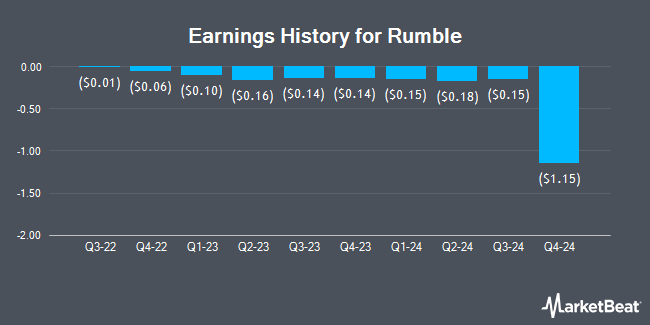

Rumble (NASDAQ:RUM - Get Free Report) posted its quarterly earnings results on Sunday. The company reported ($0.14) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.06), Zacks reports. The company had revenue of $25.09 million during the quarter, compared to analysts' expectations of $26.78 million. Rumble had a negative net margin of 289.37% and a negative return on equity of 97.99%. The business's revenue was up 11.6% compared to the same quarter last year.

Rumble Stock Performance

Shares of Rumble stock traded down $0.09 during trading on Friday, reaching $7.98. The company had a trading volume of 1,156,556 shares, compared to its average volume of 2,975,239. Rumble has a fifty-two week low of $4.92 and a fifty-two week high of $17.40. The company has a market cap of $3.46 billion, a price-to-earnings ratio of -5.58 and a beta of 0.72. The firm's fifty day moving average is $8.90 and its 200-day moving average is $8.99.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the company. Brevan Howard Capital Management LP purchased a new stake in shares of Rumble in the 2nd quarter valued at approximately $186,000. Bank of America Corp DE lifted its holdings in shares of Rumble by 0.4% during the 2nd quarter. Bank of America Corp DE now owns 637,500 shares of the company's stock worth $5,725,000 after acquiring an additional 2,678 shares during the period. California State Teachers Retirement System lifted its holdings in Rumble by 9.7% during the 2nd quarter. California State Teachers Retirement System now owns 55,586 shares of the company's stock valued at $499,000 after purchasing an additional 4,916 shares during the last quarter. Canada Pension Plan Investment Board acquired a new stake in shares of Rumble during the 2nd quarter worth approximately $75,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its position in shares of Rumble by 305.5% during the 2nd quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 142,715 shares of the company's stock worth $1,282,000 after buying an additional 107,521 shares during the period. Institutional investors own 26.15% of the company's stock.

About Rumble

(

Get Free Report)

Rumble Inc operates video sharing platforms in the United States, Canada, and internationally. The company operates rumble.com, a free-to-use video sharing and livestreaming platform where users can subscribe to channels to stay in touch with creators, and access video on-demand (VOD) and live content streamed by creators.

Recommended Stories

Before you consider Rumble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rumble wasn't on the list.

While Rumble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.