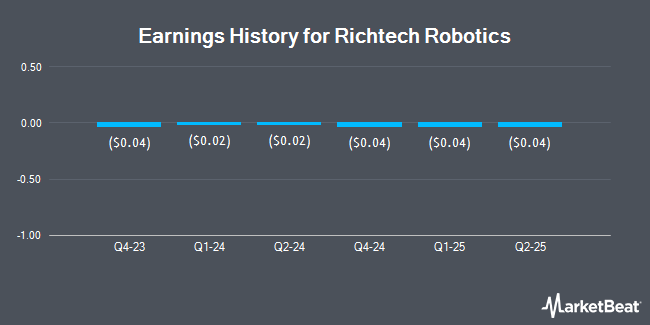

Richtech Robotics (NASDAQ:RR - Get Free Report) announced its quarterly earnings data on Monday. The company reported ($0.04) EPS for the quarter, meeting analysts' consensus estimates of ($0.04), Zacks reports. Richtech Robotics had a negative return on equity of 23.85% and a negative net margin of 366.21%. The company had revenue of $1.18 million during the quarter, compared to the consensus estimate of $1.42 million.

Richtech Robotics Stock Down 1.1%

RR stock traded down $0.03 during mid-day trading on Friday, reaching $2.24. 3,064,130 shares of the stock traded hands, compared to its average volume of 12,338,782. The business has a 50-day moving average of $1.97 and a two-hundred day moving average of $2.10. Richtech Robotics has a 52 week low of $0.52 and a 52 week high of $5.20. The firm has a market capitalization of $255.91 million, a PE ratio of -13.03 and a beta of -4.51.

Insider Buying and Selling at Richtech Robotics

In related news, COO Phil Zheng sold 105,213 shares of the stock in a transaction dated Thursday, May 29th. The shares were sold at an average price of $2.64, for a total value of $277,762.32. Following the completion of the transaction, the chief operating officer owned 1,294,787 shares of the company's stock, valued at $3,418,237.68. This represents a 7.52% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders own 41.30% of the company's stock.

Hedge Funds Weigh In On Richtech Robotics

Hedge funds and other institutional investors have recently made changes to their positions in the company. Geode Capital Management LLC lifted its position in Richtech Robotics by 128.9% in the 2nd quarter. Geode Capital Management LLC now owns 1,463,608 shares of the company's stock valued at $2,854,000 after acquiring an additional 824,253 shares in the last quarter. Bank of America Corp DE increased its stake in shares of Richtech Robotics by 3,231.2% during the 2nd quarter. Bank of America Corp DE now owns 1,248,742 shares of the company's stock worth $2,435,000 after purchasing an additional 1,211,256 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in shares of Richtech Robotics by 4.8% during the 2nd quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 862,730 shares of the company's stock worth $1,682,000 after purchasing an additional 39,249 shares during the last quarter. Goldman Sachs Group Inc. acquired a new position in shares of Richtech Robotics during the 1st quarter worth about $459,000. Finally, JPMorgan Chase & Co. increased its stake in shares of Richtech Robotics by 71.4% during the 2nd quarter. JPMorgan Chase & Co. now owns 78,489 shares of the company's stock worth $153,000 after purchasing an additional 32,684 shares during the last quarter. 0.01% of the stock is owned by institutional investors.

Richtech Robotics Company Profile

(

Get Free Report)

Richtech Robotics Inc develops, manufactures, deploys, and sells robotic solutions for automation in the service industry. The company offers indoor transport and delivery, sanitation, and food and beverage automation solutions, such as ADAM and ARM worker robots; delivery robots, including Matradee, Matradee X, Matradee L, Richie, and Robbie; and cleaning robots comprising DUST-E SX, and DUST-E MX, as well as accessories, such as bus tubs, cup holders, magnetic tray cases, smartwatches, table location systems, and tray covers.

Further Reading

Before you consider Richtech Robotics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Richtech Robotics wasn't on the list.

While Richtech Robotics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.