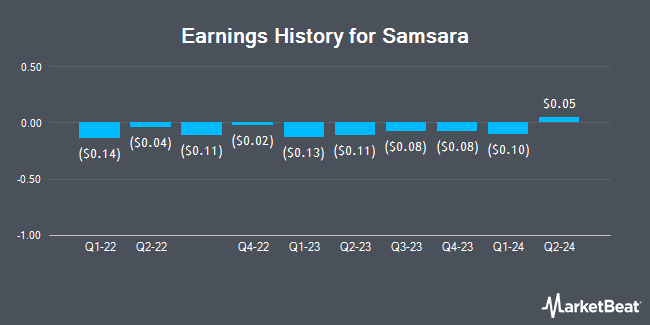

Samsara (NYSE:IOT - Get Free Report) issued its quarterly earnings results on Thursday. The company reported ($0.02) earnings per share for the quarter, missing analysts' consensus estimates of $0.07 by ($0.09), Zacks reports. Samsara had a negative return on equity of 19.44% and a negative net margin of 21.80%. The company had revenue of $346.29 million during the quarter, compared to analyst estimates of $335.35 million. Samsara updated its FY 2026 guidance to 0.320-0.340 EPS and its Q1 2026 guidance to 0.050-0.060 EPS.

Samsara Price Performance

NYSE:IOT traded down $1.12 during mid-day trading on Monday, reaching $34.25. The stock had a trading volume of 10,686,857 shares, compared to its average volume of 3,618,123. The stock has a market cap of $19.22 billion, a P/E ratio of -72.86 and a beta of 1.63. The business's 50 day moving average is $49.02 and its 200 day moving average is $48.36. Samsara has a fifty-two week low of $27.14 and a fifty-two week high of $61.90.

Insiders Place Their Bets

In other Samsara news, insider Adam Eltoukhy sold 23,960 shares of the company's stock in a transaction that occurred on Friday, December 20th. The stock was sold at an average price of $43.81, for a total transaction of $1,049,687.60. Following the completion of the sale, the insider now owns 331,106 shares of the company's stock, valued at $14,505,753.86. This represents a 6.75 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Sanjit Biswas sold 145,392 shares of the stock in a transaction that occurred on Tuesday, March 4th. The shares were sold at an average price of $44.27, for a total value of $6,436,503.84. Following the transaction, the insider now owns 120,000 shares in the company, valued at approximately $5,312,400. This trade represents a 54.78 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,369,776 shares of company stock valued at $64,065,203 over the last ninety days. Corporate insiders own 60.04% of the company's stock.

Institutional Trading of Samsara

A hedge fund recently bought a new stake in Samsara stock. Brighton Jones LLC purchased a new stake in Samsara Inc. (NYSE:IOT - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 308,168 shares of the company's stock, valued at approximately $13,464,000. Brighton Jones LLC owned about 0.05% of Samsara as of its most recent filing with the Securities & Exchange Commission. Institutional investors and hedge funds own 96.02% of the company's stock.

Analyst Ratings Changes

IOT has been the topic of a number of research reports. Wells Fargo & Company dropped their price objective on Samsara from $55.00 to $51.00 and set an "overweight" rating on the stock in a research note on Friday. Berenberg Bank started coverage on shares of Samsara in a research report on Monday, February 3rd. They issued a "hold" rating and a $57.00 price target on the stock. Truist Financial reduced their price objective on shares of Samsara from $50.00 to $42.00 and set a "hold" rating for the company in a research report on Friday. Cowen reiterated a "buy" rating on shares of Samsara in a report on Friday. Finally, JPMorgan Chase & Co. increased their target price on shares of Samsara from $40.00 to $44.00 and gave the company a "neutral" rating in a research note on Friday, December 6th. Nine analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat, Samsara presently has a consensus rating of "Moderate Buy" and an average target price of $49.60.

View Our Latest Analysis on IOT

About Samsara

(

Get Free Report)

Samsara Inc provides solutions that connects physical operations data to its connected operations cloud in the United States and internationally. The company's Connected Operations Cloud includes Data Platform, which ingests, aggregates, and enriches data from its IoT devices and has embedded capabilities for AI, workflows and analytics, alerts, API connections, and data security and privacy.

Recommended Stories

Before you consider Samsara, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Samsara wasn't on the list.

While Samsara currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.