Hess (NYSE:HES - Get Free Report) had its price target lifted by Scotiabank from $146.58 to $155.00 in a research report issued on Friday,Benzinga reports. The brokerage currently has a "sector perform" rating on the oil and gas producer's stock. Scotiabank's price target suggests a potential upside of 1.26% from the stock's previous close.

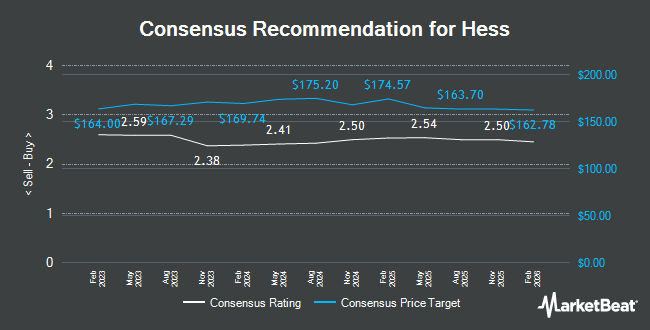

A number of other research analysts also recently commented on the company. Piper Sandler increased their target price on Hess from $147.00 to $153.00 and gave the stock an "overweight" rating in a report on Wednesday, July 2nd. UBS Group increased their target price on Hess from $163.00 to $173.00 and gave the stock a "buy" rating in a research report on Wednesday, June 11th. Wells Fargo & Company dropped their target price on Hess from $193.00 to $184.00 and set an "overweight" rating on the stock in a research report on Thursday, June 26th. Wall Street Zen raised Hess from a "sell" rating to a "hold" rating in a research report on Saturday, June 14th. Finally, Mizuho dropped their target price on Hess from $193.00 to $191.00 and set a "neutral" rating on the stock in a research report on Tuesday, May 13th. Six research analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $163.70.

Get Our Latest Report on HES

Hess Stock Performance

NYSE:HES traded up $1.04 during trading hours on Friday, reaching $153.08. 1,123,684 shares of the stock were exchanged, compared to its average volume of 1,841,196. The company has a quick ratio of 0.91, a current ratio of 1.08 and a debt-to-equity ratio of 0.71. The firm has a 50 day simple moving average of $137.31 and a 200-day simple moving average of $140.58. Hess has a 52 week low of $123.79 and a 52 week high of $161.69. The stock has a market capitalization of $47.35 billion, a P/E ratio of 21.17 and a beta of 0.62.

Hess (NYSE:HES - Get Free Report) last released its earnings results on Wednesday, April 30th. The oil and gas producer reported $1.81 EPS for the quarter, missing analysts' consensus estimates of $1.95 by ($0.14). Hess had a return on equity of 21.78% and a net margin of 17.65%. The firm had revenue of $2.92 billion for the quarter, compared to the consensus estimate of $2.95 billion. During the same period in the prior year, the business earned $3.16 EPS. The company's quarterly revenue was down 12.1% on a year-over-year basis. As a group, sell-side analysts forecast that Hess will post 8.08 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CEO John B. Hess sold 250,000 shares of the firm's stock in a transaction dated Friday, June 6th. The stock was sold at an average price of $136.01, for a total transaction of $34,002,500.00. Following the completion of the transaction, the chief executive officer owned 1,734,679 shares of the company's stock, valued at $235,933,690.79. This trade represents a 12.60% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 9.10% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the company. Bank Julius Baer & Co. Ltd Zurich bought a new position in Hess during the first quarter valued at about $25,000. Global X Japan Co. Ltd. boosted its stake in Hess by 106.2% during the first quarter. Global X Japan Co. Ltd. now owns 200 shares of the oil and gas producer's stock valued at $32,000 after buying an additional 103 shares in the last quarter. Capital Analysts LLC boosted its stake in Hess by 367.4% during the first quarter. Capital Analysts LLC now owns 201 shares of the oil and gas producer's stock valued at $32,000 after buying an additional 158 shares in the last quarter. Millstone Evans Group LLC bought a new position in Hess during the fourth quarter valued at about $33,000. Finally, Wayfinding Financial LLC acquired a new position in shares of Hess in the 1st quarter valued at $33,000. Institutional investors own 88.51% of the company's stock.

About Hess

(

Get Free Report)

Hess Corporation, an exploration and production company, explores, develops, produces, purchases, transports, and sells crude oil, natural gas liquids (NGLs), and natural gas. The company operates in two segments, Exploration and Production, and Midstream. It conducts production operations primarily in the United States, Guyana, the Malaysia/Thailand Joint Development Area, and Malaysia; and exploration activities principally offshore Guyana, the U.S.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hess wasn't on the list.

While Hess currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.