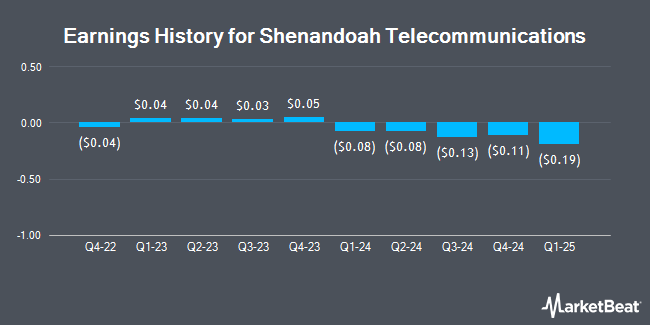

Shenandoah Telecommunications (NASDAQ:SHEN - Get Free Report) will likely be announcing its Q3 2025 results after the market closes on Wednesday, October 29th. Analysts expect the company to announce earnings of ($0.19) per share and revenue of $90.9490 million for the quarter. Shenandoah Telecommunications has set its FY 2025 guidance at EPS.Investors may visit the the company's upcoming Q3 2025 earningresults page for the latest details on the call scheduled for Wednesday, October 29, 2025 at 4:30 PM ET.

Shenandoah Telecommunications (NASDAQ:SHEN - Get Free Report) last announced its earnings results on Thursday, July 31st. The utilities provider reported ($0.19) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.20) by $0.01. The firm had revenue of $88.57 million during the quarter, compared to analysts' expectations of $89.94 million. Shenandoah Telecommunications had a negative return on equity of 3.78% and a negative net margin of 8.90%.

Shenandoah Telecommunications Stock Performance

Shares of NASDAQ SHEN traded down $0.02 during trading hours on Wednesday, reaching $12.74. The stock had a trading volume of 231,202 shares, compared to its average volume of 291,510. The firm has a market cap of $698.92 million, a price-to-earnings ratio of -22.75 and a beta of 0.81. The company has a current ratio of 0.73, a quick ratio of 0.73 and a debt-to-equity ratio of 0.56. Shenandoah Telecommunications has a fifty-two week low of $9.77 and a fifty-two week high of $16.28. The firm has a 50-day moving average of $13.28 and a 200-day moving average of $13.23.

Wall Street Analyst Weigh In

SHEN has been the subject of several analyst reports. Weiss Ratings reaffirmed a "sell (d)" rating on shares of Shenandoah Telecommunications in a research note on Wednesday, October 8th. Wall Street Zen downgraded Shenandoah Telecommunications from a "hold" rating to a "strong sell" rating in a research note on Sunday, August 10th. One investment analyst has rated the stock with a Buy rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus price target of $26.00.

Check Out Our Latest Analysis on SHEN

Insider Activity at Shenandoah Telecommunications

In other news, major shareholder Ecp Controlco, Llc acquired 30,000 shares of the company's stock in a transaction that occurred on Friday, August 8th. The stock was purchased at an average cost of $12.52 per share, with a total value of $375,600.00. Following the purchase, the insider directly owned 3,221,550 shares of the company's stock, valued at approximately $40,333,806. This trade represents a 0.94% increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through the SEC website. Also, major shareholder Ecp Fiber Holdings Gp, Llc acquired 30,000 shares of the company's stock in a transaction that occurred on Friday, August 1st. The stock was purchased at an average cost of $13.48 per share, with a total value of $404,400.00. Following the completion of the purchase, the insider directly owned 3,094,541 shares in the company, valued at $41,714,412.68. This represents a 0.98% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders purchased a total of 394,206 shares of company stock valued at $5,249,422 over the last ninety days. 4.51% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Shenandoah Telecommunications

Hedge funds have recently bought and sold shares of the company. Tower Research Capital LLC TRC increased its stake in Shenandoah Telecommunications by 80.6% in the 2nd quarter. Tower Research Capital LLC TRC now owns 4,992 shares of the utilities provider's stock valued at $68,000 after purchasing an additional 2,228 shares in the last quarter. Bridgeway Capital Management LLC acquired a new stake in Shenandoah Telecommunications during the 2nd quarter valued at $1,574,000. Raymond James Financial Inc. acquired a new stake in Shenandoah Telecommunications during the 2nd quarter valued at $76,000. The Manufacturers Life Insurance Company grew its holdings in Shenandoah Telecommunications by 5.5% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 18,768 shares of the utilities provider's stock valued at $256,000 after buying an additional 986 shares during the last quarter. Finally, Jump Financial LLC acquired a new stake in Shenandoah Telecommunications during the 2nd quarter valued at $190,000. 61.96% of the stock is owned by hedge funds and other institutional investors.

About Shenandoah Telecommunications

(

Get Free Report)

Shenandoah Telecommunications Company, together with its subsidiaries, provides a range of broadband communication services and cell tower colocation space in the Mid-Atlantic portion of the United States. It operates in two segments, Broadband and Tower. The company Broadband segment offers broadband, video, and voice services to residential and commercial customers in Virginia, West Virginia, Maryland, Pennsylvania, and Kentucky through hybrid fiber coaxial cable under the Shentel brand; and fiber optic services under the Glo Fiber brand name.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Shenandoah Telecommunications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shenandoah Telecommunications wasn't on the list.

While Shenandoah Telecommunications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.