Arrowhead Pharmaceuticals (NASDAQ:ARWR - Get Free Report) had its price target dropped by analysts at Royal Bank Of Canada from $40.00 to $38.00 in a research report issued on Friday,Benzinga reports. The brokerage currently has an "outperform" rating on the biotechnology company's stock. Royal Bank Of Canada's price target points to a potential upside of 103.97% from the stock's previous close.

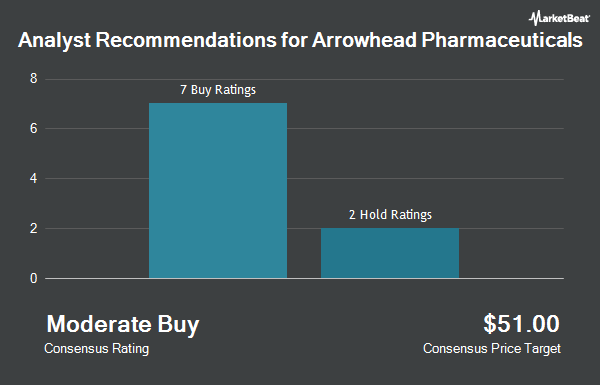

ARWR has been the topic of a number of other research reports. TD Cowen upgraded shares of Arrowhead Pharmaceuticals to a "strong-buy" rating in a research report on Monday, July 28th. Citigroup cut their target price on shares of Arrowhead Pharmaceuticals from $21.00 to $17.00 and set a "neutral" rating on the stock in a research note on Tuesday, May 13th. HC Wainwright reaffirmed a "buy" rating and set a $80.00 target price on shares of Arrowhead Pharmaceuticals in a research note on Tuesday, May 20th. Wall Street Zen lowered shares of Arrowhead Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Friday, July 18th. Finally, Chardan Capital reaffirmed a "buy" rating and set a $60.00 target price on shares of Arrowhead Pharmaceuticals in a research note on Tuesday, May 13th. Three equities research analysts have rated the stock with a hold rating, five have given a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $43.14.

Get Our Latest Stock Analysis on ARWR

Arrowhead Pharmaceuticals Trading Up 4.7%

NASDAQ:ARWR traded up $0.83 during trading hours on Friday, reaching $18.63. The company's stock had a trading volume of 289,068 shares, compared to its average volume of 1,885,965. The firm has a market capitalization of $2.58 billion, a price-to-earnings ratio of -14.54, a PEG ratio of 25.55 and a beta of 0.94. The firm has a 50-day simple moving average of $16.52 and a 200-day simple moving average of $15.92. Arrowhead Pharmaceuticals has a 1 year low of $9.57 and a 1 year high of $27.34. The company has a debt-to-equity ratio of 0.39, a quick ratio of 4.87 and a current ratio of 4.87.

Arrowhead Pharmaceuticals (NASDAQ:ARWR - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The biotechnology company reported ($1.26) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.94) by ($0.32). The business had revenue of $27.77 million for the quarter, compared to analysts' expectations of $29.01 million. During the same quarter last year, the firm earned ($1.38) EPS. Research analysts expect that Arrowhead Pharmaceuticals will post -2.42 EPS for the current fiscal year.

Institutional Trading of Arrowhead Pharmaceuticals

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. GAMMA Investing LLC boosted its position in shares of Arrowhead Pharmaceuticals by 297.6% during the first quarter. GAMMA Investing LLC now owns 2,175 shares of the biotechnology company's stock worth $28,000 after acquiring an additional 1,628 shares during the last quarter. GF Fund Management CO. LTD. purchased a new stake in shares of Arrowhead Pharmaceuticals in the fourth quarter valued at $49,000. Nisa Investment Advisors LLC raised its stake in shares of Arrowhead Pharmaceuticals by 75.9% in the second quarter. Nisa Investment Advisors LLC now owns 3,032 shares of the biotechnology company's stock valued at $48,000 after acquiring an additional 1,308 shares during the period. CWM LLC increased its stake in Arrowhead Pharmaceuticals by 134.3% in the 1st quarter. CWM LLC now owns 4,401 shares of the biotechnology company's stock worth $56,000 after buying an additional 2,523 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. increased its stake in Arrowhead Pharmaceuticals by 29.5% in the 2nd quarter. Mirae Asset Global Investments Co. Ltd. now owns 5,335 shares of the biotechnology company's stock worth $84,000 after buying an additional 1,214 shares during the period. 62.61% of the stock is owned by hedge funds and other institutional investors.

Arrowhead Pharmaceuticals Company Profile

(

Get Free Report)

Arrowhead Pharmaceuticals, Inc develops medicines for the treatment of intractable diseases in the United States. The company's products in pipeline includes Plozasiran, which is in Phase 2b and one Phase 3 clinical trial to treat hypertriglyceridemia, mixed dyslipidemia, and chylomicronemia syndrome; Zodasiran that is in Phase 2b clinical trial for the treatment of dyslipidemia and hypertriglyceridemia; ARO-PNPLA3, which is in Phase 1 clinical trial to treat patients with non-alcoholic steatohepatitis; ARO-RAGE that is in Phase 1/2a clinical trial to treat inflammatory pulmonary conditions; and ARO-MUC5AC, which is in Phase 1/2a clinical trial to treat muco-obstructive pulmonary diseases.

See Also

Before you consider Arrowhead Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arrowhead Pharmaceuticals wasn't on the list.

While Arrowhead Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.