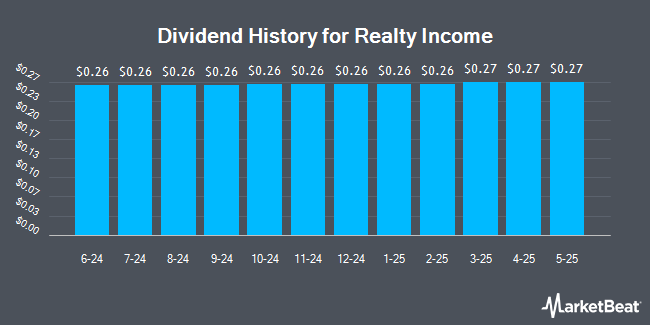

Realty Income Corporation (NYSE:O - Get Free Report) declared a monthly dividend on Friday, August 15th, Wall Street Journal reports. Investors of record on Tuesday, September 2nd will be given a dividend of 0.269 per share by the real estate investment trust on Monday, September 15th. This represents a c) dividend on an annualized basis and a dividend yield of 5.5%. The ex-dividend date of this dividend is Tuesday, September 2nd. This is a 2.1% increase from Realty Income's previous monthly dividend of $0.26.

Realty Income has a dividend payout ratio of 213.2% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect Realty Income to earn $4.32 per share next year, which means the company should continue to be able to cover its $3.22 annual dividend with an expected future payout ratio of 74.5%.

Realty Income Price Performance

Shares of O traded up $1.0940 during trading hours on Tuesday, reaching $58.9640. 4,593,780 shares of the stock traded hands, compared to its average volume of 4,780,692. The company has a current ratio of 1.85, a quick ratio of 1.85 and a debt-to-equity ratio of 0.72. Realty Income has a 52-week low of $50.71 and a 52-week high of $64.88. The company's 50-day moving average price is $57.45 and its two-hundred day moving average price is $56.61. The company has a market cap of $53.91 billion, a P/E ratio of 57.25, a price-to-earnings-growth ratio of 4.42 and a beta of 0.76.

Realty Income (NYSE:O - Get Free Report) last released its earnings results on Wednesday, August 6th. The real estate investment trust reported $1.05 earnings per share for the quarter, missing analysts' consensus estimates of $1.06 by ($0.01). Realty Income had a net margin of 16.77% and a return on equity of 2.34%. The firm had revenue of $1.34 billion for the quarter, compared to analysts' expectations of $1.33 billion. During the same quarter last year, the firm posted $1.07 EPS. The firm's quarterly revenue was up 5.3% compared to the same quarter last year. On average, analysts anticipate that Realty Income will post 4.19 earnings per share for the current year.

Institutional Investors Weigh In On Realty Income

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Norges Bank acquired a new position in Realty Income during the 2nd quarter valued at approximately $676,500,000. Northern Trust Corp increased its stake in Realty Income by 41.2% during the 4th quarter. Northern Trust Corp now owns 13,139,719 shares of the real estate investment trust's stock valued at $701,792,000 after purchasing an additional 3,834,403 shares in the last quarter. Vanguard Group Inc. increased its stake in Realty Income by 2.5% during the 2nd quarter. Vanguard Group Inc. now owns 146,136,211 shares of the real estate investment trust's stock valued at $8,418,907,000 after purchasing an additional 3,624,852 shares in the last quarter. Nuveen LLC acquired a new stake in shares of Realty Income in the first quarter worth $207,573,000. Finally, Geode Capital Management LLC increased its stake in shares of Realty Income by 8.3% in the second quarter. Geode Capital Management LLC now owns 26,979,134 shares of the real estate investment trust's stock worth $1,548,687,000 after acquiring an additional 2,058,031 shares during the period. Hedge funds and other institutional investors own 70.81% of the company's stock.

About Realty Income

(

Get Free Report)

Realty Income, The Monthly Dividend Company, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a real estate investment trust ("REIT"), and its monthly dividends are supported by the cash flow from over 15,450 real estate properties (including properties acquired in the Spirit merger in January 2024) primarily owned under long-term net lease agreements with commercial clients.

See Also

Before you consider Realty Income, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Realty Income wasn't on the list.

While Realty Income currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.