Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) was upgraded by investment analysts at Wall Street Zen from a "sell" rating to a "hold" rating in a report released on Sunday.

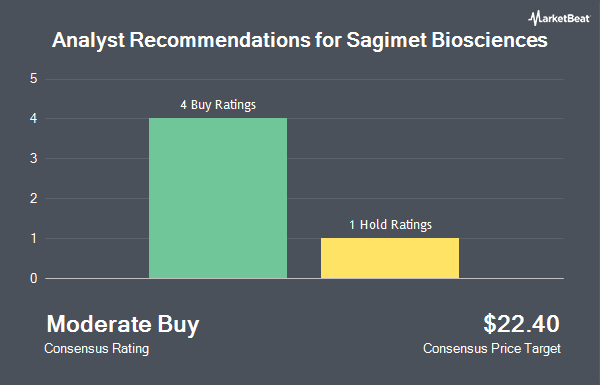

Other equities analysts also recently issued research reports about the stock. Weiss Ratings restated a "sell (d-)" rating on shares of Sagimet Biosciences in a report on Wednesday, October 8th. Canaccord Genuity Group restated a "buy" rating and set a $28.00 price objective on shares of Sagimet Biosciences in a report on Thursday, October 2nd. Zacks Research upgraded shares of Sagimet Biosciences from a "hold" rating to a "strong-buy" rating in a report on Tuesday, October 14th. HC Wainwright upgraded shares of Sagimet Biosciences to a "buy" rating and set a $29.00 price objective on the stock in a report on Thursday, August 7th. Finally, Wedbush began coverage on shares of Sagimet Biosciences in a report on Monday, August 11th. They issued an "outperform" rating and a $28.00 price target on the stock. One equities research analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $25.67.

Get Our Latest Research Report on Sagimet Biosciences

Sagimet Biosciences Stock Down 2.5%

SGMT opened at $7.36 on Friday. Sagimet Biosciences has a 52-week low of $1.73 and a 52-week high of $11.41. The company has a market cap of $239.35 million, a P/E ratio of -4.02 and a beta of 3.23. The firm's 50-day moving average price is $7.34 and its 200-day moving average price is $6.29.

Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) last posted its quarterly earnings data on Wednesday, August 13th. The company reported ($0.32) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.52) by $0.20. On average, research analysts anticipate that Sagimet Biosciences will post -1.6 EPS for the current fiscal year.

Insiders Place Their Bets

In other Sagimet Biosciences news, insider Eduardo Bruno Martins sold 8,277 shares of the business's stock in a transaction dated Monday, July 21st. The shares were sold at an average price of $9.13, for a total transaction of $75,569.01. Following the sale, the insider directly owned 106,936 shares in the company, valued at $976,325.68. This represents a 7.18% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO David Happel sold 65,478 shares of the company's stock in a transaction that occurred on Monday, July 21st. The shares were sold at an average price of $9.13, for a total value of $597,814.14. Following the completion of the transaction, the chief executive officer directly owned 689,722 shares of the company's stock, valued at $6,297,161.86. This trade represents a 8.67% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 84,535 shares of company stock worth $771,805 over the last three months. Company insiders own 14.70% of the company's stock.

Institutional Investors Weigh In On Sagimet Biosciences

Large investors have recently modified their holdings of the company. XTX Topco Ltd acquired a new stake in shares of Sagimet Biosciences in the first quarter valued at approximately $35,000. Persistent Asset Partners Ltd acquired a new stake in shares of Sagimet Biosciences in the first quarter valued at approximately $35,000. ANTIPODES PARTNERS Ltd acquired a new stake in shares of Sagimet Biosciences in the second quarter valued at approximately $41,000. Charles Schwab Investment Management Inc. acquired a new stake in shares of Sagimet Biosciences in the first quarter valued at approximately $49,000. Finally, Jasper Ridge Partners L.P. acquired a new stake in shares of Sagimet Biosciences in the first quarter valued at approximately $62,000. 87.86% of the stock is owned by institutional investors and hedge funds.

About Sagimet Biosciences

(

Get Free Report)

Sagimet Biosciences Inc, a clinical-stage biopharmaceutical company, develops therapeutics called fatty acid synthase (FASN) inhibitors for the treatment of diseases that result from dysfunctional metabolic pathways in the United States. The company's lead drug candidate is Denifanstat, a once-daily pill and selective FASN inhibitor for the treatment of metabolic dysfunction associated steatohepatitis.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sagimet Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sagimet Biosciences wasn't on the list.

While Sagimet Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.