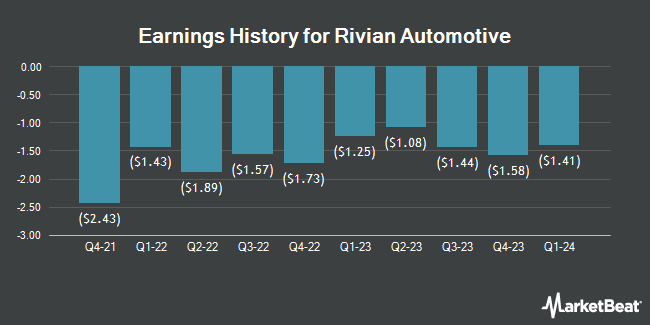

Rivian Automotive (NASDAQ:RIVN - Get Free Report) is expected to be posting its quarterly earnings results after the market closes on Thursday, February 20th. Analysts expect Rivian Automotive to post earnings of ($0.69) per share and revenue of $1.43 billion for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

Rivian Automotive Stock Up 5.5 %

Shares of RIVN traded up $0.73 on Friday, reaching $14.03. The company's stock had a trading volume of 33,856,768 shares, compared to its average volume of 27,819,302. The company has a current ratio of 5.09, a quick ratio of 3.70 and a debt-to-equity ratio of 0.93. Rivian Automotive has a twelve month low of $8.26 and a twelve month high of $18.85. The stock has a market capitalization of $14.32 billion, a PE ratio of -2.51 and a beta of 2.04. The firm has a fifty day moving average of $13.59 and a 200-day moving average of $12.53.

Insider Activity at Rivian Automotive

In other news, CFO Claire Mcdonough sold 18,501 shares of the business's stock in a transaction that occurred on Monday, December 16th. The shares were sold at an average price of $15.00, for a total value of $277,515.00. Following the completion of the sale, the chief financial officer now directly owns 351,900 shares in the company, valued at approximately $5,278,500. The trade was a 4.99 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CEO Robert J. Scaringe sold 71,429 shares of the stock in a transaction on Monday, January 6th. The shares were sold at an average price of $16.17, for a total transaction of $1,155,006.93. Following the transaction, the chief executive officer now directly owns 863,361 shares in the company, valued at approximately $13,960,547.37. This represents a 7.64 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 363,142 shares of company stock valued at $4,958,860 over the last 90 days. 2.51% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

RIVN has been the subject of several analyst reports. Cantor Fitzgerald reiterated an "overweight" rating and issued a $13.00 price objective on shares of Rivian Automotive in a research note on Monday, January 6th. The Goldman Sachs Group increased their target price on shares of Rivian Automotive from $10.00 to $12.00 and gave the company a "neutral" rating in a research report on Thursday, November 14th. Mizuho cut their price objective on shares of Rivian Automotive from $15.00 to $12.00 and set a "neutral" rating for the company in a report on Monday, November 4th. Truist Financial raised their price objective on shares of Rivian Automotive from $12.00 to $14.00 and gave the stock a "hold" rating in a report on Thursday, January 16th. Finally, UBS Group raised their price objective on shares of Rivian Automotive from $11.00 to $14.00 and gave the stock a "neutral" rating in a report on Thursday, January 16th. Two equities research analysts have rated the stock with a sell rating, fourteen have given a hold rating and ten have issued a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $15.13.

Get Our Latest Stock Report on Rivian Automotive

About Rivian Automotive

(

Get Free Report)

Rivian Automotive, Inc, together with its subsidiaries, designs, develops, manufactures, and sells electric vehicles and accessories. The company offers consumer vehicles, including a two-row, five-passenger pickup truck under the R1T brand, a three-row, seven-passenger sport utility vehicle under the R1S name.

Featured Articles

Before you consider Rivian Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rivian Automotive wasn't on the list.

While Rivian Automotive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.