analysts anticipate that Rapt Therapeutics will post -2.14 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the company. Simplicity Wealth LLC bought a new position in shares of Rapt Therapeutics during the first quarter valued at about $25,000. OCONNOR A Distinct Business Unit of UBS ASSET MANAGEMENT AMERICAS LLC bought a new stake in shares of Rapt Therapeutics in the 4th quarter valued at about $63,000. Sei Investments Co. purchased a new stake in Rapt Therapeutics during the 4th quarter valued at about $64,000. Invesco Ltd. grew its position in Rapt Therapeutics by 411.7% during the 1st quarter. Invesco Ltd. now owns 58,901 shares of the company's stock worth $72,000 after acquiring an additional 47,391 shares during the last quarter. Finally, Shay Capital LLC bought a new position in Rapt Therapeutics during the 4th quarter worth approximately $81,000. Institutional investors own 99.09% of the company's stock.

About Rapt Therapeutics

(

Get Free Report)

RAPT Therapeutics, Inc, a clinical-stage immunology-based biopharmaceutical company, focuses on discovery, development, and commercialization of oral small molecule therapies for patients with unmet needs in oncology and inflammatory diseases in the United States. The company's lead inflammation drug candidate is zelnecirnon (RPT193), a C-C motif chemokine receptor 4 (CCR4) antagonist that selectively inhibit the migration of type 2 T helper cells into inflamed tissues.

Featured Articles

Before you consider Rapt Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rapt Therapeutics wasn't on the list.

While Rapt Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.