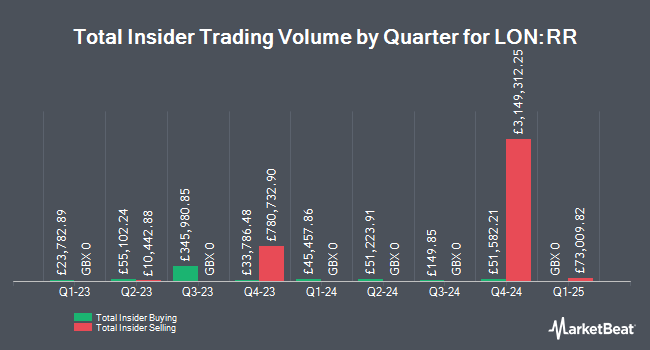

Rolls-Royce Holdings plc (LON:RR - Get Free Report) insider Tufan Erginbilgic sold 6,811 shares of Rolls-Royce Holdings plc stock in a transaction on Monday, September 29th. The stock was sold at an average price of GBX 1,190, for a total value of £81,050.90.

Tufan Erginbilgic also recently made the following trade(s):

- On Tuesday, August 26th, Tufan Erginbilgic sold 7,694 shares of Rolls-Royce Holdings plc stock. The shares were sold at an average price of GBX 1,047, for a total transaction of £80,556.18.

- On Monday, July 28th, Tufan Erginbilgic sold 7,763 shares of Rolls-Royce Holdings plc stock. The shares were sold at an average price of GBX 985, for a total transaction of £76,465.55.

Rolls-Royce Holdings plc Price Performance

Shares of LON:RR opened at GBX 1,190 on Wednesday. The business's 50 day simple moving average is GBX 1,080.21 and its 200 day simple moving average is GBX 917.14. Rolls-Royce Holdings plc has a 1 year low of GBX 196.45 and a 1 year high of GBX 537.20. The company has a market capitalization of £102.06 billion, a P/E ratio of 43.38, a P/E/G ratio of 0.55 and a beta of 1.82.

Rolls-Royce Holdings plc (LON:RR - Get Free Report) last released its earnings results on Thursday, July 31st. The company reported GBX 15.74 earnings per share for the quarter. Rolls-Royce Holdings plc had a negative return on equity of 78.08% and a net margin of 13.08%. On average, sell-side analysts anticipate that Rolls-Royce Holdings plc will post 8.5952 EPS for the current fiscal year.

Analyst Ratings Changes

RR has been the topic of several research analyst reports. Shore Capital reaffirmed a "hold" rating on shares of Rolls-Royce Holdings plc in a research note on Thursday, July 31st. JPMorgan Chase & Co. boosted their target price on shares of Rolls-Royce Holdings plc from GBX 1,040 to GBX 1,245 and gave the stock an "overweight" rating in a research note on Monday, August 11th. Deutsche Bank Aktiengesellschaft upped their target price on Rolls-Royce Holdings plc from GBX 1,000 to GBX 1,220 and gave the stock a "buy" rating in a report on Thursday, August 7th. Morgan Stanley restated an "overweight" rating on shares of Rolls-Royce Holdings plc in a report on Friday, September 5th. Finally, Citigroup lifted their target price on shares of Rolls-Royce Holdings plc from GBX 641 to GBX 1,101 and gave the stock a "neutral" rating in a research report on Friday, August 29th. Three research analysts have rated the stock with a Buy rating and two have given a Hold rating to the company's stock. According to data from MarketBeat.com, Rolls-Royce Holdings plc currently has a consensus rating of "Moderate Buy" and an average price target of GBX 1,188.67.

View Our Latest Analysis on RR

About Rolls-Royce Holdings plc

(

Get Free Report)

Rolls-Royce Holdings plc develops and delivers complex power and propulsion solutions for air, sea, and land in the United Kingdom and internationally. The company operates through four segments: Civil Aerospace, Defence, Power Systems, and New Markets. The Civil Aerospace segment develops, manufactures, markets, and sells aero engines for large commercial aircraft, regional jet, and business aviation markets, as well as provides aftermarket services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rolls-Royce Holdings plc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rolls-Royce Holdings plc wasn't on the list.

While Rolls-Royce Holdings plc currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.