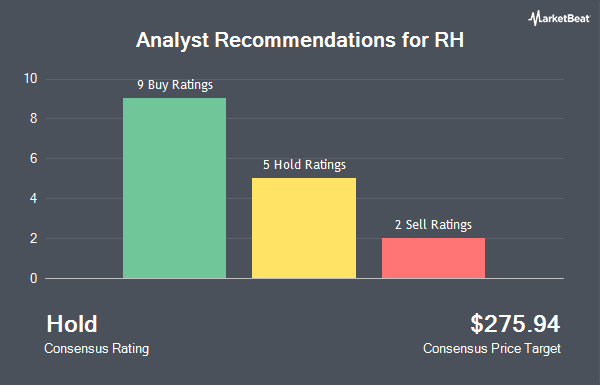

RH (NYSE:RH - Get Free Report) has received an average recommendation of "Hold" from the seventeen research firms that are currently covering the company, MarketBeat Ratings reports. Three equities research analysts have rated the stock with a sell recommendation, four have given a hold recommendation and ten have issued a buy recommendation on the company. The average 12-month target price among brokers that have issued a report on the stock in the last year is $270.35.

Several equities analysts recently issued reports on RH shares. Morgan Stanley dropped their price target on RH from $530.00 to $300.00 and set an "overweight" rating on the stock in a research report on Thursday, April 3rd. Zelman & Associates decreased their price target on RH from $305.00 to $251.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 9th. Barclays decreased their price target on RH from $515.00 to $436.00 and set an "overweight" rating on the stock in a research note on Thursday, April 3rd. JPMorgan Chase & Co. decreased their price target on RH from $510.00 to $250.00 and set an "overweight" rating on the stock in a research note on Monday, April 14th. Finally, Citigroup reissued a "neutral" rating and set a $200.00 price target (down previously from $437.00) on shares of RH in a research note on Thursday, April 3rd.

Get Our Latest Stock Report on RH

RH Price Performance

RH stock opened at $188.46 on Thursday. RH has a 1-year low of $123.03 and a 1-year high of $457.26. The stock has a market cap of $3.53 billion, a PE ratio of 44.87, a P/E/G ratio of 0.54 and a beta of 2.17. The stock's fifty day moving average is $193.67 and its two-hundred day moving average is $262.03.

RH (NYSE:RH - Get Free Report) last issued its quarterly earnings data on Thursday, June 12th. The company reported $0.13 earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.07) by $0.20. The company had revenue of $813.95 million for the quarter, compared to analyst estimates of $817.66 million. RH had a negative return on equity of 67.71% and a net margin of 2.57%. The business's quarterly revenue was up 12.0% compared to the same quarter last year. During the same quarter last year, the company posted ($0.40) earnings per share. On average, research analysts expect that RH will post 4.39 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the business. Treasurer of the State of North Carolina raised its holdings in RH by 0.6% in the 4th quarter. Treasurer of the State of North Carolina now owns 6,546 shares of the company's stock valued at $2,576,000 after acquiring an additional 40 shares during the last quarter. ProShare Advisors LLC increased its holdings in shares of RH by 7.5% during the 4th quarter. ProShare Advisors LLC now owns 700 shares of the company's stock worth $276,000 after buying an additional 49 shares during the last quarter. Ridgewood Investments LLC increased its holdings in shares of RH by 19.8% during the 2nd quarter. Ridgewood Investments LLC now owns 303 shares of the company's stock worth $57,000 after buying an additional 50 shares during the last quarter. Farther Finance Advisors LLC increased its holdings in shares of RH by 67.8% during the 2nd quarter. Farther Finance Advisors LLC now owns 151 shares of the company's stock worth $29,000 after buying an additional 61 shares during the last quarter. Finally, UMB Bank n.a. increased its holdings in shares of RH by 53.8% during the 2nd quarter. UMB Bank n.a. now owns 180 shares of the company's stock worth $34,000 after buying an additional 63 shares during the last quarter. 90.17% of the stock is currently owned by institutional investors and hedge funds.

About RH

(

Get Free ReportRH, together with its subsidiaries, operates as a retailer in the home furnishings market. The company offers products in various categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, baby, child, and teen furnishings. It provides its products through rh.com, rhbabyandchild.com, rhteen.com, rhmodern.com, and waterworks.com online channels, as well as operates RH Galleries, RH outlet stores, RH Guesthouse, and Waterworks showrooms in the United States, Canada, the United Kingdom, and Germany.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RH wasn't on the list.

While RH currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.