Sera Prognostics (NASDAQ:SERA - Get Free Report) is expected to announce its Q2 2025 earnings results before the market opens on Wednesday, August 6th. Analysts expect the company to announce earnings of ($0.21) per share and revenue of $0.05 million for the quarter.

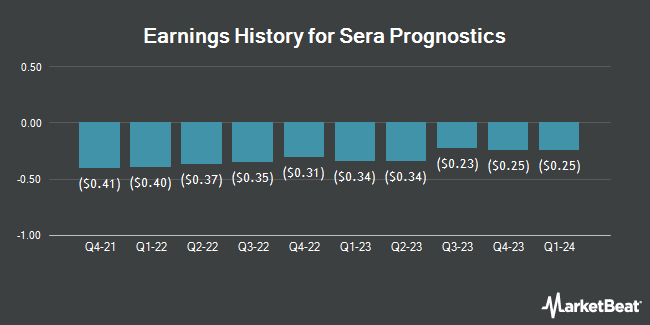

Sera Prognostics (NASDAQ:SERA - Get Free Report) last released its quarterly earnings results on Wednesday, May 14th. The company reported ($0.20) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.24) by $0.04. Sera Prognostics had a negative net margin of 28,685.22% and a negative return on equity of 51.35%. The company had revenue of $0.04 million during the quarter, compared to analysts' expectations of $0.06 million. On average, analysts expect Sera Prognostics to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Sera Prognostics Stock Down 2.9%

SERA stock traded down $0.08 during mid-day trading on Friday, reaching $2.70. 59,613 shares of the stock traded hands, compared to its average volume of 118,313. Sera Prognostics has a 52 week low of $1.37 and a 52 week high of $9.13. The business has a 50-day moving average of $2.32 and a two-hundred day moving average of $3.36. The firm has a market capitalization of $101.71 million, a PE ratio of -2.87 and a beta of 0.99.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded shares of Sera Prognostics from a "sell" rating to a "hold" rating in a report on Saturday, June 21st.

View Our Latest Stock Analysis on SERA

Insider Buying and Selling at Sera Prognostics

In related news, CEO Zhenya Lindgardt sold 23,042 shares of the stock in a transaction dated Monday, June 9th. The shares were sold at an average price of $1.43, for a total value of $32,950.06. Following the completion of the sale, the chief executive officer owned 844,209 shares in the company, valued at approximately $1,207,218.87. This trade represents a 2.66% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders have sold a total of 67,848 shares of company stock valued at $128,049 in the last three months. 13.50% of the stock is currently owned by company insiders.

About Sera Prognostics

(

Get Free Report)

Sera Prognostics, Inc, a women's health diagnostic company, discovers, develops, and commercializes biomarker tests for improving pregnancy outcomes in the United States. The company develops PreTRM test, a blood-based biomarker test to predict the risk of spontaneous preterm birth in singleton pregnancies.

See Also

Before you consider Sera Prognostics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sera Prognostics wasn't on the list.

While Sera Prognostics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.