Wall Street Zen upgraded shares of Repsol (OTCMKTS:REPYY - Free Report) from a hold rating to a buy rating in a research report sent to investors on Friday morning.

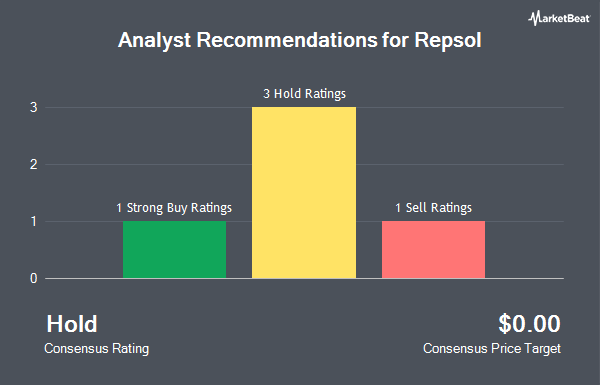

A number of other research firms also recently commented on REPYY. BNP Paribas downgraded Repsol from a "neutral" rating to an "underperform" rating in a research note on Tuesday, April 15th. Citigroup reiterated a "buy" rating on shares of Repsol in a report on Thursday, July 10th. Kepler Capital Markets downgraded Repsol from a "strong-buy" rating to a "hold" rating in a report on Tuesday, May 20th. Finally, Barclays upgraded Repsol from a "reduce" rating to an "overweight" rating in a report on Thursday, May 22nd. One research analyst has rated the stock with a sell rating, four have issued a hold rating, three have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company has an average rating of "Hold".

Get Our Latest Report on Repsol

Repsol Price Performance

OTCMKTS:REPYY traded down $0.08 during midday trading on Friday, reaching $14.97. 52,144 shares of the company traded hands, compared to its average volume of 131,763. Repsol has a twelve month low of $10.41 and a twelve month high of $16.20. The firm has a market capitalization of $17.33 billion, a price-to-earnings ratio of 23.39, a price-to-earnings-growth ratio of 4.88 and a beta of 0.67. The company has a fifty day moving average price of $14.62 and a 200 day moving average price of $13.14.

Repsol (OTCMKTS:REPYY - Get Free Report) last released its quarterly earnings data on Thursday, July 24th. The energy company reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.41 by $0.23. Repsol had a return on equity of 8.99% and a net margin of 1.33%. The business had revenue of $16.48 billion during the quarter, compared to analyst estimates of $14.91 billion. On average, equities research analysts forecast that Repsol will post 2.36 earnings per share for the current fiscal year.

Repsol Cuts Dividend

The company also recently announced a dividend, which was paid on Tuesday, July 15th. Shareholders of record on Tuesday, July 8th were paid a $0.4554 dividend. The ex-dividend date was Monday, July 7th. This represents a yield of 313.0%. Repsol's payout ratio is 143.75%.

Repsol Company Profile

(

Get Free Report)

Repsol, SA operates as a multi-e energy company worldwide. Its Upstream segment engages in the exploration, development, and production of crude oil and natural gas reserves, as well as develops low-carbon geological solutions. The company's Industrial segment is involved in refining activities and petrochemicals business; the trading, transport, and sale of crude oil, natural gas, and fuels; and development of hydrogen, biomethane, sustainable biofuels, and synthetic fuels.

Further Reading

Before you consider Repsol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Repsol wasn't on the list.

While Repsol currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.