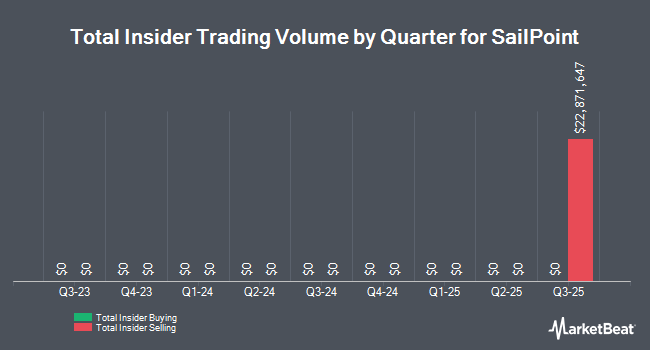

SailPoint, Inc. (NASDAQ:SAIL - Get Free Report) President Matt Mills sold 51,700 shares of the business's stock in a transaction on Wednesday, October 8th. The stock was sold at an average price of $22.45, for a total transaction of $1,160,665.00. Following the completion of the sale, the president directly owned 1,965,537 shares in the company, valued at approximately $44,126,305.65. This represents a 2.56% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website.

Matt Mills also recently made the following trade(s):

- On Thursday, October 9th, Matt Mills sold 61,279 shares of SailPoint stock. The stock was sold at an average price of $22.42, for a total transaction of $1,373,875.18.

- On Tuesday, October 7th, Matt Mills sold 50,671 shares of SailPoint stock. The stock was sold at an average price of $22.55, for a total transaction of $1,142,631.05.

SailPoint Stock Performance

Shares of SailPoint stock traded up $0.87 during trading on Thursday, hitting $23.30. The company's stock had a trading volume of 3,897,020 shares, compared to its average volume of 2,432,018. The stock has a 50-day moving average price of $21.14 and a two-hundred day moving average price of $20.08. SailPoint, Inc. has a 52 week low of $15.05 and a 52 week high of $26.35.

SailPoint (NASDAQ:SAIL - Get Free Report) last issued its quarterly earnings results on Tuesday, September 9th. The company reported $0.07 earnings per share for the quarter, topping analysts' consensus estimates of $0.04 by $0.03. The business had revenue of $264.36 million for the quarter, compared to analyst estimates of $243.41 million. The company's quarterly revenue was up 32.9% on a year-over-year basis. SailPoint has set its FY 2026 guidance at 0.200-0.220 EPS. Q3 2026 guidance at 0.050-0.06 EPS.

Institutional Investors Weigh In On SailPoint

A number of institutional investors and hedge funds have recently made changes to their positions in SAIL. Assetmark Inc. bought a new stake in SailPoint in the 1st quarter worth about $32,000. Loomis Sayles & Co. L P bought a new stake in SailPoint in the 2nd quarter worth about $42,000. State of Wyoming bought a new stake in SailPoint in the 2nd quarter worth about $45,000. Kayne Anderson Rudnick Investment Management LLC bought a new stake in SailPoint in the 1st quarter worth about $49,000. Finally, Quarry LP bought a new stake in SailPoint in the 1st quarter worth about $70,000.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on SAIL. Royal Bank Of Canada reiterated an "outperform" rating and set a $29.00 price target (up from $27.00) on shares of SailPoint in a report on Thursday, June 12th. Barclays boosted their target price on SailPoint from $23.00 to $25.00 and gave the company an "overweight" rating in a research report on Thursday, June 12th. Scotiabank started coverage on SailPoint in a research report on Wednesday, September 3rd. They issued a "sector outperform" rating and a $25.00 target price for the company. Arete started coverage on SailPoint in a research report on Monday, July 7th. They issued a "sell" rating and a $16.00 target price for the company. Finally, Morgan Stanley raised SailPoint from an "equal weight" rating to an "overweight" rating and set a $25.00 target price for the company in a research report on Tuesday, September 2nd. One investment analyst has rated the stock with a Strong Buy rating, fourteen have issued a Buy rating, three have assigned a Hold rating and three have given a Sell rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $25.58.

View Our Latest Report on SAIL

SailPoint Company Profile

(

Get Free Report)

SailPoint, Inc delivers solutions to enable comprehensive identity security for the enterprise. Its solutions enable organizations to establish, control, and automate policies that help them define and maintain a robust security posture and achieve regulatory compliance. The company was founded by Mark David McClain in 2005 and is headquartered in Austin, TX.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SailPoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SailPoint wasn't on the list.

While SailPoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.