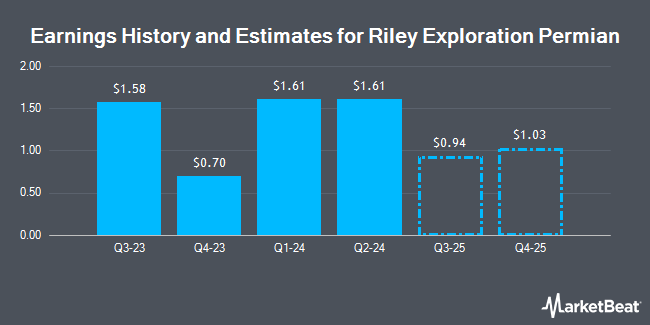

Riley Exploration Permian, Inc. (NYSE:REPX - Free Report) - Analysts at Roth Capital issued their Q3 2025 earnings estimates for Riley Exploration Permian in a report issued on Monday, October 13th. Roth Capital analyst N. Pope expects that the company will earn $1.18 per share for the quarter. Roth Capital has a "Strong-Buy" rating on the stock. The consensus estimate for Riley Exploration Permian's current full-year earnings is $6.39 per share. Roth Capital also issued estimates for Riley Exploration Permian's Q4 2025 earnings at $1.02 EPS and FY2026 earnings at $4.11 EPS.

Riley Exploration Permian Stock Up 0.1%

Shares of Riley Exploration Permian stock opened at $27.77 on Thursday. The company has a market cap of $612.11 million, a price-to-earnings ratio of 4.92 and a beta of 1.18. The company's 50 day moving average is $27.67 and its 200 day moving average is $26.90. Riley Exploration Permian has a twelve month low of $21.98 and a twelve month high of $37.55. The company has a quick ratio of 0.64, a current ratio of 0.70 and a debt-to-equity ratio of 0.53.

Riley Exploration Permian Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, November 6th. Investors of record on Tuesday, October 21st will be given a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 5.8%. This is a positive change from Riley Exploration Permian's previous quarterly dividend of $0.38. The ex-dividend date is Tuesday, October 21st. Riley Exploration Permian's payout ratio is currently 35.32%.

Insider Activity at Riley Exploration Permian

In other Riley Exploration Permian news, insider Corey Neil Riley sold 3,500 shares of the stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $26.42, for a total value of $92,470.00. Following the transaction, the insider directly owned 176,700 shares in the company, valued at approximately $4,668,414. This trade represents a 1.94% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Bobby Riley sold 15,000 shares of the stock in a transaction that occurred on Monday, August 11th. The stock was sold at an average price of $26.01, for a total transaction of $390,150.00. Following the completion of the transaction, the chief executive officer owned 399,636 shares in the company, valued at $10,394,532.36. The trade was a 3.62% decrease in their ownership of the stock. The disclosure for this sale can be found here. 4.70% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in REPX. American Century Companies Inc. raised its position in Riley Exploration Permian by 25.8% in the first quarter. American Century Companies Inc. now owns 484,614 shares of the company's stock worth $14,136,000 after acquiring an additional 99,273 shares during the period. Raymond James Financial Inc. bought a new position in Riley Exploration Permian in the second quarter worth approximately $2,033,000. Mackenzie Financial Corp raised its position in Riley Exploration Permian by 83.5% in the second quarter. Mackenzie Financial Corp now owns 121,731 shares of the company's stock worth $3,193,000 after acquiring an additional 55,400 shares during the period. Geode Capital Management LLC raised its position in Riley Exploration Permian by 14.9% in the second quarter. Geode Capital Management LLC now owns 319,695 shares of the company's stock worth $8,386,000 after acquiring an additional 41,574 shares during the period. Finally, Nuveen LLC bought a new position in Riley Exploration Permian in the first quarter worth approximately $926,000. 58.91% of the stock is currently owned by institutional investors.

Riley Exploration Permian Company Profile

(

Get Free Report)

Riley Exploration Permian, Inc, an independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in Texas and New Mexico. The company's activities are primarily focused on the Northwest Shelf and Yeso trend of the Permian Basin.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Riley Exploration Permian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Riley Exploration Permian wasn't on the list.

While Riley Exploration Permian currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.