Redwire (NYSE:RDW - Free Report) had its target price cut by Canaccord Genuity Group from $21.00 to $17.50 in a research report released on Monday morning,Benzinga reports. They currently have a buy rating on the stock.

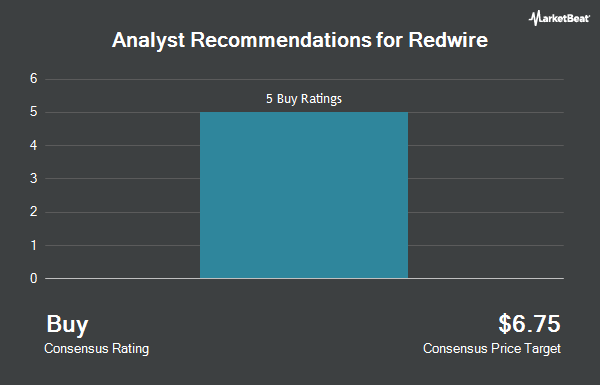

Several other research analysts also recently weighed in on RDW. Truist Financial set a $16.00 price target on shares of Redwire and gave the stock a "hold" rating in a research report on Thursday, June 26th. Alliance Global Partners reissued a "buy" rating on shares of Redwire in a research report on Monday, May 12th. Roth Capital reiterated a "buy" rating on shares of Redwire in a research note on Tuesday, June 24th. Wall Street Zen lowered shares of Redwire from a "hold" rating to a "strong sell" rating in a research report on Saturday, August 9th. Finally, HC Wainwright restated a "buy" rating and set a $22.00 target price (down from $26.00) on shares of Redwire in a research report on Friday, August 8th. One analyst has rated the stock with a sell rating, one has assigned a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $19.42.

Read Our Latest Stock Analysis on Redwire

Redwire Stock Performance

Shares of RDW traded down $0.12 during trading hours on Monday, reaching $8.97. 3,682,869 shares of the company traded hands, compared to its average volume of 5,451,274. The stock has a market capitalization of $1.28 billion, a P/E ratio of -2.76 and a beta of 2.52. The company has a quick ratio of 1.18, a current ratio of 1.46 and a debt-to-equity ratio of 0.21. Redwire has a 12-month low of $5.67 and a 12-month high of $26.66. The business has a fifty day moving average price of $15.51 and a 200-day moving average price of $14.30.

Redwire (NYSE:RDW - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported ($0.39) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.11) by ($0.28). Redwire had a negative return on equity of 32.67% and a negative net margin of 71.95%. The firm had revenue of $61.76 million for the quarter, compared to analysts' expectations of $80.48 million. Equities analysts anticipate that Redwire will post -0.85 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of RDW. LPL Financial LLC purchased a new position in Redwire during the fourth quarter worth approximately $191,000. Vanguard Group Inc. raised its stake in Redwire by 8.4% during the fourth quarter. Vanguard Group Inc. now owns 1,310,660 shares of the company's stock worth $21,573,000 after purchasing an additional 101,620 shares during the period. JPMorgan Chase & Co. raised its stake in Redwire by 7.8% during the fourth quarter. JPMorgan Chase & Co. now owns 10,854 shares of the company's stock worth $179,000 after purchasing an additional 782 shares during the period. Wells Fargo & Company MN raised its stake in Redwire by 43.4% during the fourth quarter. Wells Fargo & Company MN now owns 16,326 shares of the company's stock worth $269,000 after purchasing an additional 4,939 shares during the period. Finally, Russell Investments Group Ltd. raised its stake in Redwire by 3,504.1% during the fourth quarter. Russell Investments Group Ltd. now owns 20,976 shares of the company's stock worth $345,000 after purchasing an additional 20,394 shares during the period. 8.10% of the stock is currently owned by hedge funds and other institutional investors.

About Redwire

(

Get Free Report)

Redwire Corporation provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally. The company provides avionics and sensors including star trackers, sun sensors, critical for navigation, and control of spacecraft; camera systems; solar array solutions for spacecraft spanning the spectrum of size, power needs, and orbital location; and strain composite booms, coilable booms, truss structures, telescope baffles, and deployable booms to position sensors or solar arrays away from the spacecraft.

Recommended Stories

Before you consider Redwire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redwire wasn't on the list.

While Redwire currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.