UDR (NYSE:UDR - Free Report) had its price objective cut by Scotiabank from $51.00 to $48.00 in a research note released on Friday morning,Benzinga reports. They currently have a sector perform rating on the real estate investment trust's stock.

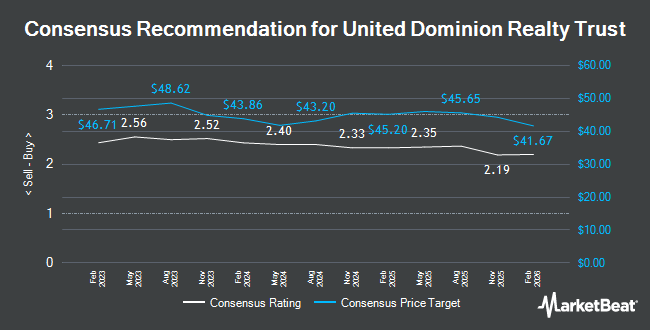

Several other analysts also recently issued reports on the company. Barclays upped their price objective on UDR from $48.00 to $51.00 and gave the company an "overweight" rating in a research report on Friday, May 9th. Royal Bank of Canada lifted their price target on shares of UDR from $43.00 to $44.00 and gave the stock a "sector perform" rating in a report on Thursday, May 8th. Mizuho lowered their price objective on UDR from $45.00 to $41.00 and set a "neutral" rating for the company in a research report on Friday, May 23rd. Zelman & Associates reissued a "neutral" rating on shares of UDR in a research note on Thursday, February 13th. Finally, Truist Financial downgraded shares of UDR from a "buy" rating to a "hold" rating and upped their price objective for the company from $45.00 to $46.00 in a research note on Monday, March 10th. One research analyst has rated the stock with a sell rating, ten have given a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat.com, UDR has a consensus rating of "Hold" and an average target price of $46.38.

Get Our Latest Report on UDR

UDR Price Performance

UDR traded down $0.06 during trading on Friday, reaching $41.17. 1,682,097 shares of the stock were exchanged, compared to its average volume of 2,154,279. The company has a debt-to-equity ratio of 1.71, a current ratio of 5.61 and a quick ratio of 5.91. The company has a market capitalization of $13.64 billion, a price-to-earnings ratio of 164.68, a P/E/G ratio of 8.67 and a beta of 0.83. UDR has a 1 year low of $36.61 and a 1 year high of $47.55. The business's 50 day moving average price is $41.32 and its two-hundred day moving average price is $42.46.

UDR (NYSE:UDR - Get Free Report) last posted its earnings results on Wednesday, April 30th. The real estate investment trust reported $0.61 earnings per share for the quarter, meeting the consensus estimate of $0.61. UDR had a net margin of 5.36% and a return on equity of 2.65%. The firm had revenue of $419.84 million during the quarter, compared to the consensus estimate of $421.23 million. During the same period last year, the firm posted $0.61 EPS. The firm's revenue for the quarter was up 2.0% on a year-over-year basis. As a group, equities research analysts anticipate that UDR will post 2.51 earnings per share for the current year.

UDR Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, July 31st. Shareholders of record on Thursday, July 10th will be issued a dividend of $0.43 per share. The ex-dividend date of this dividend is Thursday, July 10th. This represents a $1.72 annualized dividend and a yield of 4.18%. UDR's dividend payout ratio is presently 491.43%.

Institutional Trading of UDR

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Beaird Harris Wealth Management LLC acquired a new position in UDR during the 1st quarter worth $28,000. Spire Wealth Management grew its stake in UDR by 3,079.2% in the first quarter. Spire Wealth Management now owns 763 shares of the real estate investment trust's stock worth $34,000 after purchasing an additional 739 shares in the last quarter. Sentry Investment Management LLC acquired a new stake in UDR during the first quarter valued at approximately $47,000. Horizon Financial Services LLC bought a new position in UDR during the 1st quarter worth approximately $51,000. Finally, Smartleaf Asset Management LLC grew its position in shares of UDR by 68.7% in the 4th quarter. Smartleaf Asset Management LLC now owns 1,206 shares of the real estate investment trust's stock worth $52,000 after acquiring an additional 491 shares in the last quarter. Institutional investors own 97.84% of the company's stock.

About UDR

(

Get Free Report)

UDR, Inc NYSE: UDR, an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

See Also

Before you consider United Dominion Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Dominion Realty Trust wasn't on the list.

While United Dominion Realty Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.