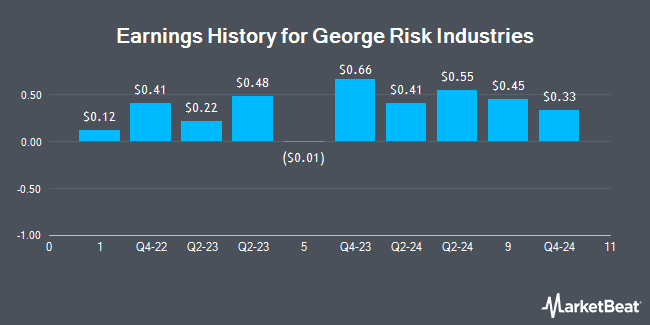

RISKGEORGE IN (OTCMKTS:RSKIA - Get Free Report) issued its quarterly earnings results on Friday. The company reported $0.77 EPS for the quarter, Zacks reports. The business had revenue of $5.90 million for the quarter. RISKGEORGE IN had a net margin of 36.28% and a return on equity of 14.40%.

RISKGEORGE IN Trading Up 3.8%

Shares of OTCMKTS:RSKIA traded up $0.69 during trading on Wednesday, reaching $18.69. 1,200 shares of the company traded hands, compared to its average volume of 3,042. The firm has a market capitalization of $91.39 million, a price-to-earnings ratio of 11.19 and a beta of 0.02. RISKGEORGE IN has a 52-week low of $14.27 and a 52-week high of $19.57. The business's fifty day moving average is $16.76 and its 200-day moving average is $16.19.

About RISKGEORGE IN

(

Get Free Report)

George Risk Industries, Inc designs, manufactures, and sells various electronic components worldwide. It operates in three segments: security line products, cable and wiring tools (Labor Saving Devices - LSDI) products, and all other products. The company offers computer keyboards, proximity switches, security alarm components and systems, pool access alarms, EZ Duct wire covers, water sensors, electronic switching devices, security switches, and wire and cable installation tools, as well as door and window contact switches, environmental products, liquid detection sensors, and raceway wire covers.

Recommended Stories

Before you consider RISKGEORGE IN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RISKGEORGE IN wasn't on the list.

While RISKGEORGE IN currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.