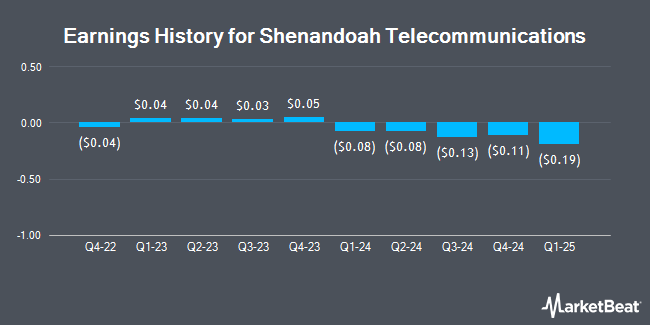

Shenandoah Telecommunications (NASDAQ:SHEN - Get Free Report) released its earnings results on Thursday. The utilities provider reported ($0.19) earnings per share for the quarter, topping analysts' consensus estimates of ($0.20) by $0.01, Zacks reports. The company had revenue of $88.57 million during the quarter, compared to the consensus estimate of $89.94 million. Shenandoah Telecommunications had a negative return on equity of 3.78% and a negative net margin of 8.90%. Shenandoah Telecommunications updated its FY 2025 guidance to EPS.

Shenandoah Telecommunications Trading Down 2.3%

Shares of SHEN stock traded down $0.31 during trading hours on Wednesday, reaching $12.97. 272,052 shares of the stock traded hands, compared to its average volume of 284,708. Shenandoah Telecommunications has a 1-year low of $9.77 and a 1-year high of $17.55. The business has a fifty day moving average price of $14.10 and a 200 day moving average price of $12.68. The company has a quick ratio of 0.73, a current ratio of 0.73 and a debt-to-equity ratio of 0.56. The firm has a market capitalization of $711.53 million, a PE ratio of -23.16 and a beta of 0.90.

Insider Buying and Selling

In other Shenandoah Telecommunications news, major shareholder Ecp Fiber Holdings Gp, Llc acquired 32,000 shares of the company's stock in a transaction dated Thursday, May 29th. The stock was bought at an average price of $12.46 per share, for a total transaction of $398,720.00. Following the purchase, the insider owned 2,532,697 shares in the company, valued at $31,557,404.62. This represents a 1.28% increase in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, major shareholder Ecp Controlco, Llc bought 36,238 shares of the stock in a transaction dated Monday, June 2nd. The stock was purchased at an average cost of $12.58 per share, for a total transaction of $455,874.04. Following the acquisition, the insider owned 2,599,274 shares in the company, valued at $32,698,866.92. The trade was a 1.41% increase in their position. The disclosure for this purchase can be found here. Insiders have purchased 624,307 shares of company stock worth $8,719,008 over the last ninety days. 4.51% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Shenandoah Telecommunications

Hedge funds have recently added to or reduced their stakes in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its stake in shares of Shenandoah Telecommunications by 4.5% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 28,964 shares of the utilities provider's stock valued at $364,000 after purchasing an additional 1,248 shares during the last quarter. Royal Bank of Canada boosted its stake in shares of Shenandoah Telecommunications by 11.8% in the 1st quarter. Royal Bank of Canada now owns 37,008 shares of the utilities provider's stock valued at $465,000 after purchasing an additional 3,904 shares during the last quarter. Acadian Asset Management LLC bought a new position in shares of Shenandoah Telecommunications in the 1st quarter valued at about $76,000. Baird Financial Group Inc. acquired a new stake in shares of Shenandoah Telecommunications in the 1st quarter valued at approximately $158,000. Finally, Caxton Associates LLP acquired a new stake in shares of Shenandoah Telecommunications in the 1st quarter valued at approximately $194,000. Institutional investors own 61.96% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have commented on SHEN. Wall Street Zen upgraded Shenandoah Telecommunications from a "sell" rating to a "hold" rating in a research note on Saturday. BWS Financial reaffirmed a "buy" rating and set a $26.00 price target on shares of Shenandoah Telecommunications in a research report on Thursday, May 1st.

View Our Latest Research Report on SHEN

Shenandoah Telecommunications Company Profile

(

Get Free Report)

Shenandoah Telecommunications Company, together with its subsidiaries, provides a range of broadband communication services and cell tower colocation space in the Mid-Atlantic portion of the United States. It operates in two segments, Broadband and Tower. The company Broadband segment offers broadband, video, and voice services to residential and commercial customers in Virginia, West Virginia, Maryland, Pennsylvania, and Kentucky through hybrid fiber coaxial cable under the Shentel brand; and fiber optic services under the Glo Fiber brand name.

See Also

Before you consider Shenandoah Telecommunications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shenandoah Telecommunications wasn't on the list.

While Shenandoah Telecommunications currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.