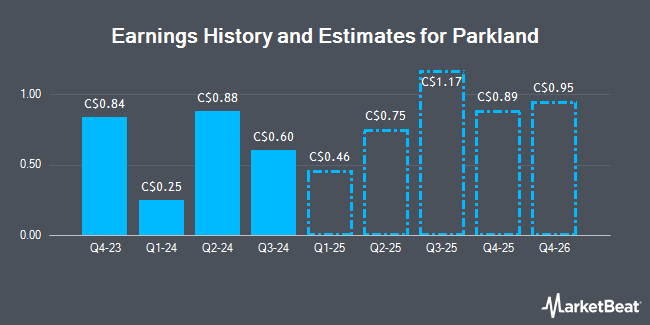

Parkland Co. (TSE:PKI - Free Report) - Equities research analysts at Scotiabank dropped their FY2026 earnings per share estimates for Parkland in a research note issued on Wednesday, August 6th. Scotiabank analyst B. Isaacson now forecasts that the company will post earnings of $3.23 per share for the year, down from their prior forecast of $3.39. Scotiabank currently has a "Hold" rating and a $44.00 price objective on the stock. The consensus estimate for Parkland's current full-year earnings is $3.60 per share.

PKI has been the subject of a number of other research reports. Raymond James Financial dropped their price target on shares of Parkland from C$47.00 to C$45.00 and set an "outperform" rating for the company in a research note on Thursday, April 17th. JPMorgan Chase & Co. cut shares of Parkland from an "overweight" rating to a "neutral" rating and reduced their price target for the stock from C$54.00 to C$41.00 in a research report on Wednesday, June 11th. BMO Capital Markets downgraded Parkland from a "strong-buy" rating to a "hold" rating in a report on Monday, June 2nd. Canaccord Genuity Group lowered their price objective on shares of Parkland from C$45.00 to C$42.00 and set a "buy" rating for the company in a research report on Thursday, April 17th. Finally, ATB Capital decreased their target price on Parkland from C$46.00 to C$45.00 and set an "outperform" rating for the company in a research note on Thursday, April 17th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and five have given a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of C$43.82.

View Our Latest Research Report on Parkland

Parkland Price Performance

PKI opened at C$38.39 on Thursday. Parkland has a twelve month low of C$30.09 and a twelve month high of C$40.29. The firm has a market cap of C$6.69 billion, a price-to-earnings ratio of 27.66, a PEG ratio of 11.79 and a beta of 1.33. The company has a current ratio of 1.39, a quick ratio of 0.73 and a debt-to-equity ratio of 199.87. The company has a fifty day simple moving average of C$38.46 and a 200 day simple moving average of C$36.64.

Parkland Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Investors of record on Friday, June 20th were issued a dividend of $0.36 per share. This represents a $1.44 annualized dividend and a dividend yield of 3.8%. This is a positive change from Parkland's previous quarterly dividend of $0.35. Parkland's dividend payout ratio (DPR) is currently 100.88%.

About Parkland

(

Get Free Report)

Parkland Corp distributes and markets fuels and lubricants. Refined fuels and other petroleum products are among the variety of offerings the company delivers to motorists, businesses, consumers, and wholesalers in the United States and Canada. Parkland operates through several subsidiaries that are either company owned-and retailer-operated, dealer-owned and dealer-operated, or dealer-cosigned and dealer-operated.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Parkland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parkland wasn't on the list.

While Parkland currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.