Newmont (NYSE:NEM - Get Free Report) had its price target hoisted by research analysts at Raymond James Financial from $67.00 to $69.00 in a note issued to investors on Monday,Benzinga reports. The brokerage currently has an "outperform" rating on the basic materials company's stock. Raymond James Financial's price target points to a potential upside of 8.20% from the stock's previous close.

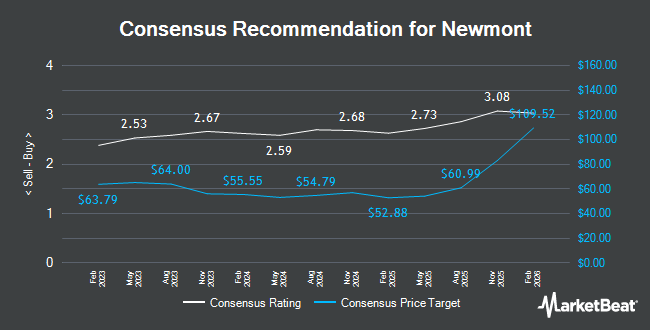

NEM has been the subject of a number of other reports. Scotiabank restated a "sector perform" rating on shares of Newmont in a research note on Monday, April 14th. Stifel Nicolaus assumed coverage on shares of Newmont in a research report on Wednesday, July 9th. They set a "buy" rating and a $73.00 target price for the company. National Bankshares raised shares of Newmont from a "sector perform" rating to an "outperform" rating in a research report on Friday. CIBC set a $74.00 target price on shares of Newmont and gave the stock a "neutral" rating in a research report on Tuesday, July 15th. Finally, Argus set a $63.00 target price on shares of Newmont in a research report on Friday, April 25th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating, nine have issued a buy rating and three have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $62.74.

View Our Latest Analysis on NEM

Newmont Stock Down 3.0%

NEM stock traded down $1.98 during midday trading on Monday, reaching $63.77. The company had a trading volume of 5,445,932 shares, compared to its average volume of 12,206,655. Newmont has a 1 year low of $36.86 and a 1 year high of $66.57. The company has a current ratio of 2.23, a quick ratio of 1.91 and a debt-to-equity ratio of 0.23. The company has a market capitalization of $70.98 billion, a P/E ratio of 11.46, a PEG ratio of 0.96 and a beta of 0.33. The company has a 50 day moving average of $57.05 and a two-hundred day moving average of $50.62.

Newmont (NYSE:NEM - Get Free Report) last posted its earnings results on Thursday, July 24th. The basic materials company reported $1.43 EPS for the quarter, topping the consensus estimate of $0.95 by $0.48. The company had revenue of $5.32 billion during the quarter, compared to the consensus estimate of $4.70 billion. Newmont had a net margin of 30.50% and a return on equity of 17.86%. The company's revenue for the quarter was up 20.8% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.72 earnings per share. On average, equities research analysts expect that Newmont will post 3.45 earnings per share for the current fiscal year.

Insider Activity at Newmont

In related news, Director Bruce R. Brook sold 2,077 shares of the firm's stock in a transaction that occurred on Tuesday, July 1st. The stock was sold at an average price of $58.75, for a total transaction of $122,023.75. Following the completion of the transaction, the director owned 43,103 shares in the company, valued at $2,532,301.25. This trade represents a 4.60% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Peter Toth sold 3,000 shares of the firm's stock in a transaction that occurred on Monday, June 2nd. The stock was sold at an average price of $54.09, for a total value of $162,270.00. Following the transaction, the executive vice president owned 77,526 shares of the company's stock, valued at $4,193,381.34. This trade represents a 3.73% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 12,231 shares of company stock valued at $679,813 in the last 90 days. 0.05% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Newmont

Hedge funds and other institutional investors have recently modified their holdings of the stock. Bessemer Group Inc. grew its position in Newmont by 13.2% during the 1st quarter. Bessemer Group Inc. now owns 11,791 shares of the basic materials company's stock worth $569,000 after acquiring an additional 1,379 shares during the last quarter. First Trust Advisors LP grew its position in Newmont by 9.9% during the 4th quarter. First Trust Advisors LP now owns 96,040 shares of the basic materials company's stock worth $3,575,000 after acquiring an additional 8,678 shares during the last quarter. Envestnet Portfolio Solutions Inc. bought a new stake in Newmont during the 1st quarter worth approximately $423,000. Spire Wealth Management grew its position in Newmont by 125.0% during the 1st quarter. Spire Wealth Management now owns 2,356 shares of the basic materials company's stock worth $114,000 after acquiring an additional 1,309 shares during the last quarter. Finally, Flagship Harbor Advisors LLC acquired a new position in Newmont during the 1st quarter worth about $202,000. Institutional investors own 68.85% of the company's stock.

About Newmont

(

Get Free Report)

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, Papua New Guinea, Ecuador, Fiji, and Ghana.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Newmont, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newmont wasn't on the list.

While Newmont currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.