Stella-Jones (TSE:SJ - Get Free Report) had its target price hoisted by research analysts at Royal Bank Of Canada from C$78.00 to C$87.00 in a note issued to investors on Wednesday,BayStreet.CA reports. The firm presently has a "sector perform" rating on the stock. Royal Bank Of Canada's price target points to a potential upside of 7.53% from the company's current price.

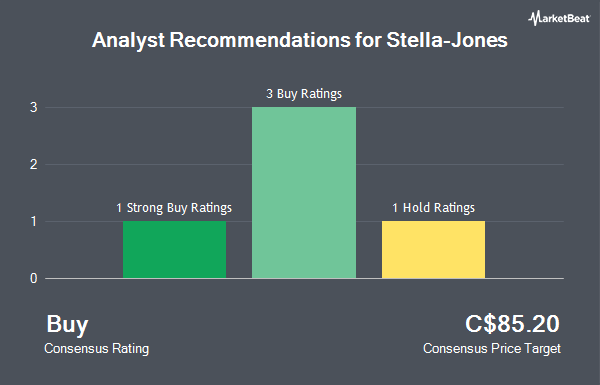

Several other research analysts also recently commented on SJ. National Bankshares dropped their target price on shares of Stella-Jones from C$93.00 to C$92.00 and set an "outperform" rating on the stock in a report on Friday, August 8th. Desjardins lifted their target price on shares of Stella-Jones from C$89.00 to C$92.00 and gave the stock a "buy" rating in a report on Wednesday, October 1st. Finally, CIBC upped their price objective on shares of Stella-Jones from C$89.00 to C$90.00 in a research report on Friday, October 3rd. One analyst has rated the stock with a Strong Buy rating, four have issued a Buy rating and one has given a Hold rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Buy" and an average price target of C$88.33.

Read Our Latest Report on Stella-Jones

Stella-Jones Stock Performance

SJ traded up C$0.96 during trading on Wednesday, hitting C$80.91. The stock had a trading volume of 49,255 shares, compared to its average volume of 114,139. The firm has a market cap of C$4.47 billion, a PE ratio of 13.62, a P/E/G ratio of 2.40 and a beta of -0.07. Stella-Jones has a 12 month low of C$62.26 and a 12 month high of C$94.74. The company has a current ratio of 6.85, a quick ratio of 1.20 and a debt-to-equity ratio of 87.53. The company has a 50 day simple moving average of C$78.37 and a 200-day simple moving average of C$75.24.

About Stella-Jones

(

Get Free Report)

Stella-Jones Inc produces and sells lumber and wood products. The company operates in two segments: Pressure-treated wood, which includes utility poles, railway ties, residential lumber, and industrial products; and Logs & Lumber segment comprises of the sales of logs harvested in the course of the company's procurement process that is determined to be unsuitable for use as utility poles, it also includes the sale of excess lumber to local home-building markets.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stella-Jones, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stella-Jones wasn't on the list.

While Stella-Jones currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.