Silgan (NYSE:SLGN - Get Free Report)'s stock had its "neutral" rating reiterated by investment analysts at Bank of America in a research note issued on Wednesday, MarketBeat reports. They currently have a $59.00 price target on the industrial products company's stock, up from their prior price target of $57.00. Bank of America's target price suggests a potential upside of 7.36% from the company's previous close.

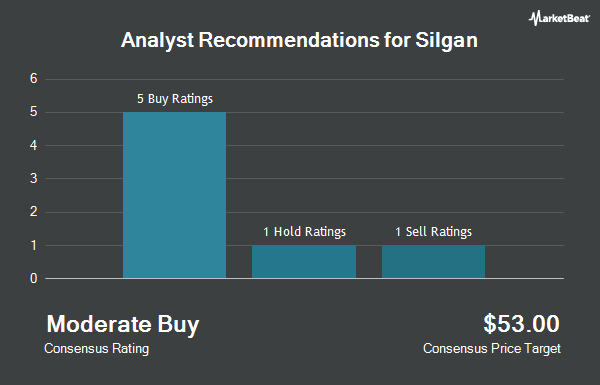

Other equities research analysts also recently issued research reports about the company. JPMorgan Chase & Co. raised Silgan from a "neutral" rating to an "overweight" rating and set a $57.00 price objective on the stock in a research report on Thursday, May 1st. Citigroup raised their price objective on Silgan from $60.00 to $63.00 and gave the company a "buy" rating in a research report on Thursday, May 8th. Truist Financial dropped their price objective on Silgan from $70.00 to $62.00 and set a "buy" rating on the stock in a research report on Tuesday, April 22nd. Finally, Raymond James Financial raised Silgan from an "outperform" rating to a "strong-buy" rating and dropped their price objective for the company from $65.00 to $60.00 in a research report on Tuesday, April 22nd. Two research analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $63.44.

Get Our Latest Stock Analysis on Silgan

Silgan Stock Down 0.7%

Shares of SLGN traded down $0.38 during midday trading on Wednesday, reaching $54.96. 365,441 shares of the stock were exchanged, compared to its average volume of 667,895. Silgan has a 52 week low of $44.17 and a 52 week high of $58.14. The company has a current ratio of 1.14, a quick ratio of 0.67 and a debt-to-equity ratio of 1.67. The company's 50 day moving average is $54.79 and its two-hundred day moving average is $52.75. The company has a market capitalization of $5.88 billion, a P/E ratio of 20.43, a PEG ratio of 1.27 and a beta of 0.75.

Silgan (NYSE:SLGN - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The industrial products company reported $0.82 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.78 by $0.04. Silgan had a return on equity of 20.00% and a net margin of 4.82%. The business had revenue of $1.47 billion for the quarter, compared to the consensus estimate of $1.48 billion. During the same quarter in the prior year, the company earned $0.69 EPS. The business's revenue was up 11.4% compared to the same quarter last year. On average, sell-side analysts anticipate that Silgan will post 4.11 earnings per share for the current year.

Insider Buying and Selling

In related news, EVP Robert B. Lewis sold 10,000 shares of Silgan stock in a transaction dated Monday, May 19th. The stock was sold at an average price of $55.92, for a total transaction of $559,200.00. Following the completion of the sale, the executive vice president owned 153,378 shares of the company's stock, valued at $8,576,897.76. The trade was a 6.12% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, VP B Frederik Prinzen sold 2,378 shares of Silgan stock in a transaction dated Tuesday, May 6th. The stock was sold at an average price of $54.05, for a total value of $128,530.90. Following the sale, the vice president directly owned 1,380 shares of the company's stock, valued at $74,589. This trade represents a 63.28% decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.13% of the company's stock.

Institutional Investors Weigh In On Silgan

A number of institutional investors and hedge funds have recently modified their holdings of the company. Arizona State Retirement System raised its position in Silgan by 0.8% during the fourth quarter. Arizona State Retirement System now owns 24,792 shares of the industrial products company's stock valued at $1,290,000 after acquiring an additional 195 shares in the last quarter. State of Michigan Retirement System raised its position in Silgan by 1.0% during the first quarter. State of Michigan Retirement System now owns 19,400 shares of the industrial products company's stock valued at $992,000 after acquiring an additional 200 shares in the last quarter. Louisiana State Employees Retirement System raised its position in Silgan by 0.9% during the first quarter. Louisiana State Employees Retirement System now owns 22,700 shares of the industrial products company's stock valued at $1,160,000 after acquiring an additional 200 shares in the last quarter. Central Pacific Bank Trust Division raised its position in Silgan by 5.9% during the first quarter. Central Pacific Bank Trust Division now owns 3,760 shares of the industrial products company's stock valued at $192,000 after acquiring an additional 210 shares in the last quarter. Finally, Aristeia Capital L.L.C. raised its position in Silgan by 4.0% during the fourth quarter. Aristeia Capital L.L.C. now owns 5,488 shares of the industrial products company's stock valued at $286,000 after acquiring an additional 212 shares in the last quarter. Institutional investors and hedge funds own 70.25% of the company's stock.

About Silgan

(

Get Free Report)

Silgan Holdings Inc, together with its subsidiaries, manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally. It operates through three segments: Dispensing and Specialty Closures, Metal Containers, and Custom Containers. The Dispensing and Specialty Closures segment offers a range of metal and plastic closures, and dispensing systems for food, beverage, health care, garden, home, personal care, beauty products, and hard surface cleaning products, as well as capping/sealing equipment and detection systems.

Recommended Stories

Before you consider Silgan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silgan wasn't on the list.

While Silgan currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.