Sabre (NASDAQ:SABR - Get Free Report)'s stock had its "sell (d-)" rating reiterated by stock analysts at Weiss Ratings in a research report issued on Wednesday,Weiss Ratings reports.

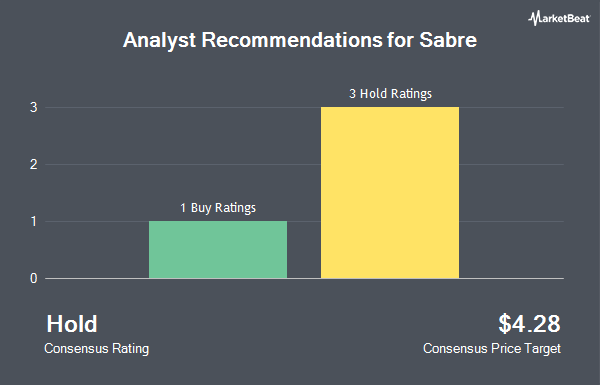

A number of other research analysts also recently issued reports on SABR. Sanford C. Bernstein upgraded shares of Sabre from a "market perform" rating to an "outperform" rating and cut their target price for the company from $4.00 to $3.00 in a research report on Monday, August 11th. Redburn Atlantic downgraded shares of Sabre from a "strong-buy" rating to a "hold" rating in a research report on Friday, August 15th. Rothschild & Co Redburn downgraded shares of Sabre from a "buy" rating to a "neutral" rating and set a $2.40 target price on the stock. in a research report on Friday, August 15th. Finally, Morgan Stanley restated a "reduce" rating on shares of Sabre in a research report on Sunday, August 10th. Two analysts have rated the stock with a Buy rating, three have issued a Hold rating and two have given a Sell rating to the company. According to data from MarketBeat, Sabre has a consensus rating of "Hold" and an average target price of $3.80.

Read Our Latest Stock Analysis on SABR

Sabre Stock Performance

SABR opened at $1.81 on Wednesday. The firm's 50-day simple moving average is $1.94 and its 200-day simple moving average is $2.46. Sabre has a twelve month low of $1.69 and a twelve month high of $4.63. The firm has a market cap of $714.06 million, a price-to-earnings ratio of -1.99 and a beta of 1.52.

Sabre (NASDAQ:SABR - Get Free Report) last posted its earnings results on Thursday, August 7th. The information technology services provider reported ($0.02) earnings per share for the quarter. The firm had revenue of $687.15 million for the quarter, compared to analyst estimates of $718.16 million. During the same quarter last year, the firm posted ($0.05) earnings per share. The business's revenue was down 1.1% compared to the same quarter last year. As a group, sell-side analysts anticipate that Sabre will post 0.04 EPS for the current fiscal year.

Institutional Trading of Sabre

A number of hedge funds have recently modified their holdings of the company. Praxis Investment Management Inc. raised its position in shares of Sabre by 111.8% in the 3rd quarter. Praxis Investment Management Inc. now owns 99,778 shares of the information technology services provider's stock valued at $183,000 after acquiring an additional 52,658 shares during the period. Public Sector Pension Investment Board raised its position in shares of Sabre by 8.0% in the 2nd quarter. Public Sector Pension Investment Board now owns 1,322,101 shares of the information technology services provider's stock valued at $4,178,000 after acquiring an additional 98,452 shares during the period. Headlands Technologies LLC raised its position in shares of Sabre by 87.5% in the 2nd quarter. Headlands Technologies LLC now owns 125,827 shares of the information technology services provider's stock valued at $398,000 after acquiring an additional 58,724 shares during the period. Tower Research Capital LLC TRC raised its position in shares of Sabre by 216.9% in the 2nd quarter. Tower Research Capital LLC TRC now owns 44,706 shares of the information technology services provider's stock valued at $141,000 after acquiring an additional 30,599 shares during the period. Finally, State of Tennessee Department of Treasury raised its position in shares of Sabre by 15.3% in the 2nd quarter. State of Tennessee Department of Treasury now owns 218,124 shares of the information technology services provider's stock valued at $689,000 after acquiring an additional 28,865 shares during the period. 89.42% of the stock is currently owned by institutional investors and hedge funds.

About Sabre

(

Get Free Report)

Sabre Corporation, together with its subsidiaries, operates as software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally. It operates through two segments: Travel Solutions and Hospitality Solutions. The Travel Solutions segment operates a business-to-business travel marketplace that offers travel content, such as inventory, prices, and availability from a range of travel suppliers, including airlines, hotels, car rental brands, rail carriers, cruise lines, and tour operators with a network of travel buyers comprising online and offline travel agencies, travel management companies, and corporate travel departments.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sabre, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sabre wasn't on the list.

While Sabre currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.