Semtech (NASDAQ:SMTC - Free Report) had its target price lifted by Benchmark from $68.00 to $76.00 in a research note released on Tuesday,Benzinga reports. They currently have a buy rating on the semiconductor company's stock.

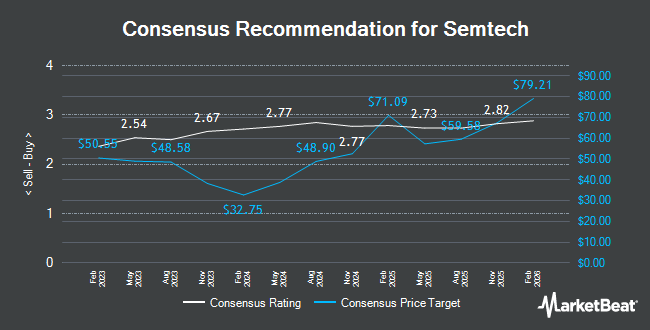

A number of other research analysts have also recently commented on the stock. Needham & Company LLC boosted their target price on shares of Semtech from $54.00 to $60.00 and gave the stock a "buy" rating in a research report on Tuesday, August 26th. Stifel Nicolaus boosted their target price on shares of Semtech from $45.00 to $54.00 and gave the company a "buy" rating in a research note on Friday, July 18th. Piper Sandler boosted their target price on shares of Semtech from $55.00 to $65.00 and gave the company an "overweight" rating in a research note on Tuesday, August 26th. Craig Hallum boosted their target price on shares of Semtech from $55.00 to $62.00 and gave the company a "buy" rating in a research note on Tuesday, August 26th. Finally, Morgan Stanley set a $43.00 target price on shares of Semtech in a research note on Wednesday, May 28th. Eleven analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $61.08.

Check Out Our Latest Research Report on SMTC

Semtech Trading Down 1.0%

SMTC stock traded down $0.61 during midday trading on Tuesday, reaching $60.30. 1,396,643 shares of the company's stock traded hands, compared to its average volume of 1,921,866. The company has a market capitalization of $5.23 billion, a P/E ratio of 251.25 and a beta of 1.98. The company has a debt-to-equity ratio of 0.94, a current ratio of 2.53 and a quick ratio of 1.78. Semtech has a fifty-two week low of $24.05 and a fifty-two week high of $79.52. The business has a 50-day moving average price of $53.00 and a two-hundred day moving average price of $41.92.

Insider Buying and Selling at Semtech

In other news, COO Asaf Silberstein sold 2,000 shares of the business's stock in a transaction on Tuesday, June 24th. The shares were sold at an average price of $42.98, for a total transaction of $85,960.00. Following the completion of the transaction, the chief operating officer owned 105,996 shares of the company's stock, valued at approximately $4,555,708.08. The trade was a 1.85% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CFO Mark Lin sold 999 shares of the business's stock in a transaction on Tuesday, July 1st. The shares were sold at an average price of $43.84, for a total transaction of $43,796.16. Following the transaction, the chief financial officer directly owned 17,211 shares of the company's stock, valued at approximately $754,530.24. This trade represents a 5.49% decrease in their position. The disclosure for this sale can be found here. Insiders own 0.48% of the company's stock.

Hedge Funds Weigh In On Semtech

Hedge funds and other institutional investors have recently modified their holdings of the company. Principal Financial Group Inc. lifted its holdings in Semtech by 4.2% in the first quarter. Principal Financial Group Inc. now owns 427,958 shares of the semiconductor company's stock worth $14,722,000 after purchasing an additional 17,345 shares during the period. Deutsche Bank AG lifted its holdings in Semtech by 168.1% in the first quarter. Deutsche Bank AG now owns 1,210,078 shares of the semiconductor company's stock worth $41,627,000 after purchasing an additional 758,642 shares during the period. Wellington Management Group LLP lifted its holdings in Semtech by 7.9% in the first quarter. Wellington Management Group LLP now owns 2,313,213 shares of the semiconductor company's stock worth $79,575,000 after purchasing an additional 170,132 shares during the period. Paradigm Capital Management Inc. NY acquired a new stake in Semtech in the first quarter worth about $6,591,000. Finally, KBC Group NV lifted its holdings in Semtech by 16.8% in the first quarter. KBC Group NV now owns 4,084 shares of the semiconductor company's stock worth $140,000 after purchasing an additional 586 shares during the period.

About Semtech

(

Get Free Report)

Semtech Corporation designs, develops, manufactures, and markets analog and mixed-signal semiconductor and advanced algorithms. It provides signal integrity products, including a portfolio of optical data communications and video transport products used in various infrastructure, and industrial applications; a portfolio of integrated circuits for data centers, enterprise networks, passive optical networks, wireless base station optical transceivers, and high-speed interface applications; and video products for broadcast applications, as well as video-over-IP technology for professional audio video applications.

Further Reading

Before you consider Semtech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Semtech wasn't on the list.

While Semtech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.