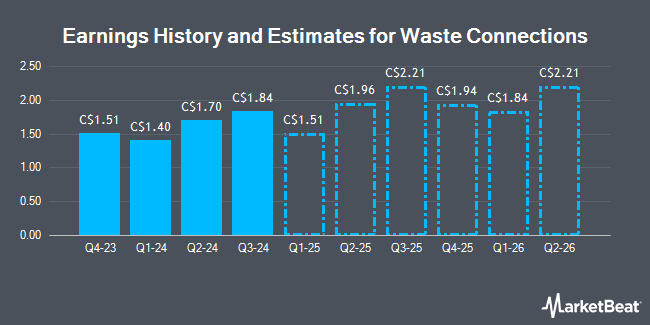

Waste Connections, Inc. (TSE:WCN - Free Report) - Stock analysts at Seaport Res Ptn lowered their Q4 2025 earnings per share (EPS) estimates for Waste Connections in a research note issued to investors on Tuesday, October 21st. Seaport Res Ptn analyst J. Mazzoni now anticipates that the company will post earnings per share of $1.61 for the quarter, down from their prior estimate of $1.65. The consensus estimate for Waste Connections' current full-year earnings is $9.98 per share. Seaport Res Ptn also issued estimates for Waste Connections' Q1 2027 earnings at $1.96 EPS.

Several other brokerages have also commented on WCN. Scotiabank raised shares of Waste Connections from a "hold" rating to a "strong-buy" rating in a research report on Friday, October 10th. Atb Cap Markets raised shares of Waste Connections from a "hold" rating to a "strong-buy" rating in a report on Thursday, July 24th. Finally, Barclays raised shares of Waste Connections to a "hold" rating in a report on Friday, September 19th. Six research analysts have rated the stock with a Strong Buy rating and one has given a Hold rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Strong Buy" and a consensus price target of C$260.00.

Check Out Our Latest Stock Report on WCN

Waste Connections Trading Up 2.5%

TSE WCN opened at C$249.42 on Thursday. The stock has a market capitalization of C$64.22 billion, a price-to-earnings ratio of 100.57, a PEG ratio of 2.22 and a beta of 0.39. Waste Connections has a one year low of C$236.00 and a one year high of C$284.73. The company has a debt-to-equity ratio of 102.69, a current ratio of 0.77 and a quick ratio of 0.74. The business's fifty day moving average is C$246.10 and its 200-day moving average is C$256.39.

Insider Buying and Selling

In related news, insider Patrick J. Shea sold 5,000 shares of the stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of C$258.01, for a total value of C$1,290,045.00. Following the transaction, the insider owned 20,671 shares of the company's stock, valued at C$5,333,304.04. This represents a 19.48% decrease in their ownership of the stock. 0.21% of the stock is currently owned by corporate insiders.

About Waste Connections

(

Get Free Report)

Waste Connections is the third- largest integrated provider of traditional solid waste and recycling services in the North America, operating 91 active landfills (12 are E&P waste landfills), 132 transfer stations, and 68 recycling operations. The firm serves residential, commercial, industrial, and energy end markets.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Waste Connections, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Connections wasn't on the list.

While Waste Connections currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.