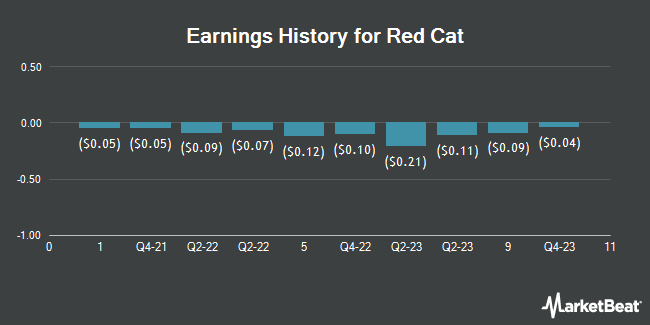

Red Cat (NASDAQ:RCAT - Get Free Report) posted its earnings results on Thursday. The company reported ($0.14) EPS for the quarter, missing the consensus estimate of ($0.12) by ($0.02), Zacks reports. The company had revenue of $3.22 million during the quarter, compared to analysts' expectations of $7.73 million.

Red Cat Stock Performance

Shares of Red Cat stock traded up $0.78 during trading on Monday, reaching $9.19. The company's stock had a trading volume of 9,791,626 shares, compared to its average volume of 7,911,298. Red Cat has a one year low of $2.31 and a one year high of $15.27. The firm has a market cap of $845.30 million, a price-to-earnings ratio of -17.02 and a beta of 1.44. The business's fifty day moving average price is $8.53 and its 200-day moving average price is $7.26.

Insider Activity at Red Cat

In other Red Cat news, Director Nicholas Reyland Liuzza, Jr. sold 100,000 shares of the stock in a transaction on Tuesday, June 10th. The shares were sold at an average price of $8.58, for a total value of $858,000.00. Following the completion of the sale, the director directly owned 387,445 shares of the company's stock, valued at $3,324,278.10. This represents a 20.52% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Joseph David Freedman sold 150,000 shares of the business's stock in a transaction dated Monday, June 30th. The stock was sold at an average price of $7.37, for a total transaction of $1,105,500.00. Following the transaction, the director owned 165,260 shares in the company, valued at approximately $1,217,966.20. The trade was a 47.58% decrease in their position. The disclosure for this sale can be found here. Insiders sold 350,309 shares of company stock valued at $2,635,570 over the last three months. 15.30% of the stock is owned by company insiders.

Institutional Investors Weigh In On Red Cat

Hedge funds have recently made changes to their positions in the stock. Bank of America Corp DE boosted its stake in Red Cat by 407.0% during the fourth quarter. Bank of America Corp DE now owns 3,397 shares of the company's stock worth $44,000 after buying an additional 2,727 shares in the last quarter. California State Teachers Retirement System acquired a new stake in Red Cat during the 2nd quarter valued at $34,000. BNP Paribas Financial Markets raised its holdings in shares of Red Cat by 1,537.2% in the second quarter. BNP Paribas Financial Markets now owns 7,220 shares of the company's stock valued at $53,000 after buying an additional 6,779 shares during the last quarter. Invesco Ltd. boosted its stake in shares of Red Cat by 8.4% in the 2nd quarter. Invesco Ltd. now owns 104,224 shares of the company's stock valued at $759,000 after purchasing an additional 8,090 shares during the last quarter. Finally, Legal & General Group Plc acquired a new stake in Red Cat during the 2nd quarter worth $61,000. Institutional investors own 37.97% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on the company. Wall Street Zen raised Red Cat from a "sell" rating to a "hold" rating in a report on Saturday, July 26th. Northland Securities set a $16.00 price target on Red Cat in a report on Friday.

View Our Latest Analysis on Red Cat

About Red Cat

(

Get Free Report)

Red Cat Holdings, Inc engages in the provision of various products, services, and solutions to the drone industry. The company operates through two segments: Enterprise and Consumer. It built infrastructure to manages drone fleets and fly, and provide services remotely, navigate confined industrial interior spaces and dangerous military environment.

Recommended Stories

Before you consider Red Cat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red Cat wasn't on the list.

While Red Cat currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.