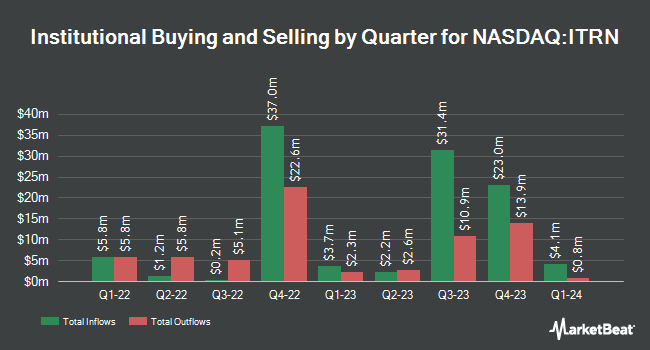

Raymond James Financial Inc. bought a new stake in Ituran Location and Control Ltd. (NASDAQ:ITRN - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 87,248 shares of the industrial products company's stock, valued at approximately $2,718,000. Raymond James Financial Inc. owned approximately 0.44% of Ituran Location and Control as of its most recent filing with the Securities and Exchange Commission.

A number of other large investors have also recently bought and sold shares of the stock. Barclays PLC lifted its position in shares of Ituran Location and Control by 132.1% in the third quarter. Barclays PLC now owns 7,731 shares of the industrial products company's stock valued at $206,000 after acquiring an additional 4,400 shares in the last quarter. DGS Capital Management LLC raised its stake in Ituran Location and Control by 14.8% in the 3rd quarter. DGS Capital Management LLC now owns 19,030 shares of the industrial products company's stock valued at $505,000 after purchasing an additional 2,460 shares during the last quarter. JPMorgan Chase & Co. lifted its holdings in Ituran Location and Control by 58.3% in the 3rd quarter. JPMorgan Chase & Co. now owns 39,464 shares of the industrial products company's stock valued at $1,047,000 after purchasing an additional 14,527 shares in the last quarter. CWA Asset Management Group LLC boosted its stake in shares of Ituran Location and Control by 20.3% during the 4th quarter. CWA Asset Management Group LLC now owns 12,708 shares of the industrial products company's stock worth $396,000 after purchasing an additional 2,144 shares during the last quarter. Finally, Assenagon Asset Management S.A. purchased a new stake in shares of Ituran Location and Control during the fourth quarter worth about $835,000. Institutional investors and hedge funds own 94.80% of the company's stock.

Analyst Ratings Changes

Separately, Barclays upped their price objective on shares of Ituran Location and Control from $35.00 to $50.00 and gave the company an "overweight" rating in a research note on Thursday, February 27th.

View Our Latest Stock Analysis on ITRN

Ituran Location and Control Stock Up 2.0 %

Shares of ITRN stock traded up $0.70 during mid-day trading on Friday, hitting $35.74. 34,121 shares of the company's stock were exchanged, compared to its average volume of 98,632. The stock has a market cap of $711.01 million, a price-to-earnings ratio of 13.69 and a beta of 0.90. Ituran Location and Control Ltd. has a fifty-two week low of $24.12 and a fifty-two week high of $45.43. The stock has a 50-day simple moving average of $36.04 and a two-hundred day simple moving average of $32.90.

Ituran Location and Control (NASDAQ:ITRN - Get Free Report) last issued its quarterly earnings results on Wednesday, February 26th. The industrial products company reported $0.70 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.68 by $0.02. Ituran Location and Control had a return on equity of 28.31% and a net margin of 15.65%. The firm had revenue of $82.88 million for the quarter, compared to analyst estimates of $81.81 million.

Ituran Location and Control Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, April 3rd. Investors of record on Thursday, March 20th were given a dividend of $0.50 per share. This is a positive change from Ituran Location and Control's previous quarterly dividend of $0.39. The ex-dividend date was Thursday, March 20th. This represents a $2.00 annualized dividend and a yield of 5.60%. Ituran Location and Control's dividend payout ratio is 73.80%.

About Ituran Location and Control

(

Free Report)

Ituran Location and Control Ltd., together with its subsidiaries, provides location based telematics services and machine-to-machine telematics products. It operates through two segments, Telematics Services and Telematics Products. The Telematics services segment offers stolen vehicle recovery and tracking services, which enables to locate, track, and recover stolen vehicles for its subscribers; fleet management services that enable corporate and individual customers to track and manage their vehicles in real time; and locator services that allow customers to protect valuable merchandise and equipment.

Featured Stories

Before you consider Ituran Location and Control, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ituran Location and Control wasn't on the list.

While Ituran Location and Control currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.