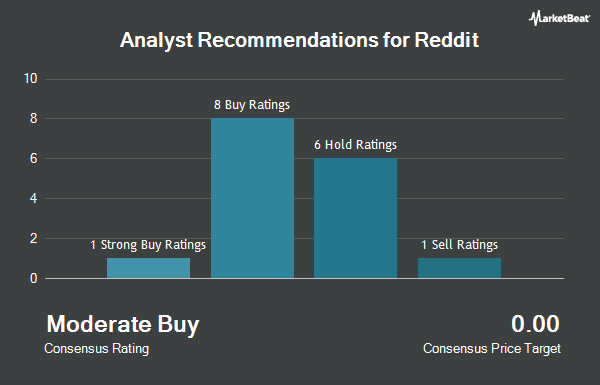

Reddit Inc. (NYSE:RDDT - Get Free Report) has earned an average rating of "Moderate Buy" from the twenty-four brokerages that are presently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell recommendation, nine have issued a hold recommendation, twelve have assigned a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12-month price objective among analysts that have covered the stock in the last year is $141.04.

Several research analysts have commented on the company. Roth Capital reaffirmed a "neutral" rating on shares of Reddit in a report on Friday, May 2nd. Piper Sandler restated an "overweight" rating and issued a $150.00 price target (up from $140.00) on shares of Reddit in a report on Friday, May 2nd. Wall Street Zen raised shares of Reddit from a "hold" rating to a "buy" rating in a research note on Saturday, June 14th. Robert W. Baird increased their price objective on shares of Reddit from $120.00 to $151.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, B. Riley restated a "buy" rating and issued a $220.00 target price (down from $222.00) on shares of Reddit in a research note on Friday, May 2nd.

Read Our Latest Analysis on Reddit

Insiders Place Their Bets

In other Reddit news, COO Jennifer L. Wong sold 33,333 shares of the firm's stock in a transaction on Monday, June 16th. The stock was sold at an average price of $124.45, for a total value of $4,148,291.85. Following the completion of the sale, the chief operating officer directly owned 1,428,007 shares of the company's stock, valued at $177,715,471.15. This trade represents a 2.28% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CAO Michelle Marie Reynolds sold 3,500 shares of the company's stock in a transaction on Wednesday, June 25th. The shares were sold at an average price of $150.64, for a total value of $527,240.00. Following the transaction, the chief accounting officer directly owned 37,868 shares in the company, valued at $5,704,435.52. This represents a 8.46% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 617,285 shares of company stock valued at $69,599,110. Company insiders own 34.25% of the company's stock.

Institutional Investors Weigh In On Reddit

Several large investors have recently added to or reduced their stakes in the company. FMR LLC lifted its stake in shares of Reddit by 7.5% during the 4th quarter. FMR LLC now owns 13,070,780 shares of the company's stock valued at $2,136,288,000 after buying an additional 913,189 shares in the last quarter. Vanguard Group Inc. raised its holdings in Reddit by 11.1% during the 1st quarter. Vanguard Group Inc. now owns 10,198,552 shares of the company's stock valued at $1,069,828,000 after acquiring an additional 1,017,162 shares during the period. Alliancebernstein L.P. lifted its position in shares of Reddit by 103.0% during the first quarter. Alliancebernstein L.P. now owns 5,659,990 shares of the company's stock worth $593,733,000 after acquiring an additional 2,871,232 shares in the last quarter. T. Rowe Price Investment Management Inc. boosted its holdings in shares of Reddit by 10.6% in the first quarter. T. Rowe Price Investment Management Inc. now owns 4,073,939 shares of the company's stock worth $427,357,000 after acquiring an additional 389,761 shares during the period. Finally, JPMorgan Chase & Co. grew its position in shares of Reddit by 98.2% in the first quarter. JPMorgan Chase & Co. now owns 1,907,495 shares of the company's stock valued at $200,096,000 after purchasing an additional 944,847 shares in the last quarter.

Reddit Price Performance

NYSE:RDDT traded up $2.89 during trading hours on Wednesday, hitting $145.89. The company's stock had a trading volume of 3,360,229 shares, compared to its average volume of 6,681,075. The company has a market capitalization of $26.92 billion, a P/E ratio of 247.28, a PEG ratio of 3.74 and a beta of 2.33. Reddit has a twelve month low of $49.13 and a twelve month high of $230.41. The stock has a fifty day simple moving average of $123.77 and a 200-day simple moving average of $140.94.

Reddit (NYSE:RDDT - Get Free Report) last issued its earnings results on Thursday, May 1st. The company reported $0.13 earnings per share for the quarter, beating analysts' consensus estimates of $0.02 by $0.11. Reddit had a net margin of 8.07% and a return on equity of 5.69%. The firm had revenue of $392.36 million for the quarter, compared to analyst estimates of $370.55 million. During the same quarter last year, the business posted ($8.19) earnings per share. The company's quarterly revenue was up 61.5% on a year-over-year basis. On average, equities analysts predict that Reddit will post 1.12 EPS for the current fiscal year.

Reddit Company Profile

(

Get Free ReportReddit, Inc operates a website that organizes digital communities. It organizes communities based on specific interests that enable users to engage in conversations by sharing experiences, submitting links, uploading images and videos, and replying to one another. The company was founded in 2005 and is headquartered in San Francisco, California.

See Also

Before you consider Reddit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reddit wasn't on the list.

While Reddit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.