Reddit (NYSE:RDDT - Get Free Report) had its price target cut by equities research analysts at Citigroup from $220.00 to $150.00 in a report issued on Monday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. Citigroup's price target points to a potential upside of 56.18% from the company's previous close.

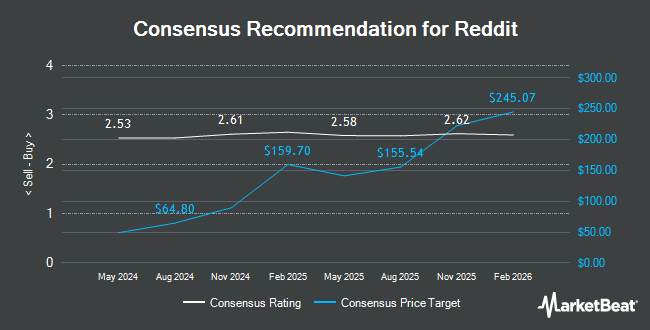

A number of other research analysts also recently issued reports on RDDT. Guggenheim reduced their price objective on shares of Reddit from $210.00 to $170.00 and set a "buy" rating on the stock in a research report on Thursday, March 20th. B. Riley raised their price objective on shares of Reddit from $112.00 to $187.00 and gave the stock a "buy" rating in a report on Tuesday, January 14th. Loop Capital reaffirmed a "buy" rating and set a $210.00 price objective on shares of Reddit in a research report on Tuesday, March 11th. Robert W. Baird increased their target price on Reddit from $160.00 to $185.00 and gave the stock a "neutral" rating in a research report on Thursday, February 13th. Finally, Roth Capital cut Reddit from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, January 22nd. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $142.22.

View Our Latest Stock Analysis on Reddit

Reddit Stock Performance

NYSE:RDDT traded up $0.66 during trading hours on Monday, reaching $96.04. The company's stock had a trading volume of 2,852,484 shares, compared to its average volume of 5,533,051. The firm has a 50-day simple moving average of $131.49 and a 200-day simple moving average of $140.37. Reddit has a 1 year low of $40.51 and a 1 year high of $230.41. The firm has a market capitalization of $17.37 billion and a price-to-earnings ratio of -12.42.

Reddit (NYSE:RDDT - Get Free Report) last announced its quarterly earnings results on Wednesday, February 12th. The company reported $0.36 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.24 by $0.12. Reddit had a negative net margin of 37.25% and a negative return on equity of 24.71%. Equities analysts anticipate that Reddit will post 1.12 earnings per share for the current fiscal year.

Insider Activity

In other Reddit news, COO Jennifer L. Wong sold 33,334 shares of the stock in a transaction dated Wednesday, April 16th. The stock was sold at an average price of $93.99, for a total value of $3,133,062.66. Following the transaction, the chief operating officer now owns 1,466,119 shares of the company's stock, valued at approximately $137,800,524.81. This represents a 2.22 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director David C. Habiger purchased 774 shares of the business's stock in a transaction on Wednesday, March 12th. The shares were purchased at an average price of $130.36 per share, with a total value of $100,898.64. Following the completion of the purchase, the director now owns 30,808 shares in the company, valued at approximately $4,016,130.88. This trade represents a 2.58 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have sold 714,202 shares of company stock valued at $96,326,958 in the last ninety days.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. raised its holdings in Reddit by 184.2% in the 4th quarter. Vanguard Group Inc. now owns 9,181,390 shares of the company's stock worth $1,500,606,000 after purchasing an additional 5,950,909 shares during the period. Jennison Associates LLC purchased a new position in shares of Reddit during the 4th quarter valued at about $494,861,000. Alliancebernstein L.P. grew its stake in shares of Reddit by 1,011.1% during the 4th quarter. Alliancebernstein L.P. now owns 2,788,758 shares of the company's stock valued at $455,795,000 after acquiring an additional 2,537,768 shares during the period. Brooklyn FI LLC purchased a new stake in Reddit in the 4th quarter worth approximately $303,082,000. Finally, GQG Partners LLC bought a new stake in Reddit during the 4th quarter worth approximately $271,539,000.

Reddit Company Profile

(

Get Free Report)

Reddit, Inc operates a website that organizes digital communities. It organizes communities based on specific interests that enable users to engage in conversations by sharing experiences, submitting links, uploading images and videos, and replying to one another. The company was founded in 2005 and is headquartered in San Francisco, California.

Featured Articles

Before you consider Reddit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reddit wasn't on the list.

While Reddit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.