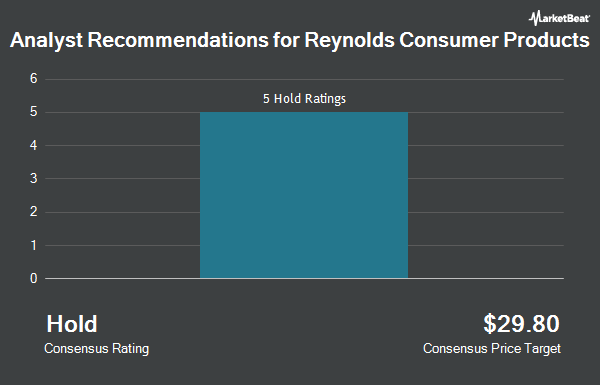

Reynolds Consumer Products Inc. (NASDAQ:REYN - Get Free Report) has earned an average recommendation of "Hold" from the nine brokerages that are currently covering the firm, MarketBeat reports. Six equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 1-year target price among brokerages that have issued ratings on the stock in the last year is $28.33.

Several research analysts have weighed in on the stock. Wall Street Zen raised shares of Reynolds Consumer Products from a "sell" rating to a "hold" rating in a research note on Friday, May 30th. Royal Bank Of Canada reissued a "sector perform" rating and issued a $30.00 price target on shares of Reynolds Consumer Products in a research report on Monday, April 28th. UBS Group cut their price objective on Reynolds Consumer Products from $26.00 to $25.00 and set a "neutral" rating on the stock in a research report on Thursday, May 1st. Canaccord Genuity Group reduced their price objective on Reynolds Consumer Products from $27.00 to $26.00 and set a "hold" rating on the stock in a research note on Thursday, May 1st. Finally, JPMorgan Chase & Co. lowered their target price on Reynolds Consumer Products from $26.00 to $24.00 and set a "neutral" rating for the company in a research note on Friday, April 11th.

Check Out Our Latest Report on REYN

Reynolds Consumer Products Trading Up 1.7%

Shares of Reynolds Consumer Products stock traded up $0.36 during mid-day trading on Friday, hitting $21.78. The stock had a trading volume of 1,772,844 shares, compared to its average volume of 745,942. The firm has a 50-day moving average of $22.29 and a two-hundred day moving average of $24.20. The firm has a market cap of $4.58 billion, a P/E ratio of 13.61 and a beta of 0.57. The company has a quick ratio of 0.72, a current ratio of 1.80 and a debt-to-equity ratio of 0.76. Reynolds Consumer Products has a 12-month low of $20.91 and a 12-month high of $32.65.

Reynolds Consumer Products (NASDAQ:REYN - Get Free Report) last announced its quarterly earnings results on Wednesday, April 30th. The company reported $0.23 EPS for the quarter, meeting the consensus estimate of $0.23. The business had revenue of $801.00 million for the quarter, compared to analyst estimates of $821.99 million. Reynolds Consumer Products had a return on equity of 16.87% and a net margin of 9.11%. The company's quarterly revenue was down 1.8% on a year-over-year basis. During the same quarter in the prior year, the company posted $0.23 EPS. Sell-side analysts forecast that Reynolds Consumer Products will post 1.66 earnings per share for the current year.

Reynolds Consumer Products Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, May 30th. Investors of record on Friday, May 16th were issued a $0.23 dividend. This represents a $0.92 annualized dividend and a yield of 4.22%. The ex-dividend date was Friday, May 16th. Reynolds Consumer Products's dividend payout ratio (DPR) is presently 57.50%.

Insiders Place Their Bets

In other Reynolds Consumer Products news, CAO Chris Mayrhofer bought 5,048 shares of the firm's stock in a transaction that occurred on Friday, May 30th. The stock was purchased at an average price of $21.99 per share, for a total transaction of $111,005.52. Following the completion of the purchase, the chief accounting officer directly owned 23,266 shares in the company, valued at $511,619.34. This trade represents a 27.71% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Rolf Stangl purchased 4,500 shares of the stock in a transaction that occurred on Friday, June 20th. The stock was acquired at an average cost of $21.24 per share, with a total value of $95,580.00. Following the completion of the acquisition, the director directly owned 30,889 shares of the company's stock, valued at $656,082.36. This represents a 17.05% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders acquired 34,766 shares of company stock worth $765,632. 0.15% of the stock is owned by insiders.

Institutional Trading of Reynolds Consumer Products

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in REYN. Bank of New York Mellon Corp boosted its holdings in shares of Reynolds Consumer Products by 13.0% in the 4th quarter. Bank of New York Mellon Corp now owns 1,211,805 shares of the company's stock valued at $32,707,000 after buying an additional 139,576 shares in the last quarter. Proficio Capital Partners LLC purchased a new stake in Reynolds Consumer Products in the fourth quarter valued at $424,000. Versor Investments LP lifted its position in Reynolds Consumer Products by 96.7% in the fourth quarter. Versor Investments LP now owns 24,212 shares of the company's stock valued at $653,000 after acquiring an additional 11,900 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its stake in Reynolds Consumer Products by 3.3% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 591,906 shares of the company's stock valued at $15,976,000 after acquiring an additional 19,044 shares in the last quarter. Finally, Victory Capital Management Inc. boosted its stake in Reynolds Consumer Products by 14.8% in the fourth quarter. Victory Capital Management Inc. now owns 19,471 shares of the company's stock valued at $526,000 after acquiring an additional 2,508 shares in the last quarter. Institutional investors and hedge funds own 26.81% of the company's stock.

Reynolds Consumer Products Company Profile

(

Get Free ReportReynolds Consumer Products Inc produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally. It operates through four segments: Reynolds Cooking & Baking, Hefty Waste & Storage, Hefty Tableware, and Presto Products. The Reynolds Cooking & Baking segment produces aluminum foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, butcher paper, plastic wrap, baking cups, oven bags, and slow cooker liners under the Reynolds Wrap, Reynolds KITCHENS, and EZ Foil brands in the United States, as well as under the ALCAN brand in Canada and under the Diamond brand internationally.

Featured Articles

Before you consider Reynolds Consumer Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reynolds Consumer Products wasn't on the list.

While Reynolds Consumer Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report