HC Wainwright reaffirmed their buy rating on shares of REGENXBIO (NASDAQ:RGNX - Free Report) in a report published on Monday,Benzinga reports. The brokerage currently has a $34.00 price objective on the biotechnology company's stock.

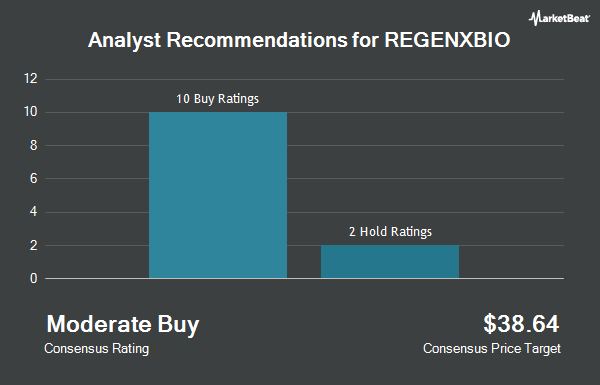

Several other research firms also recently issued reports on RGNX. Wall Street Zen downgraded REGENXBIO from a "hold" rating to a "strong sell" rating in a research note on Saturday, August 9th. Barclays lowered their price target on REGENXBIO from $50.00 to $37.00 and set an "overweight" rating on the stock in a report on Friday, August 8th. Chardan Capital reiterated a "buy" rating and set a $52.00 price target on shares of REGENXBIO in a report on Friday, August 8th. Finally, Royal Bank Of Canada lowered their price target on REGENXBIO from $21.00 to $17.00 and set an "outperform" rating on the stock in a report on Friday, August 8th. Five analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat, REGENXBIO presently has a consensus rating of "Moderate Buy" and an average target price of $28.38.

Read Our Latest Stock Report on RGNX

REGENXBIO Stock Performance

Shares of NASDAQ RGNX traded down $0.29 during mid-day trading on Monday, reaching $9.20. The company had a trading volume of 294,794 shares, compared to its average volume of 541,778. The stock has a fifty day moving average of $8.75 and a two-hundred day moving average of $8.25. The company has a market capitalization of $464.69 million, a price-to-earnings ratio of -2.67 and a beta of 1.17. REGENXBIO has a 12-month low of $5.03 and a 12-month high of $13.48.

REGENXBIO (NASDAQ:RGNX - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The biotechnology company reported ($1.38) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.13) by ($0.25). The company had revenue of $21.36 million during the quarter, compared to analysts' expectations of $40.87 million. REGENXBIO had a negative return on equity of 66.95% and a negative net margin of 112.70%. Sell-side analysts forecast that REGENXBIO will post -4.84 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CEO Curran Simpson sold 7,734 shares of the company's stock in a transaction dated Wednesday, September 10th. The shares were sold at an average price of $10.02, for a total value of $77,494.68. Following the sale, the chief executive officer owned 244,597 shares of the company's stock, valued at $2,450,861.94. The trade was a 3.07% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. 12.79% of the stock is currently owned by insiders.

Hedge Funds Weigh In On REGENXBIO

A number of hedge funds have recently modified their holdings of the stock. Millennium Management LLC lifted its holdings in shares of REGENXBIO by 406.3% during the fourth quarter. Millennium Management LLC now owns 1,322,344 shares of the biotechnology company's stock valued at $10,222,000 after acquiring an additional 1,061,187 shares during the period. 22NW LP bought a new position in shares of REGENXBIO during the first quarter valued at $4,781,000. AQR Capital Management LLC lifted its holdings in shares of REGENXBIO by 2,247.7% during the first quarter. AQR Capital Management LLC now owns 620,595 shares of the biotechnology company's stock valued at $4,437,000 after acquiring an additional 594,161 shares during the period. Vanguard Group Inc. lifted its holdings in shares of REGENXBIO by 16.3% during the first quarter. Vanguard Group Inc. now owns 3,472,988 shares of the biotechnology company's stock valued at $24,832,000 after acquiring an additional 487,036 shares during the period. Finally, Exome Asset Management LLC bought a new position in shares of REGENXBIO during the first quarter valued at $2,898,000. 88.08% of the stock is owned by institutional investors and hedge funds.

REGENXBIO Company Profile

(

Get Free Report)

REGENXBIO Inc, a clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States. Its gene therapy product candidates are based on NAV Technology Platform, a proprietary adeno-associated virus gene delivery platform. The company's products in pipeline includes ABBV-RGX-314 for the treatment of wet age-related macular degeneration, diabetic retinopathy, and other chronic retinal diseases; and RGX-202, which is in Phase I/II clinical trial for the treatment of Duchenne muscular dystrophy.

Featured Articles

Before you consider REGENXBIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REGENXBIO wasn't on the list.

While REGENXBIO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.