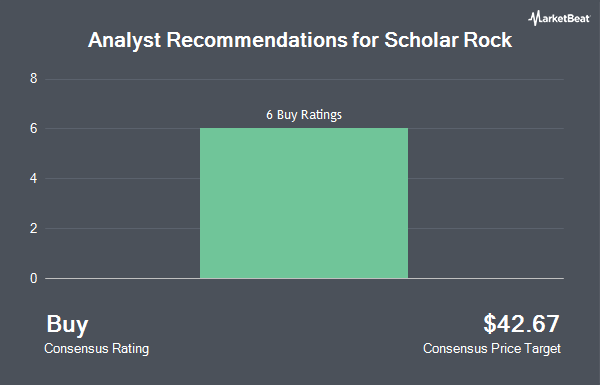

Shares of Scholar Rock Holding Corporation (NASDAQ:SRRK - Get Free Report) have received an average rating of "Buy" from the seven ratings firms that are covering the stock, MarketBeat reports. Six analysts have rated the stock with a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $42.67.

SRRK has been the topic of several recent analyst reports. Wedbush reiterated an "outperform" rating and issued a $50.00 target price on shares of Scholar Rock in a report on Wednesday, June 18th. Lifesci Capital upgraded Scholar Rock to a "strong-buy" rating in a report on Tuesday, June 3rd.

Check Out Our Latest Analysis on SRRK

Scholar Rock Trading Up 0.4%

Scholar Rock stock traded up $0.13 during trading on Friday, reaching $33.41. 1,398,171 shares of the company were exchanged, compared to its average volume of 1,295,251. The company has a debt-to-equity ratio of 0.16, a current ratio of 10.25 and a quick ratio of 10.25. The stock's 50 day simple moving average is $31.73 and its two-hundred day simple moving average is $35.90. The company has a market capitalization of $3.17 billion, a P/E ratio of -13.21 and a beta of 0.28. Scholar Rock has a 52-week low of $6.76 and a 52-week high of $46.98.

Scholar Rock (NASDAQ:SRRK - Get Free Report) last announced its quarterly earnings results on Wednesday, May 14th. The company reported ($0.67) earnings per share for the quarter, missing the consensus estimate of ($0.63) by ($0.04). During the same quarter in the previous year, the business earned ($0.59) EPS. On average, equities research analysts expect that Scholar Rock will post -2.42 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, Director Kristina Burow sold 5,400 shares of the business's stock in a transaction dated Thursday, May 29th. The stock was sold at an average price of $29.72, for a total transaction of $160,488.00. Following the completion of the transaction, the director now directly owns 21,071 shares of the company's stock, valued at approximately $626,230.12. The trade was a 20.40% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, insider Tracey Sacco sold 5,000 shares of the company's stock in a transaction that occurred on Friday, April 25th. The stock was sold at an average price of $32.83, for a total transaction of $164,150.00. Following the sale, the insider now owns 71,750 shares in the company, valued at $2,355,552.50. The trade was a 6.51% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 32,000 shares of company stock valued at $966,651. Corporate insiders own 13.30% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Global Retirement Partners LLC lifted its position in shares of Scholar Rock by 584.7% during the 4th quarter. Global Retirement Partners LLC now owns 897 shares of the company's stock worth $39,000 after purchasing an additional 766 shares during the last quarter. CWM LLC lifted its holdings in Scholar Rock by 152.8% during the 1st quarter. CWM LLC now owns 996 shares of the company's stock worth $32,000 after buying an additional 602 shares during the last quarter. GF Fund Management CO. LTD. acquired a new position in shares of Scholar Rock during the 4th quarter worth about $85,000. Federated Hermes Inc. acquired a new position in Scholar Rock in the first quarter valued at approximately $71,000. Finally, Strs Ohio purchased a new position in shares of Scholar Rock in the 1st quarter valued at $77,000. Institutional investors and hedge funds own 91.08% of the company's stock.

Scholar Rock Company Profile

(

Get Free ReportScholar Rock Holding Corporation, a biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role. The company develops Apitegromab, an inhibitor of the activation of myostatin that is in Phase 3 clinical trial for the treatment of spinal muscular atrophy; and SRK-181, which has completed Phase 1 clinical trials for the treatment of cancers that are resistant to checkpoint inhibitor therapies, such as anti-PD-1 or anti-PD-L1 antibody therapies.

Featured Articles

Before you consider Scholar Rock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholar Rock wasn't on the list.

While Scholar Rock currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.