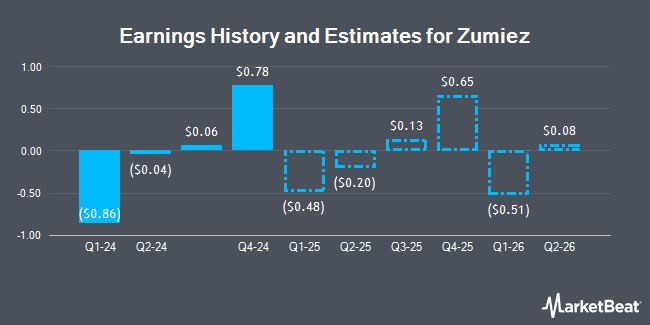

Zumiez Inc. (NASDAQ:ZUMZ - Free Report) - Equities research analysts at Seaport Res Ptn lifted their Q3 2026 EPS estimates for shares of Zumiez in a report issued on Wednesday, August 27th. Seaport Res Ptn analyst M. Kummetz now forecasts that the apparel and footwear maker will post earnings per share of $0.17 for the quarter, up from their prior forecast of $0.15. The consensus estimate for Zumiez's current full-year earnings is ($0.12) per share. Seaport Res Ptn also issued estimates for Zumiez's FY2026 earnings at $0.33 EPS, FY2027 earnings at $0.80 EPS and FY2028 earnings at $1.14 EPS.

Zumiez Stock Down 1.1%

Shares of NASDAQ ZUMZ traded down $0.20 during mid-day trading on Thursday, reaching $17.00. 49,772 shares of the company were exchanged, compared to its average volume of 272,603. The company's 50-day simple moving average is $14.65 and its 200-day simple moving average is $13.70. The stock has a market capitalization of $302.00 million, a P/E ratio of 1,702.70 and a beta of 0.96. Zumiez has a twelve month low of $11.31 and a twelve month high of $31.37.

Zumiez (NASDAQ:ZUMZ - Get Free Report) last announced its quarterly earnings data on Thursday, June 5th. The apparel and footwear maker reported ($0.79) EPS for the quarter, missing analysts' consensus estimates of ($0.77) by ($0.02). Zumiez had a net margin of 0.08% and a return on equity of 0.23%. The firm had revenue of $184.34 million during the quarter, compared to the consensus estimate of $182.23 million. During the same period last year, the business earned ($0.86) EPS. The business's revenue was up 3.9% on a year-over-year basis. Zumiez has set its Q2 2025 guidance at -0.240--0.090 EPS.

Zumiez declared that its board has approved a share repurchase program on Thursday, June 5th that authorizes the company to repurchase $15.00 million in shares. This repurchase authorization authorizes the apparel and footwear maker to reacquire up to 6% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's management believes its shares are undervalued.

Insider Buying and Selling

In other news, Director Liliana Gil Valletta sold 6,600 shares of the firm's stock in a transaction that occurred on Thursday, June 26th. The shares were sold at an average price of $12.82, for a total transaction of $84,612.00. Following the transaction, the director directly owned 10,809 shares of the company's stock, valued at approximately $138,571.38. This trade represents a 37.91% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 20.30% of the company's stock.

Institutional Investors Weigh In On Zumiez

A number of large investors have recently bought and sold shares of the company. American Century Companies Inc. lifted its holdings in shares of Zumiez by 2.0% in the second quarter. American Century Companies Inc. now owns 40,044 shares of the apparel and footwear maker's stock worth $531,000 after acquiring an additional 797 shares during the last quarter. Bank of New York Mellon Corp lifted its holdings in shares of Zumiez by 2.5% in the first quarter. Bank of New York Mellon Corp now owns 51,383 shares of the apparel and footwear maker's stock worth $765,000 after acquiring an additional 1,257 shares during the last quarter. Mutual Advisors LLC lifted its holdings in shares of Zumiez by 4.3% in the second quarter. Mutual Advisors LLC now owns 33,410 shares of the apparel and footwear maker's stock worth $443,000 after acquiring an additional 1,392 shares during the last quarter. Point72 Asia Singapore Pte. Ltd. bought a new position in shares of Zumiez in the fourth quarter worth about $29,000. Finally, Wells Fargo & Company MN lifted its holdings in shares of Zumiez by 20.6% in the fourth quarter. Wells Fargo & Company MN now owns 9,093 shares of the apparel and footwear maker's stock worth $174,000 after acquiring an additional 1,555 shares during the last quarter. 95.45% of the stock is currently owned by institutional investors and hedge funds.

About Zumiez

(

Get Free Report)

Zumiez Inc operates as a specialty retailer of apparel, footwear, accessories, and hardgoods for young men and women. The company provides hardgoods, including skateboards, snowboards, bindings, components, and other equipment. It operates stores in the United States, Canada, Europe, and Australia under the names of Zumiez, Blue Tomato, and Fast Times.

Featured Articles

Before you consider Zumiez, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zumiez wasn't on the list.

While Zumiez currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.