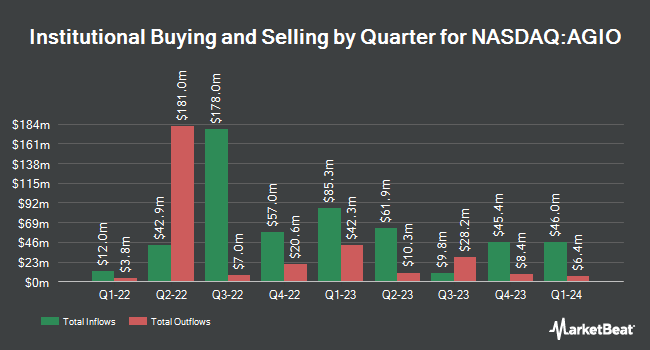

Rock Springs Capital Management LP cut its position in shares of Agios Pharmaceuticals, Inc. (NASDAQ:AGIO - Free Report) by 32.6% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 471,086 shares of the biopharmaceutical company's stock after selling 228,303 shares during the period. Rock Springs Capital Management LP owned about 0.83% of Agios Pharmaceuticals worth $15,480,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds have also made changes to their positions in the company. Vanguard Group Inc. lifted its stake in Agios Pharmaceuticals by 1.5% in the fourth quarter. Vanguard Group Inc. now owns 5,631,321 shares of the biopharmaceutical company's stock worth $185,045,000 after acquiring an additional 85,339 shares during the period. Geode Capital Management LLC lifted its position in shares of Agios Pharmaceuticals by 0.5% in the 3rd quarter. Geode Capital Management LLC now owns 1,357,531 shares of the biopharmaceutical company's stock worth $60,326,000 after purchasing an additional 6,101 shares during the period. Fisher Asset Management LLC boosted its stake in shares of Agios Pharmaceuticals by 12.3% during the fourth quarter. Fisher Asset Management LLC now owns 960,661 shares of the biopharmaceutical company's stock valued at $31,567,000 after purchasing an additional 105,333 shares in the last quarter. Artisan Partners Limited Partnership increased its holdings in Agios Pharmaceuticals by 27.4% during the fourth quarter. Artisan Partners Limited Partnership now owns 499,134 shares of the biopharmaceutical company's stock valued at $16,402,000 after buying an additional 107,292 shares during the period. Finally, Charles Schwab Investment Management Inc. increased its holdings in Agios Pharmaceuticals by 1.5% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 472,547 shares of the biopharmaceutical company's stock valued at $15,528,000 after buying an additional 6,927 shares during the period.

Analysts Set New Price Targets

Several analysts have issued reports on the company. StockNews.com cut Agios Pharmaceuticals from a "hold" rating to a "sell" rating in a research report on Friday, February 14th. HC Wainwright initiated coverage on Agios Pharmaceuticals in a research report on Monday, February 24th. They set a "buy" rating and a $58.00 price objective on the stock. One investment analyst has rated the stock with a sell rating, four have given a hold rating and five have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $56.57.

Check Out Our Latest Stock Analysis on AGIO

Insider Activity

In related news, Director Jacqualyn A. Fouse sold 7,497 shares of the firm's stock in a transaction on Thursday, April 10th. The shares were sold at an average price of $25.90, for a total transaction of $194,172.30. Following the completion of the transaction, the director now owns 149,220 shares of the company's stock, valued at $3,864,798. This trade represents a 4.78 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Corporate insiders own 4.93% of the company's stock.

Agios Pharmaceuticals Stock Up 0.6 %

Shares of AGIO traded up $0.19 during mid-day trading on Friday, hitting $29.45. 358,865 shares of the company traded hands, compared to its average volume of 703,953. The business has a 50 day moving average of $30.30 and a 200 day moving average of $38.25. The company has a market capitalization of $1.69 billion, a PE ratio of 2.60 and a beta of 0.83. Agios Pharmaceuticals, Inc. has a 1-year low of $23.42 and a 1-year high of $62.58.

Agios Pharmaceuticals (NASDAQ:AGIO - Get Free Report) last posted its quarterly earnings results on Thursday, February 20th. The biopharmaceutical company reported ($1.74) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.69) by ($0.05). Agios Pharmaceuticals had a negative return on equity of 2.51% and a net margin of 1,845.92%. As a group, research analysts expect that Agios Pharmaceuticals, Inc. will post -6.85 EPS for the current fiscal year.

Agios Pharmaceuticals Profile

(

Free Report)

Agios Pharmaceuticals, Inc, a biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States. Its lead product includes PYRUKYND (mitapivat), an activator of wild-type and mutant pyruvate kinase (PK), enzymes for the treatment of hemolytic anemias.

Further Reading

Before you consider Agios Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agios Pharmaceuticals wasn't on the list.

While Agios Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.