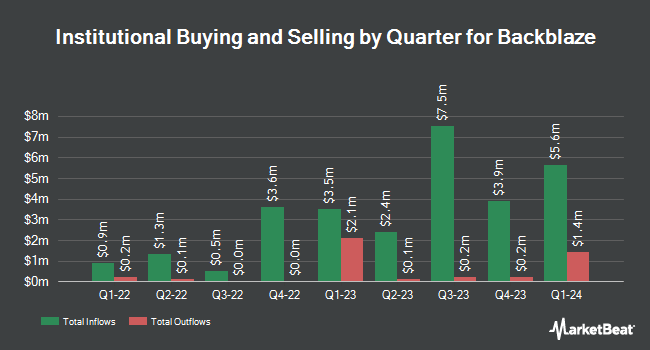

Raymond James Financial Inc. bought a new position in shares of Backblaze, Inc. (NASDAQ:BLZE - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 268,793 shares of the company's stock, valued at approximately $1,618,000. Raymond James Financial Inc. owned about 0.61% of Backblaze at the end of the most recent reporting period.

A number of other large investors have also recently modified their holdings of the business. R Squared Ltd bought a new position in shares of Backblaze in the 4th quarter valued at $38,000. Quantbot Technologies LP increased its stake in shares of Backblaze by 60.6% in the fourth quarter. Quantbot Technologies LP now owns 11,648 shares of the company's stock valued at $70,000 after buying an additional 4,393 shares during the period. Intech Investment Management LLC bought a new position in Backblaze in the 4th quarter valued at approximately $114,000. Virtu Financial LLC bought a new position in shares of Backblaze during the fourth quarter valued at $117,000. Finally, SG Americas Securities LLC lifted its holdings in shares of Backblaze by 46.7% during the fourth quarter. SG Americas Securities LLC now owns 19,853 shares of the company's stock worth $120,000 after purchasing an additional 6,322 shares during the period. Institutional investors and hedge funds own 54.03% of the company's stock.

Analyst Ratings Changes

Several research analysts have issued reports on the stock. Needham & Company LLC started coverage on shares of Backblaze in a report on Tuesday, March 11th. They set a "buy" rating and a $8.00 price target for the company. Lake Street Capital dropped their price objective on Backblaze from $12.00 to $11.00 and set a "buy" rating on the stock in a research note on Wednesday, February 26th. Finally, B. Riley decreased their target price on Backblaze from $11.50 to $11.00 and set a "buy" rating for the company in a research note on Tuesday, February 18th. Six research analysts have rated the stock with a buy rating, According to MarketBeat, the company has an average rating of "Buy" and an average price target of $10.83.

Read Our Latest Research Report on BLZE

Backblaze Stock Performance

Shares of NASDAQ BLZE traded up $0.83 during midday trading on Thursday, hitting $5.35. The company's stock had a trading volume of 313,519 shares, compared to its average volume of 393,622. The company has a current ratio of 0.54, a quick ratio of 0.54 and a debt-to-equity ratio of 0.39. The firm has a market capitalization of $290.51 million, a price-to-earnings ratio of -4.82 and a beta of 1.03. Backblaze, Inc. has a one year low of $3.94 and a one year high of $10.00. The stock has a fifty day moving average price of $4.91 and a 200 day moving average price of $6.07.

Backblaze Company Profile

(

Free Report)

Backblaze, Inc, a storage cloud platform, provides businesses and consumers cloud services to store, use, and protect data in the United States and internationally. The company offers cloud services through a web-scale software infrastructure built on commodity hardware. It also provides Backblaze B2 Cloud Storage, which enables customers to store data, developers to build applications, and partners to expand their use cases.

Read More

Before you consider Backblaze, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Backblaze wasn't on the list.

While Backblaze currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.