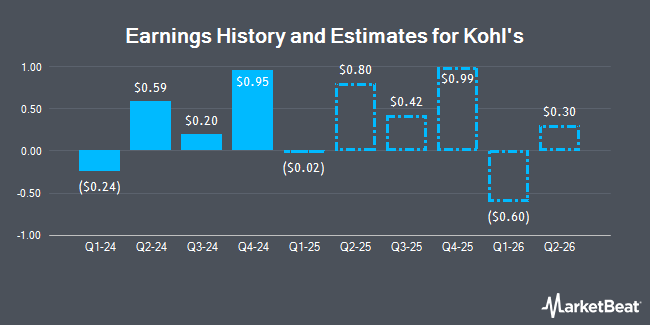

Kohl's Corporation (NYSE:KSS - Free Report) - Research analysts at Telsey Advisory Group cut their Q4 2026 earnings per share (EPS) estimates for shares of Kohl's in a research report issued on Thursday, August 28th. Telsey Advisory Group analyst D. Telsey now forecasts that the company will post earnings of $0.40 per share for the quarter, down from their previous forecast of $0.41. Telsey Advisory Group currently has a "Market Perform" rating and a $16.00 target price on the stock. The consensus estimate for Kohl's' current full-year earnings is $1.30 per share. Telsey Advisory Group also issued estimates for Kohl's' Q4 2027 earnings at $0.41 EPS.

Kohl's (NYSE:KSS - Get Free Report) last released its quarterly earnings data on Wednesday, August 27th. The company reported $0.56 earnings per share for the quarter, beating the consensus estimate of $0.33 by $0.23. Kohl's had a return on equity of 4.62% and a net margin of 1.31%.The business had revenue of $3.35 billion for the quarter, compared to analysts' expectations of $3.37 billion. During the same quarter in the previous year, the business posted $0.59 EPS. Kohl's's revenue for the quarter was down 5.0% on a year-over-year basis. Kohl's has set its FY 2025 guidance at 0.500-0.800 EPS.

Several other equities analysts have also recently weighed in on the company. JPMorgan Chase & Co. lifted their price objective on Kohl's from $10.00 to $11.00 and gave the company an "underweight" rating in a report on Thursday. Evercore ISI lifted their target price on Kohl's from $8.00 to $13.00 and gave the company an "in-line" rating in a research report on Thursday. Robert W. Baird lifted their target price on Kohl's from $9.00 to $15.00 and gave the company a "neutral" rating in a research report on Thursday. The Goldman Sachs Group lifted their target price on Kohl's from $7.00 to $11.00 and gave the company a "sell" rating in a research report on Thursday. Finally, Barclays lifted their target price on Kohl's from $5.00 to $8.00 and gave the company an "underweight" rating in a research report on Thursday. One investment analyst has rated the stock with a Buy rating, nine have issued a Hold rating and six have issued a Sell rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Reduce" and a consensus price target of $12.46.

View Our Latest Research Report on Kohl's

Kohl's Stock Down 1.7%

Shares of NYSE:KSS traded down $0.26 during trading on Friday, hitting $15.11. 5,698,869 shares of the company's stock traded hands, compared to its average volume of 9,200,296. Kohl's has a 52 week low of $6.04 and a 52 week high of $21.39. The company has a current ratio of 1.36, a quick ratio of 0.19 and a debt-to-equity ratio of 1.00. The company has a market cap of $1.69 billion, a price-to-earnings ratio of 8.17 and a beta of 1.74. The company has a 50-day moving average price of $11.35 and a 200-day moving average price of $9.51.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in KSS. Alyeska Investment Group L.P. acquired a new position in shares of Kohl's during the 1st quarter worth approximately $11,650,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. acquired a new position in shares of Kohl's during the 1st quarter worth approximately $7,818,000. Gate City Capital Management LLC acquired a new position in shares of Kohl's during the 4th quarter worth approximately $12,773,000. AQR Capital Management LLC increased its position in shares of Kohl's by 88.1% during the 1st quarter. AQR Capital Management LLC now owns 1,774,244 shares of the company's stock worth $14,513,000 after purchasing an additional 831,055 shares during the last quarter. Finally, Geode Capital Management LLC increased its position in shares of Kohl's by 43.0% during the 2nd quarter. Geode Capital Management LLC now owns 2,615,482 shares of the company's stock worth $22,182,000 after purchasing an additional 785,936 shares during the last quarter. Institutional investors and hedge funds own 98.04% of the company's stock.

Kohl's Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, September 24th. Shareholders of record on Wednesday, September 10th will be given a dividend of $0.125 per share. The ex-dividend date of this dividend is Wednesday, September 10th. This represents a $0.50 annualized dividend and a dividend yield of 3.3%. Kohl's's payout ratio is 27.03%.

About Kohl's

(

Get Free Report)

Kohl's Corporation operates as an omnichannel retailer in the United States. It offers branded apparel, footwear, accessories, beauty, and home products through its stores and website. The company provides its products primarily under the brand names of Croft & Barrow, Jumping Beans, SO, Sonoma Goods for Life, and Tek Gear, as well as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang.

Featured Stories

Before you consider Kohl's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kohl's wasn't on the list.

While Kohl's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.