Ribbon Communications (NASDAQ:RBBN - Get Free Report) will likely be issuing its Q2 2025 quarterly earnings data after the market closes on Wednesday, July 23rd. Analysts expect the company to announce earnings of $0.05 per share and revenue of $213.31 million for the quarter. Ribbon Communications has set its FY 2025 guidance at EPS and its Q2 2025 guidance at EPS.

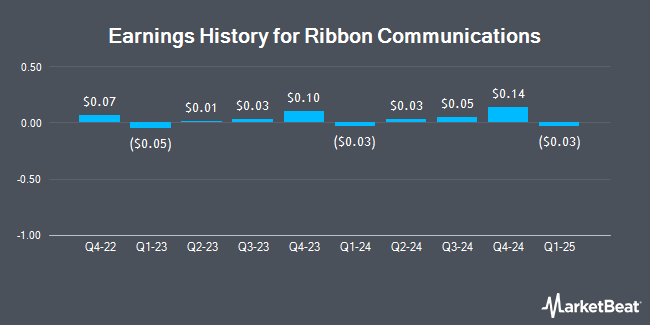

Ribbon Communications (NASDAQ:RBBN - Get Free Report) last announced its quarterly earnings results on Tuesday, April 29th. The communications equipment provider reported ($0.03) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.01 by ($0.04). The business had revenue of $181.28 million during the quarter, compared to the consensus estimate of $191.66 million. Ribbon Communications had a negative net margin of 6.00% and a positive return on equity of 6.76%. The company's quarterly revenue was up .9% compared to the same quarter last year. During the same period last year, the firm earned ($0.01) EPS. On average, analysts expect Ribbon Communications to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Ribbon Communications Stock Performance

Ribbon Communications stock traded up $0.07 on Friday, hitting $4.06. The company's stock had a trading volume of 418,232 shares, compared to its average volume of 455,531. The firm has a market cap of $716.75 million, a P/E ratio of -14.00 and a beta of 1.36. The company has a quick ratio of 1.13, a current ratio of 1.39 and a debt-to-equity ratio of 0.86. The company has a fifty day moving average price of $3.83 and a 200-day moving average price of $3.92. Ribbon Communications has a one year low of $2.75 and a one year high of $5.38.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Strs Ohio bought a new stake in shares of Ribbon Communications in the 1st quarter valued at about $69,000. Dynamic Technology Lab Private Ltd bought a new stake in Ribbon Communications during the 1st quarter worth approximately $124,000. Jane Street Group LLC increased its stake in Ribbon Communications by 436.9% during the 1st quarter. Jane Street Group LLC now owns 101,211 shares of the communications equipment provider's stock worth $397,000 after purchasing an additional 82,361 shares in the last quarter. Finally, AQR Capital Management LLC bought a new stake in Ribbon Communications during the 1st quarter worth approximately $805,000. Institutional investors and hedge funds own 70.92% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on the stock. Wall Street Zen lowered shares of Ribbon Communications from a "buy" rating to a "hold" rating in a report on Friday, May 2nd. B. Riley lowered their target price on shares of Ribbon Communications from $7.50 to $6.00 and set a "buy" rating on the stock in a report on Wednesday, April 30th. Finally, Rosenblatt Securities reiterated a "buy" rating and set a $5.50 price target on shares of Ribbon Communications in a research report on Wednesday, April 30th. One research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $5.88.

Get Our Latest Report on Ribbon Communications

Ribbon Communications Company Profile

(

Get Free Report)

Ribbon Communications Inc provides communications technology in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally. It operates through two segments, Cloud and Edge, and IP Optical Networks. The Cloud and Edge segment provides software and hardware products, solutions, and services for voice over internet protocol communications, voice over long-term evolution, and voice over 5G communications, and unified communications and collaboration.

Recommended Stories

Before you consider Ribbon Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ribbon Communications wasn't on the list.

While Ribbon Communications currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.