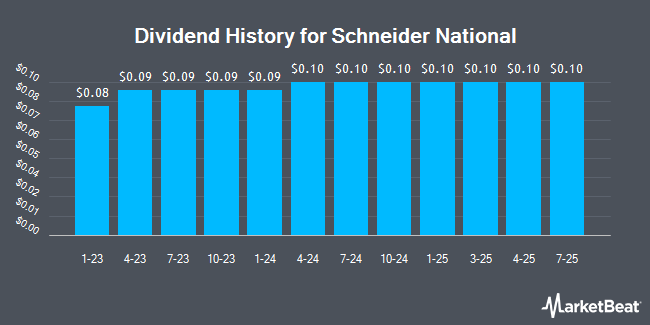

Schneider National, Inc. (NYSE:SNDR - Get Free Report) declared a quarterly dividend on Wednesday, July 30th, RTT News reports. Stockholders of record on Friday, September 12th will be given a dividend of 0.095 per share on Thursday, October 9th. This represents a c) annualized dividend and a dividend yield of 1.6%. The ex-dividend date is Friday, September 12th.

Schneider National has a dividend payout ratio of 27.5% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect Schneider National to earn $1.82 per share next year, which means the company should continue to be able to cover its $0.38 annual dividend with an expected future payout ratio of 20.9%.

Schneider National Price Performance

SNDR stock opened at $24.11 on Monday. The firm has a 50 day moving average price of $24.69 and a 200-day moving average price of $24.85. Schneider National has a 52-week low of $20.59 and a 52-week high of $33.90. The firm has a market capitalization of $4.22 billion, a price-to-earnings ratio of 34.44, a PEG ratio of 0.74 and a beta of 1.11. The company has a debt-to-equity ratio of 0.17, a quick ratio of 1.77 and a current ratio of 1.91.

Schneider National (NYSE:SNDR - Get Free Report) last announced its earnings results on Thursday, July 31st. The company reported $0.21 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.21. The firm had revenue of $1.42 billion for the quarter, compared to analysts' expectations of $1.41 billion. Schneider National had a net margin of 2.29% and a return on equity of 4.39%. The business's revenue was up 7.9% compared to the same quarter last year. During the same period in the prior year, the company earned $0.21 EPS. Equities research analysts forecast that Schneider National will post 1.12 EPS for the current fiscal year.

Schneider National Company Profile

(

Get Free Report)

Schneider National, Inc, together with its subsidiaries, provides surface transportation and logistics solutions in the United States, Canada, and Mexico. It operates through three segments: Truckload, Intermodal, and Logistics. The Truckload segment offers over the road freight transportation services primarily through dry van, bulk, temperature-controlled, and flat-bed trailers across either network or dedicated configurations.

Further Reading

Before you consider Schneider National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schneider National wasn't on the list.

While Schneider National currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.