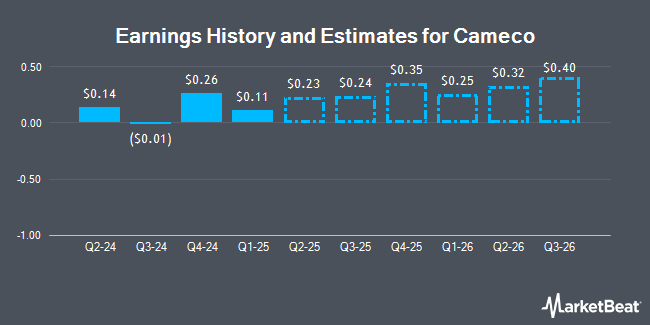

Cameco Corporation (NYSE:CCJ - Free Report) TSE: CCO - Equities research analysts at National Bank Financial cut their FY2026 EPS estimates for shares of Cameco in a research report issued to clients and investors on Thursday, July 31st. National Bank Financial analyst M. Sidibe now expects that the basic materials company will post earnings of $0.99 per share for the year, down from their previous estimate of $1.01. The consensus estimate for Cameco's current full-year earnings is $1.27 per share. National Bank Financial also issued estimates for Cameco's FY2027 earnings at $1.71 EPS.

Cameco (NYSE:CCJ - Get Free Report) TSE: CCO last announced its earnings results on Thursday, July 31st. The basic materials company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.29 by $0.22. The firm had revenue of $467.72 million during the quarter, compared to the consensus estimate of $819.79 million. Cameco had a net margin of 14.97% and a return on equity of 8.21%. The firm's revenue for the quarter was up 46.7% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.14 EPS.

Several other analysts have also recently commented on the company. Wall Street Zen upgraded Cameco from a "hold" rating to a "buy" rating in a report on Saturday. Glj Research restated a "buy" rating and issued a $75.27 price target on shares of Cameco in a report on Thursday, June 12th. Royal Bank Of Canada lifted their price target on Cameco from $100.00 to $110.00 and gave the company an "outperform" rating in a report on Friday. Raymond James Financial restated an "outperform" rating on shares of Cameco in a report on Wednesday, June 18th. Finally, UBS Group restated a "buy" rating on shares of Cameco in a report on Tuesday, June 10th. Ten equities research analysts have rated the stock with a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat.com, Cameco currently has a consensus rating of "Buy" and a consensus target price of $82.65.

Read Our Latest Stock Report on CCJ

Cameco Stock Down 2.6%

CCJ opened at $72.97 on Monday. The company has a debt-to-equity ratio of 0.15, a current ratio of 2.96 and a quick ratio of 2.00. The stock has a market capitalization of $31.77 billion, a price-to-earnings ratio of 83.87 and a beta of 1.06. The business has a 50-day moving average of $70.40 and a two-hundred day moving average of $54.41. Cameco has a 12 month low of $35.00 and a 12 month high of $80.32.

Institutional Trading of Cameco

A number of institutional investors have recently modified their holdings of CCJ. Manchester Capital Management LLC lifted its position in Cameco by 100.0% during the 1st quarter. Manchester Capital Management LLC now owns 600 shares of the basic materials company's stock worth $25,000 after acquiring an additional 300 shares in the last quarter. Hurley Capital LLC acquired a new position in Cameco during the 4th quarter worth approximately $27,000. Dagco Inc. acquired a new position in Cameco during the 1st quarter worth approximately $28,000. SVB Wealth LLC acquired a new position in Cameco during the 1st quarter worth approximately $29,000. Finally, Trust Co. of Vermont lifted its position in Cameco by 1,029.4% during the 2nd quarter. Trust Co. of Vermont now owns 384 shares of the basic materials company's stock worth $29,000 after acquiring an additional 350 shares in the last quarter. Hedge funds and other institutional investors own 70.21% of the company's stock.

About Cameco

(

Get Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.