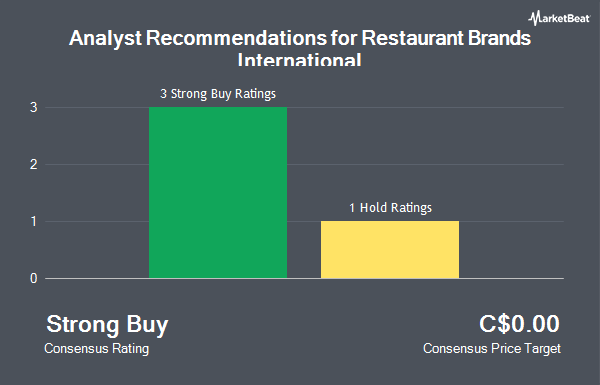

Restaurant Brands International (TSE:QSR - Get Free Report) NYSE: QSR was downgraded by equities researchers at Northcoast Research from a "strong-buy" rating to a "hold" rating in a research report issued on Friday,Zacks.com reports.

A number of other analysts also recently commented on QSR. Scotiabank upgraded shares of Restaurant Brands International to a "hold" rating in a research report on Wednesday, June 18th. Argus downgraded shares of Restaurant Brands International from a "strong-buy" rating to a "hold" rating in a research report on Friday, August 15th. One analyst has rated the stock with a Strong Buy rating and four have given a Hold rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold".

Get Our Latest Stock Report on QSR

Restaurant Brands International Stock Performance

TSE:QSR traded down C$1.00 during mid-day trading on Friday, hitting C$86.99. The stock had a trading volume of 226,464 shares, compared to its average volume of 891,906. The stock has a market capitalization of C$28.52 billion, a price-to-earnings ratio of 32.95, a P/E/G ratio of 2.22 and a beta of 0.42. The company has a 50 day simple moving average of C$90.47 and a 200-day simple moving average of C$92.23. Restaurant Brands International has a 52 week low of C$83.32 and a 52 week high of C$102.37. The company has a current ratio of 1.02, a quick ratio of 0.80 and a debt-to-equity ratio of 494.65.

Restaurant Brands International Company Profile

(

Get Free Report)

Restaurant Brands International is one of the largest restaurant companies in the world, with more than $35 billion in 2021 systemwide sales across a footprint that spans more than 28,000 restaurants and 100 countries. The firm generates revenue primarily from retail sales at its company-owned restaurants, royalty fees and lease income from franchised stores, and from its Tim Horton's supply chain operations.

Further Reading

Before you consider Restaurant Brands International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Restaurant Brands International wasn't on the list.

While Restaurant Brands International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.